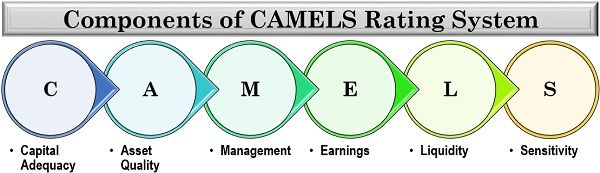

Definition: CAMELS rating system is an internationally recognized supervisory tool which was developed in the US to measure the bank’s or other financial institution’s level of risk with the help of its financial statements. The parameters used for judgement comprises of capital adequacy, asset quality, management, earnings, liquidity and sensitivity.

The CAMELS rating system is adopted as a tool for determining the strengths and weaknesses of the various financial institutions and rating their performance in the economy by the supervisory authorities of a country.

Content: CAMELS Rating System

- Components and Factors

- Capital Adequacy

- Asset Quality

- Management

- Earnings

- Liquidity

- Sensitivity

- Composite Ratings

- Numerical Ratings

- Purpose

Components and Factors of CAMELS Rating System

This concept was initially implemented as a Uniform Financial Institutions Rating System (UFIRS) in the year 1979 in the US as a CAMEL rating. It was modified to include the sixth component ‘sensitivity’ to it, in the year 1995, by the Federal Reserve and the OCC.

The initials of the six components unanimously form the word CAMELS.

Let us now understand each of these components and the factors affecting the rating of each:

Capital Adequacy

The first component is the analysis of capital adequacy ratio and capital to risk-weighted assets for determining the minimum money to be maintained by the financial institutions as per the guidelines of financial regulators.

Rating Factors of Capital Adequacy:

- The composition of the Balance Sheet;

- Overall financial condition of the institutions;

- Growth plans and prospects along with its management;

- Earning strength and quality;

- Dividend reasonableness;

- Access to the various sources of capital like capital markets;

- Quality and level of money infused;

- Management’s ability to fulfil the additional capital requirement;

- Off-Balance Sheet activities exposed to risk;

- Estimation of the problem assets in terms of its nature, volume and trends;

- Capital adequacy for valuation reserves and loss due to lease or loan allowances.

Asset Quality

Financial institutions earn by means of providing loans. These institutional loans are their assets, and the companies assess the risk involved in such investments to assure superior asset quality and investment decision. To determine the asset quality gross non-performing asset (GNPA) ration is computed.

Rating Factors of Asset Quality:

- Management Information System, loan portfolio management, written policies and procedures and internal control;

- The volume of problem assets, overdue or rescheduled loans;

- Considering the bank’s capacity while the growth of institutional loans;

- Reserves for loss on loans in case of problem credit and other related assets;

- Investment diversification and concentration of assets;

- Management’s ability to regulate all the assets and recover problem assets;

- Nature and volume of credit documentation exceptions;

- Level of exposure to counterparties involved in trading and securities underwriting activities;

- Credit risk analysis, non-performing assets, problem trends, nonaccrual, severity, distribution, restructuring, classifying and level of on and off-balance sheet transactions;

- Appropriate risk identification practices, underwriting standards adequacy and credit administration practice.

Management

The Institute’s ability to identify, respond and manage the financial risk involved in the day to day institutional operations like credit offers, transactions, interest rates, etc.

Rating Factors of Management:

- Internal control, policies and audit competence;

- The efficiency of the management information system and risk monitoring system;

- Level of support from the management or the board;

- Adherence to the laws, rules and regulations;

- Management’s ability to plan, manage and respond to risks;

- Taking corrective measures on the advice of supervisory authorities and auditors;

- Willingness to meet the banking community requirements;

- Maintaining reasonable compensation policies;

- Institution’s overall performance and risk profile.

Earnings

The ability of the financial institutions to generate returns on the asset employed determine their profits. It is an essential parameter for analysing the risk and recovery of the institution.

Rating Factors of Earnings:

- Earning source;

- Earning stability, trends and level;

- Level of operational expenses;

- Market risks exposure in terms of foreign exchange, interest rates and price fluctuations;

- Retained earnings as a source of adequate capital;

- Maintaining provisions for loan allowances and loss on the lease;

- Managing the forecasting process, management information system and budgeting system;

Liquidity

The financial institutions need to keep sound liquidity position to ensure carrying of uninterrupted business operations. The primary ratio calculated to determine liquidity is the liquid cash to asset ratio.

Rating Factors of Liquidity:

- Deposit stability and trend;

- Ability to acquire funds from money market and other sources of capital;

- Institution’s ability to sell off the pools of assets which are difficult to be sold individually;

- The holding of assets which are readily convertible into cash without any loss;

- Maintaining adequate liquid sources of funds to meet day to day expenses without creating burden over the institution;

- The extent of reliance on the short term sources of the fund like borrowings, brokered deposits, etc. to invest in long term assets;

- The degree of diversification of the various sources of funds;

- Management’s ability to analyze and regulate the institution’s liquidity position, and ensuring effective implementation of the management information system, fund management strategies, liquidity policies and contingency funding plans.

Sensitivity

The effect of market fluctuations on the financial institutions, such as the response to changes in interest rates, commodity price, foreign exchange rates, derivatives, etc.

Rating Factors of Sensitivity:

- Management efficiency in identifying, analyzing and controlling the level of market risk;

- Analysis of the interest rate risk involved in non-trading positions;

- Responsiveness of the financial institutions towards the fluctuation in commodity prices, interest rates, equity prices, foreign exchange rates, etc.;

- Assess trading and international operations risk.

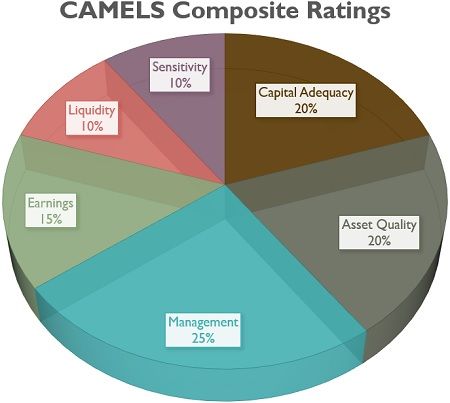

CAMELS Composite Ratings

The composite rating of the components determines the weight or importance given to each element individually. In the following pie diagram, the CAMELS composite rating is shown:

- Capital Adequacy 20%: The capital acquisition and its source, play a significant role in finding out the CAMELS rating of the institution.

- Asset Quality 20%: Assets here basically refers to the loans provided by these financial institutions shown in the balance sheet, which are judged by their quality.

- Management 25%: Management of risk at each step, right from planning, organizing, staffing and controlling involves CAMELS rating.

- Earnings 15%: The earning potential, sustainability, quality and trend are analyzed by the supervisory level.

- Liquidity 10%: The movement and availability of liquid cash and cash equivalents also affects the rating.

- Sensitivity 10%: The last component is the institution’s sensitivity or responsiveness towards the market risk.

CAMELS Numerical Ratings

CAMELS numerical rating defines the position of financial institutions and chalks out the areas of improvement. Let us now find out the rating analysis and its interpretation of different components with the help of the following table:

| Rating | Rating Range | Rating Analysis | Interpretation |

|---|---|---|---|

| 1 | 1.0 - 1.4 | Strong | Most suitable in all aspect. |

| 2 | 1.5 - 2.4 | Satisfactory | Favorable but has certain weakness |

| 3 | 2.5 - 3.4 | Less Than Satisfactory | Involves financial, operational or managerial weaknesses which needs supervisory concern |

| 4 | 3.5 - 4.4 | Deficient | Involves financial weaknesses up to an alarming stage |

| 5 | 4.5 - 5.0 | Critically Deficient | Involves critical financial weaknesses which may lead to failure of institution |

Each rating and its analysis is interpreted as follows:

- One is “Strong”: The top-rated financial institutions are the ones which range between a rating of 1.0 to 1.4; they have the most favourable financial, operational and managerial conditions.

- Two is “Satisfactory”: The banks which are suitable but has some identified weaknesses and are rated between 1.5 to 2.4.

- Three is “Less Than Satisfactory”: These financial institutions are rated between 2.5 to 3.4 and require supervisory concern to overcome several financial, operational and managerial weaknesses.

- Four is “Deficient”: The banks or other financial institutions which lie between a range of 3.5 to 4.4 are at an alarming stage. It pertains many economic weaknesses which may lead to loss or risk of failure.

- Five is “Critically Deficient”: The most inferior rating is between 4.5 to 5. Here, the financial institutions have crucial financial weaknesses and need serious attention; otherwise, it will lead to a high degree of failure.

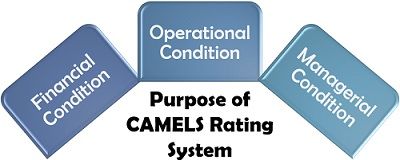

Purpose of CAMELS Rating System

The CAMELS rating system is highly efficient to determine the risk level associated with financial institutions. It has majorly served the following purposes:

Financial Condition: To determine the financial health and soundness of the institution, the CAMELS rating system is widely used.

Operational Condition: CAMELS rating system analyzes the institution’s liquidity position and manages risk is to ensure sound operational condition.

Managerial Condition: It also indicates management’s efficiency of handling risks, managing sources of funds, liquidity position and earnings potential of the institution.

Ashish Gupta says

Good Article. Keep it up.

Rishuu says

Thanks for the knowledge it really helped me