Goodwill is that segment of the total purchase consideration that is left after evaluating the fair value of assets. However, the determination of the price or value of goodwill is quite challenging. This is because it deals with the intangible components.

The simplest way to calculate goodwill is to estimate the business’s overall value. Besides this, there are some formulas that facilitate the calculation.

The formula and steps for calculation are discussed in length further in this post.

Content: How to calculate Goodwill?

- What is Goodwill?

- Need

- Negative Goodwill

- Formula

- Steps

- Goodwill Calculator

- Goodwill Impairment

- Example

- Final Words

What is Goodwill?

It is the gap between the purchase consideration and the book value of the business. It is an asset for the company, but it is intangible in nature. Moreover, Goodwill is often acquired through acquisitions.

Unlike other assets, it has an indefinite useful life. Hence, there is no need to amortize the value of goodwill.

Some intangible factors constituting goodwill are as follows:

Some intangible factors constituting goodwill are as follows:

- Brand Name

- Customers Relations

- Reputation

- Honesty

- Post-purchase Experience

Further, it is of two types – Self-generated Goodwill and Purchased Goodwill.

There are three methods available at disposal for calculating goodwill listed below. These methods are also known as Methods of Goodwill Valuation.

- Average Profit Method

- Super Profit Method

- Capitalization Method

Need for Goodwill Calculation

Basically, the need to calculate goodwill arises when one company acquires another company. As the acquirer wants to determine the company’s worth above its assets.

However, the following situations demand goodwill calculation:

- Admission of a partner

- Change in profit sharing ratio

- Retirement of a partner

- Sale of a business

- Amalgamation of two existing partnership firms

Let us understand it with the help of an example.

Suppose Z ltd. has acquired Y ltd. for Rs. 80 Lakhs. The net asset value of Y ltd. is Rs. 60 Lakhs. So, Z ltd. has paid the premium of Rs. 20 Lakhs for the company’s goodwill in the market.

Y ltd. might have created its goodwill over the years with the help of intangible components. These components could be – Customer Satisfaction, Brand Value etc.

Negative Goodwill

Negative Goodwill is when the firm is valued or acquired at a price lower than the total of its fair value of assets. It is alternatively known as ‘Badwill‘ as it is the contrast to Goodwill.

The reason behind Negative Goodwill:

The absence of negotiation leads to Negative Goodwill. That is, the acquiree has not negotiated the fair price of its acquisition with the acquirer.

Formula to Calculate Goodwill

There are two methods to calculate goodwill given below:

1. Goodwill = P – (A – L)

Where,

P is the Purchase Price of the business,

A represents companies assets,

and L represents companies’ liabilities

2. Goodwill = (C + NCI + FV) – NA

Where,

C is Consideration paid,

NCI is the amount of Non-controlling interest,

FV is the fair value of previous equity interest,

and NA represents net identifiable assets

Steps to Calculate Goodwill on Acquisition

The following steps are suitable for goodwill calculation in both, the sale or purchase of the company.

Step 1: Get the Book Value of Assets from the Balance Sheet

The first step is learning the value of assets appearing on the Acquiree’s Balance Sheet. It includes all the assets listed on the balance sheet like:

- Fixed Assets

- Current Assets and Non-current Assets

- Intangible Assets

Step 2: Ascertain the Fair Value of Assets

The next step is to find the asset’s fair value listed above. You can also understand it as the current market value of assets.

For this purpose, the acquirer can use various methods, including Discounted Cash Flows.

Step 3: Make Necessary Adjustments in Fair Value

Post fair value ascertainment, calculate the variance existing between them. More precisely, calculate the difference between the asset’s fair and market value.

Step 4: Compute Excess Purchase Price

Now, compute the excess purchase price out of the total purchase consideration. For this, find the variance between the Net Book Value of Assets and Purchase Consideration.

Where,

Purchase Consideration is the total amount paid by the acquirer to acquire the company. And the Net Book Value of assets is obtained by subtracting the liabilities from assets.

Step 5: Calculate Goodwill

At last, deduct the adjusted fair value of assets from the excess purchase price to calculate Goodwill.

Goodwill Calculator

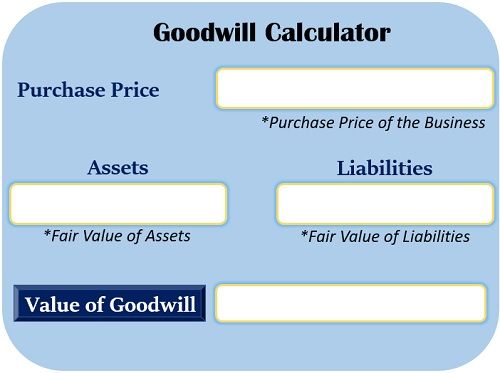

It is a tool that enables us to compute the value of goodwill. Several vendors offer this tool through websites and software. Besides, the user can select the appropriate method for goodwill calculation.

Goodwill Calculator contains fields as per the selected valuation method. You need to input the required information in the respective fields. After that, you will get the value of goodwill in just one click.

Sample:

Goodwill Impairment

The word impairment primarily means deterioration. Thus, goodwill impairment is the deterioration of the value of goodwill. It happens due to the reduction in the cash flows from acquired assets. Consequently, there is a decline in the fair value of the assets.

The need for impairment arises when the asset’s market value falls below the historical cost. Thus, the companies must conduct goodwill valuations periodically to track impairment.

Example

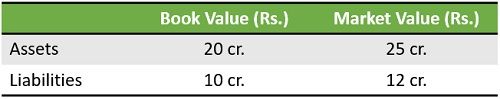

Company M depicts the value of assets and liabilities in the financial statements as of 31st March 2016 as follows:

Further, Company Z acquired M on 12th July 2016 for a consideration of Rs. 30 crores. Compute the value of goodwill acquired by company Z.

Solution:

We will put all the details in the formula considering the fair value of assets.

Goodwill = P – (A – L)

= 30 – (25 – 12)

= 17

Thus, company Z acquired goodwill of Rs. 17 cr with company M.

Final Words

All in all, besides being an intangible asset, goodwill calculation is a must for companies. It is vital, especially during acquisitions and consolidations.

One can calculate it using the formula and steps explained above. However, there are various methods available for goodwill valuation that can be used as per the requirement.

Leave a Reply