Definition: Profitability ratios are the financial measures to analyze the earning capacity and determine the financial soundness of the organization by comparing the earnings with different expenditures, and ensure the optimum utilization of the various resources.

Analyzing the financial position of an organization using the profitability ratios, are essential for all the people associated with the business entity; be its stakeholders, customers, investors and directors.

Content: Profitability Ratios

- Types

- Gross Profit Ratio

- Net Profit Ratio

- Operating Profit Ratio

- Operating Ratio

- Return on Equity

- Return on Asset

- Return on Capital Employed

- Example

- Solution

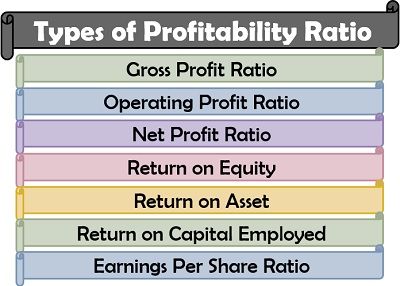

Types of Profitability Ratios

There are different types of profitability ratios, analyzing and interpreting the financial position and stability of the organization on various parameters.

Some of these ratios holding primary importance for the organization, business associates and public are mentioned below:

To know more about these ratios in detail, read below.

Gross Profit Ratio

The gross profit ratio determines the percentage of disposable income available with the organization to carry out business operations.

Formula:![]()

Where,

Gross Profit = Net Sales – Cost of Goods Sold (COGS)

Net Sales = Gross Sales – Sales Return – Discount Allowed

Analysis: The gross profit ratio indicates the profit margin of the organization. Thus a higher ratio implies a better earning potential. Gross profit is the profit which excludes any indirect income. It is acquired before deducting any of indirect expense incurred on those activities which are not directly influencing the manufacturing of goods or services.

Net Profit Ratio

The net profit ratio depicts the net income of an organization which is available for the shareholders after paying off all the operating and non-operating expenses.

Formula:![]()

Where,

Net Profit = Gross Profit + Indirect Income – Indirect Expenses

Net Sales = Gross Sales – Sales Return – Discount Allowed

Analysis: This ratio must be high since it indicates the profitability of the organization after paying off administrative and other indirect expenses.

Operating Profit Ratio

The operating profit ratio finds out the organization’s ability to meet the operating expenses.

Formula:![]()

Where,

Operating Profit = Gross Profit – Operating Expenses – Depreciation and Amortization

Net Sales = Gross Sales – Sales Return – Discount Allowed

Analysis: Operating profit ratio is essential for the manufacturing units since it shows the organization’s operational efficiency, therefore it should be high.

Operating Ratio

The operating ratio determines the cost incurred by the organization on its operating expenses in comparison to the sales.

Formula:![]()

Where,

Operating Cost = Cost of Goods Sold (COGS) + Operating Expense

Net Sales = Gross Sales – Sales Return – Discount Allowed

Analysis: The lower is the operating ratio, the better it is for the organization because it implies the expenses incurred on operational activities.

Return on Equity

Return on equity shows the percentage return on the shareholder’s investment in the organization.

Formula:![]()

Where,

Net Profit After Tax = Net Profit Before Tax – Taxes

Analysis: The return on equity or shareholder’s equity should be higher as it indicates an adequate earning capacity of the organization on the owner’s capital.

Return on Asset

The yield on asset determines the company’s ability to earn a profit in comparison to the total assets employed in the business.

Formula:![]()

Where,

Net Profit After Tax = Net Profit Before Tax – Taxes

Analysis: This ration should be high since it depicts an effective utilization of the assets of the organization.

Return on Capital Employed

The return on capital employed depicts the efficiency of the company to generate profits on the money invested.

Formula:![]()

Where,

Earnings Before Interest and Tax = Net Profit Before Interest and Tax

Capital Employed = Total Assets – Current Liabilities

Analysis: The return on capital employed determines the overall financial stability of the organization. Thus a higher ratio means a productive capital investment.

Example

ABC Ltd. records a gross sale of ₹1000000 in the previous financial year. Out of which the sales return was worth ₹10000 and the discount of ₹90000 was allowed. With the help of the following information, find out the various profitability ratios:

- If the cost of goods sold was ₹450000, find out the gross profit ratio.

- The given indirect income is ₹30000, and indirect expense is ₹120000, what will be the net profit ratio?

- It is given that, the operating expenses amounted to ₹125000 and the machine was depreciated by ₹10000. Calculate the operating profit ratio and the operating ratio.

- If the company paid taxes of ₹15000 and shareholder’s equity is ₹1800000, find out the return on equity.

- The total assets amounted to ₹2400000, calculate the return on asset.

- The balance sheet showed current liabilities of ₹1500000, what will be the return on capital employed?

Solution

Gross Profit Ratio = (Gross Profit/Net Sales) ⨯ 100

Net Sales = Gross Sales – Sales Return – Discount Allowed

Net Sales = 1000000 – 10000 – 90000

Net Sales = ₹900000

Gross Profit = Net Sales – Cost of Goods Sold (COGS)

Gross Profit = 900000 – 450000

Gross Profit = ₹450000

Gross Profit Ratio = (450000/900000) ⨯ 100

Gross Profit Ratio = 50%

Net Profit Ratio = (Net Profit/Net Sales) ⨯ 100

Net Sales = ₹900000

Net Profit = Gross Profit + Indirect Income – Indirect Expenses

Net Profit = 450000 + 30000 – 120000

Net Profit = ₹360000

Net Profit Ratio = (360000/900000) ⨯ 100

Net Profit Ratio = 40%

Operating Profit Ratio = (Operating Profit/Net Sales) ⨯ 100

Net Sales = ₹900000

Operating Profit = Gross Profit – Operating Expenses – Depreciation and Amortization

Operating Profit = 450000 – 125000 – 10000

Operating Profit = ₹315000

Operating Profit Ratio = (315000/900000) ⨯ 100

Operating Profit Ratio = 35%

Operating Ratio = (Operating Cost/Net Sales) ⨯ 100

Net Sales = ₹900000

Operating Cost = Cost of Goods Sold (COGS) + Operating Expenses

Operating Cost = 450000 + 125000

Operating Cost = ₹575000

Operating Ratio = (575000/900000) ⨯ 100

Operating Ratio = 63.89%

Return on Equity = (Net Profit After Tax/Shareholder’s Equity) ⨯ 100

Net Profit After Tax = Net Profit Before Tax – Taxes

Net Profit After Tax = 360000 – 15000

Net Profit After Tax = ₹345000

Shareholder’s Equity = ₹1800000

Return on Equity = (345000/1800000) ⨯ 100

Return on Equity = 19.17%

Return on Asset = (Net Profit After Tax/Total Assets) ⨯ 100

Net Profit After Tax = ₹345000

Total Assets = ₹2400000

Return on Equity = (345000/2400000) ⨯ 100

Return on Equity = 13.38%

Return on Capital Employed = (Earnings Before Interest and Tax/Capital Employed) ⨯ 100

Earnings Before Interest and Tax = Net Profit Before Interest and Tax

Earnings Before Interest and Tax = ₹360000

Capital Employed = Total Assets – Current Liabilities

Capital Employed = 2400000 – 1500000

Capital Employed = ₹900000

Return on Capital Employed = (360000/900000) ⨯ 100

Return on Capital Employed = 40%

The business entities keep on measuring the profitability of its operations from time to time.

This is done to examine the performance of the organization, along with the returns yield by the investments made.

Kavitha says

tnqu