Definition: As per (SA-500), audit evidence mentions the data or facts based on which the auditor reaches a conclusion whether the financial statement of the company displaying the true and fair value or not, during which the auditor discovers various affirmations of the administration to express his point of view on these affirmations.

The auditor needs to evaluate such so that he can reach the conclusion of whether the statement is fair or not. These evaluations are done based on the facts and reasons, and such facts and reasons are known as audit evidence. It involves the facts of accounting records as well as other information or facts. Its auditor’s responsibility as well as duty to find sufficient and relevant evidence to form an opinion on the financial statement to cut down the risk.

Content: Audit Evidence

Sources of Audit Evidence

By way of performance of compliance and substantive methods, the auditor must find adequate and relevant evidence to facilitate him to assemble. For gathering moderate assurance, compliance procedures are tests designed to acquire feasible assurance that those internal controls on which audit reliance is to be placed are in effect.

Because of the following reasons, the auditor is intended to assure to acquire audit evidence from compliance procedure reasonably:

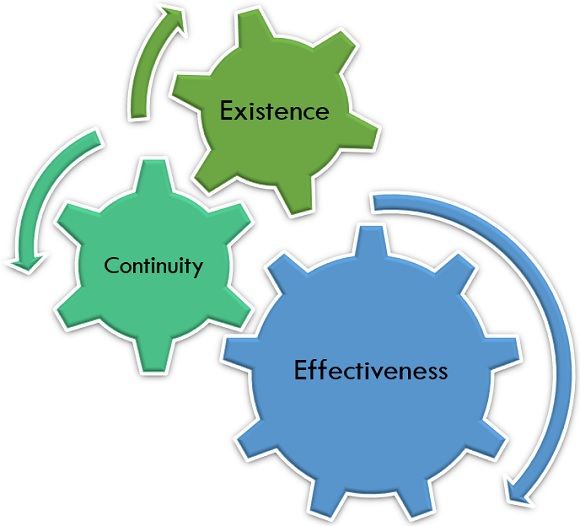

- Existence: Existence of internal controls.

- Effectiveness: Effectiveness of internal controls, whether they are functioning productively or not.

- Continuity: Continuity of internal controls, i.e., it has been operated throughout with confidence.

To collect evidence for assessing the integrity, genuineness and efficiency of the produced information provided by the accounting system, a substantive process is outlined. The following declaration is intended to sensibly assure the auditor for acquiring the audit evidence from substantive procedures.

- Existence of assets and liabilities at an inclined moment.

- Rights and obligations regarding assets and liabilities, i.e., assets are the right and liability is an obligation of a company.

- Occurrence, i.e., a transaction that took place is related to the entity during the admissible period.

- Completeness of reports, i.e., there is no unrecorded asset, liabilities or transactions.

- Valuation of asset or liability is recorded at the appropriate carrying value.

- Measurement of transactions that it is recorded properly and revenue or expenses is allocated to the proper period.

The authenticity of audit evidence as per SA- 500 rely upon its internal or external sources as well as its structure. However, the reliability of audit evidence is based on the conditions under which it is acquired. For evaluating the reliability of audit evidence, the following generalizations may be useful:

- In general, external evidence acts as substantial trustworthy evidence than internal evidence.

- Although when related internal control is satisfactory internal evidence becomes more trustworthy.

- However, oral evidence is also important, but rather than that, written evidence acts as more reliable evidence.

- The evidence which the auditor gathers by himself will be treated more reliable instead of getting it from other entities.

- Precisely, audit evidence is the facts gathered and recorded by the auditor for reaching a conclusion based on which he places his point of view on the financial statements.

Primary sources of audit evidence involve the following:

- Elemental documentation of the company and the accounting system.

- Tangible assets.

- Personnel and the administration of the company.

- Suppliers, customers, knowledge of the company’s business and other parties dealing with the company.

However, the auditor is never certain about the financial statement’s correctness; he requires sufficient evidence to form an impartial base for making his point of view.

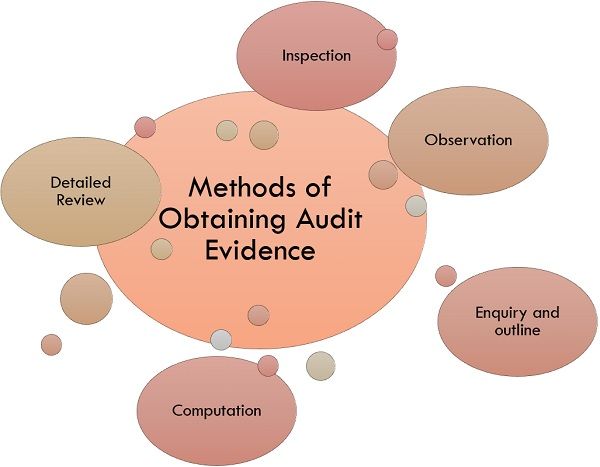

Methods of Obtaining Audit Evidence

As described in SA- 500 of auditing, the auditor collects evidence by operating substantive and compliance procedures by following any or all methods described below:

1. Inspection: For getting the evidence of the fluctuating degree of authenticity based on its nature and sources and internal control’s efficiency over their processing, precise inspection is required.

The primary classification of evidence is divided into four major documentary evidence; they are as follows:

- Evidence derived and held by third parties.

- Evidence that is derived from third parties but held by the entities.

- Evidence that is derived by entities but held by third parties.

- Evidence derived and held by the entity.

2. Observation: Noticing procedures and methods of others is known as observation. For Example, the auditor observes the stock counts done by his clients.

3. Enquiry and outline: Gathering facts and data from the knowledgeable person from inside as well as outside the organization is known as enquiry. It may be in written form or can be an oral enquiry addressed to the person within the organization. Enquiry helps the auditor to collect the information which he does not possess earlier. Outline refers to the enquiry’s response to authenticating data of the accounting records, i.e., it is an evidence collection activity done by the auditor. Generally, it is done in a substantive method, as it is a procedure of asking and getting information from the third parties authenticating the existence of an item.

4. Computation: Doing a separate evaluation of accounting records and source scripts to review its analytical accuracy is known as computation. It is an activity of gathering evidence that can be applied in all stages of an audit. It consists of counting of items, reconciliation as well as mathematical calculations. However, the reliability of evidence relies upon the competence and experience of a person gathering information.

5. Detailed Review: Studying important ratios as well as trends and investigating unexpected fluctuations and items comes under the detailed review.

Characteristics of Audit Evidence

Following are the characteristics of audit evidence:

- Adequacy: It specifies whether the documents provided are adequate or not for the purpose of a fair audit process. An auditor adopts various audit procedures for gathering adequate audit evidence.

- Authenticity: Audit evidence should have authenticity so that the auditor can form his opinion based on the authenticating evidence. The authenticity of documents depends upon the sources of evidence.

- Information’s Nature: It implies the type of information gathered as audit evidence. It can be varied according to the source of information.

- Pertinence: The importance of audit evidence is depending upon the type of audit conducted. The information collected may relevant for one audit is not necessarily relevant for another type of audit.

Conclusion

Audit Evidence is a base for an auditor to set his opinion on the financial statement’s correctness and reliability, whether they display the true and fair value or not.

Leave a Reply