Definition: Capital asset pricing model (CAPM) is a tool used by investors, financial analysts and economists to study the relationship between the expected return from the investment and the systematic risk involved (measured in terms of Beta coefficient), by taking into consideration the expected overall market return and the risk-free rate of interest.

Whenever an investment portfolio is created, the capital asset pricing model helps to asses the risk and estimate the possible returns from the investments made.

Content: Capital Asset Pricing Model (CAPM)

- Elements

- Capital Market Line (CML)

- Security Market Line (SML)

- Formula

- Example

- Assumptions

- Advantages

- Limitations

- Validity

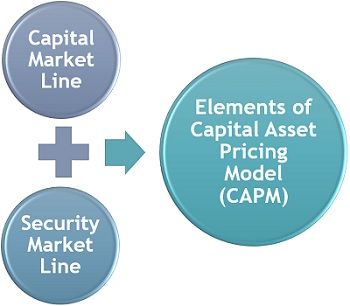

Elements of CAPM

To determine the returns on investment and the return on securities portfolio with the help of systematic risk involved in it, the capital asset pricing model provides the following two ways:

Capital Market Line (CML)

The capital market line is a theoretical concept which outlines the efficient portfolios by interpreting the risk-return trade-off. It is the means of preparing a combination which provides the highest possible returns on a minimum level of risk.

Security Market Line (SML)

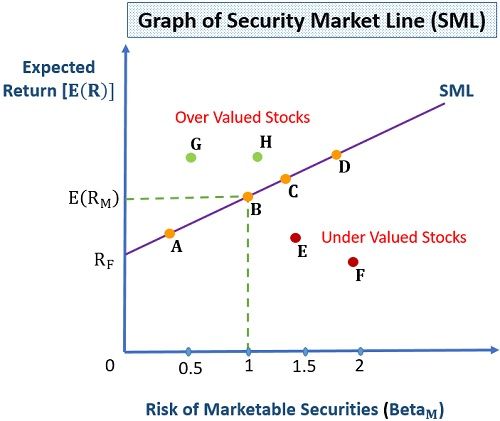

The security market line is the graphical representation plotting the relationship between systematic risk and returns on a portfolio. Here, the systematic risk is related to the marketable securities is denoted as ‘beta’ and depicted on the x-axis, whereas expected return is represented on the y-axis.

Graphical Representation of the Security Market Line

Let us now understand the SML in detail, with the help of the following graph:

The value of Beta determines the risk-return relationship as follows:

- If Beta = 1; there is a balance of risk and return, i.e. the value of the securities decreases or increases proportionately to the stock market, denoting average risk involved.

- If Beta > 1; then we can say that the stocks are overvalued and are highly volatile to the fluctuations in the stock market holding high risk.

- If Beta < 1; the stocks are undervalued and are less volatile to the market fluctuations, in other words, such securities are less risky.

Formula

Expected Return on Investment:

The method for calculating the expected return on investments with the help of the security market line is as follows:

![]() Where,

Where,

E(Ri) is the ‘expected return on investments’

RF is the ‘risk-free rate of return.’

ßi is the ‘systematic risk of investment.’

E(RM) is the ‘expected return of the market.’

Market Risk Premium:

Market risk premium determines the excess return over the risk-free rate of the whole market. It is calculated as below:

![]()

Risk Premium of Security:

The risk premium of a particular investment which is the excess of returns from that specific security over the risk-free rate is calculated as below:

Example

Question: Considering the above graph, let us assume that systematic risk involved in ‘A,’ i.e. Beta A is 0.45; similarly, Beta B is 1, and Beta C is 1.35. If the risk-free rate of return is 3%, and the expected market return is 11.5%, find out the expected return on each security.

Solution:

E(Ri) = RF + ßi × [E(RM) – (RF)]

E(RA) = 3 + 0.45 × (11.5 – 3)

E(RA) = 6.83%

E(RB) = 3 + 1 × (11.5 – 3)

E(RB) = 11.5%

E(RC) = 3 + 1.35 × (11.5 – 3)

E(RC) = 14.48%

RPi = ßi × [E(RM) – RF]

RPA = 0.45 × (11.5 – 3)

E(RA) = 3.83%

RPM = E(RM) – RF

RPM = 11.5 – 3

RPM = 8.5

Therefore, we can say that:

![]()

![]()

These formulae of expected return on investments are derived from the above formulae.

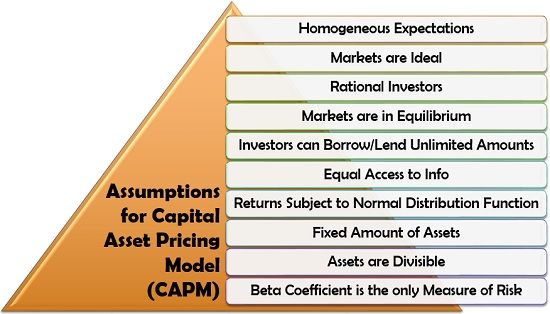

Assumptions for Capital Asset Pricing Model (CAPM)

The concept of capital asset pricing model works on certain assumptions. These are explained in detail below:

Homogeneous Expectations: The CAPM assumes that the expectations of the investors remain the same throughout the given period.

Markets are Ideal: The next assumption is that there is no transaction fees and taxes charged from investors. Moreover, there is no short-selling restrictions or inflation.

Rational Investors: The investors are assumed to be rational, i.e. they try to stay away from risky securities. At the same time, they aim to make the maximum utility of their investments.

Markets are in Equilibrium: It is presumed that the investors never influence the value of the securities; instead, they only take the investments at a price available in the market.

Investors can Borrow/Lend Unlimited Amounts: The investors can avail limitless borrowings lying under the risk-free rate. The financial institutions also provide unlimited funds to investors.

Equal Access to Info: Another assumption is that the investors have the complete knowledge of the market and the securities they invest in.

Returns Subject to Normal Distribution Function: The returns which the investors can avail on the complete portfolio is subjected to the normal distribution function.

Diversified Investors: It is assumed that all the investors aim at diversifying their portfolio into different kinds of securities with different risk and return involved.

Fixed Amount of Assets: CAPM assumes that the quantity of the available assets remains the same throughout the given period.

Assets are Divisible: All holdings in the portfolio are easily bought and sold in the open market and are divisible into small units.

Beta Coefficient is the Only Measure of Risk: The level of systematic risk of the securities is measured strictly in terms of Beta.

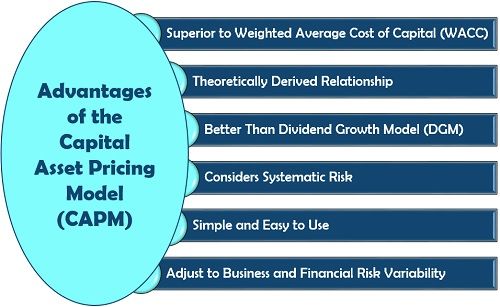

Advantages of CAPM

The CAPM has proved to be very useful to the financial analysts as well as the investors for determining the returns possible from various investments. The other benefits are as follows:

- Superior to Weighted Average Cost of Capital (WACC): The CAPM provides a better discount rate than the WACC for investment valuation.

- Theoretically-Derived Relationship: After repetitive empirical research and testing, CAPM establishes a relationship between the expected return and the systematic risk.

- Better Than Dividend Growth Model (DGM): The DGM only focuses on the systematic risk at a company’s level, but CAPM considers the systematic risk of the whole stock market.

- Considers Systematic Risk: The other return models ignore the systematic risk while determining the return from investments.

- Simple and Easy to Use: To assure a better rate of returns to the investors, CAPM quickly calculates and stress-test all the possible alternatives.

- Adjust to Business and Financial Risk Variability: Unlike other models such as WACC, CAPM can be used even in the case where the new business mix and its financing is different from the existing business.

Limitations of CAPM

CAPM is an efficient tool for planning investments, but its assumptions are quite unrealistic, which leads to the following criticism of this model:

Different Expectations: As in a CAPM, it is assumed that the expectations of the investor are homogeneous, but in reality, the investor has different expectations and investment strategies.

Some Assets Are Not Divisible: When we talk of divisible assets, the shares are the most common ones out of it. However, many fixed assets like land and building cannot be divided into units.

Borrowing Limitations: CAPM assumes that there is no borrowing or lending limit, but it is not so. The investors are bound to strictly follow the limitations for borrowing funds when financial institutions are allowed for limited lendings.

Trades Fluctuate Prices: The large trades often determine the price of investments, denying the assumptions that markets are always at equilibrium.

Trading Fees and Bid-Ask Spreads: When the CAPM concept assumes that markets are ideal, the investor needs to pay specific fees like the transaction fees, taxes and bid-ask spread.

Individual Investors Lack Information: Many times, the investors lack proper information about the securities they invest in, the risk involved in it and its return.

Small Individual Investors are Not Diversified: The institutional and large investors go for a diversified portfolio, but the small retail investors might invest in a particular asset class like either in real estate or fixed deposits to be on a safer side or instead of proper information.

Irrational Behaviour: In reality, the investors behave irrationally being influenced emotionally or making investments in a preferred sector irrespective of the returns and risk involved in it. The investors may not invest to maximize the utility of their funds.

Validity of CAPM

The capital asset pricing model considers the overall market risk while estimating the returns from a particular investment. Thus, it assists the investors to plan a compelling portfolio and adequately manage the risk and returns on it.

It has proved to be a useful tool for evaluating the cost of retained earnings.

However, CAPM is based on the assumptions which may differ from the real world situations, leading to the criticism of this model.

toffee says

thanks alot,,,,,its really great