Definition: Budgetary Control is a system of control that focuses on cost management with the help of budgets for Departmental and Organizational levels. It begins with budget preparation as per employees’ responsibilities, thereafter comparing the actual and planned outcomes and ends with variance analysis followed by a review.

In brief, we can understand it as a road map for achieving organizational control.

The managers use it as a tool for effective Planning and Control. Thus, it specifies the future course of action along with the basis of evaluation.

Also, Budgetary Control develops a basis for comparison between the budgeted & actual outputs.

To achieve accurate results, the managers create a Master Budget and this Budget incorporates several Functional Budgets. Organizations prepare these functional budgets based on the functions of management.

Broadly, Budgetary Control may involve:

- Budget Preparation

- Coordination at organizational and departmental level

- Analyzing actual and budgeted performances

- Efforts toward achieving maximum profitability

Content: Budgetary Control

- What are Budget and Budgeting?

- Objectives

- Characteristics

- Advantages

- Disadvantages

- Important Points to Remember

- Types of Budgets

- Conclusion

What are Budget and Budgeting?

A Budget is a statement prepared to quantitatively specify the future course of action to meet strategic objectives. However, the duration of the Budget is specific.

By creating Budgets, the organization can access or achieve opportunities and expenditures.

Besides, Budgeting is an umbrella term that incorporates budget preparation and coordination. It is a universal process that applies to almost every situation.

In comparison to Budgeting, Budget has a narrow scope as it only involves the preparation of strategic plans. And we can refer to the overall process of Budgeting as Budgetary Control.

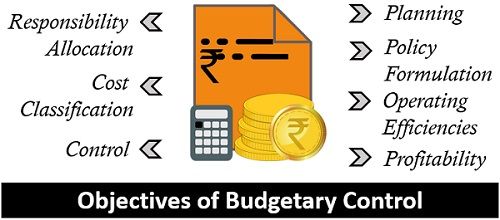

Objectives of Budgetary Control

The goal of budgetary control is to assist firms in their management functions. Also, it is one of the mediums of communication in the organization.

- Planning: The organizations prepare a Budget for the future to achieve organizational objectives. By this, they try to analyze the issues and their solutions.

- Policy Formulation: The organizations collect authentic information during the process of Budgeting. Based on this data, they plan suitable business policies.

- Operating Efficiencies: Another goal of Budgeting is achieving operating efficiencies. Therefore, they economically manage Cost Centres and departments existing in the company.

- Profitability: Every company operates intending to earn profit. Therefore, through budgets, the organizations try to minimize wastage.

- Responsibility Allocation: By budgetary control, the management can state employees’ responsibilities in advance.

- Cost Classification: Budgetary control helps classify costs under Fixed and Variable costs.

- Control: Budgets act as a tool for effective organizational control. It provides the basis for Comparison, Identification and Elimination of barriers.

Characteristics

The main characteristics of the budgetary control are as follows:

- Involves planning of activities.

- Systematic collection and recording of data.

- Allocation of suitable responsibilities as per skill and capabilities.

- Periodic review of performance between actual and budgeted ones.

- Determining suitable corrective actions.

- Increase profitability through cost control.

- Review and Revision of budgets.

Advantages and Disadvantages of Budgetary Control

Advantages

Following are some of the advantages of Budgetary Control:

- Media for Communication: It is an effective source of communication in the organization. This is because it conveys plans and policies from top-level to lower management levels.

- Based on Detailed Research: The preparation of budgets involves thorough research and study.

- Coordination among Departments: The firms coordinate their plans, goals & objectives at the organizational level using Budgeting.

- Control on Resources and Liquidity: Budgetary control establishes control over liquidity & available resources.

- Comparative Analysis: Managers can prepare various budgets as per the need. After that, use them for tracking performance through a comparative analysis.

Disadvantages

The budgetary control possesses certain disadvantages discussed as under:

- Dynamic Environment: The environment in which a business operates is Dynamic. So, the manager faces difficulty in preparing a suitable Budget.

- Misleading Facts: The error in the data is due to incomplete, undisclosed records. As a result, they may affect the production of the actual output.

- Rigid: It may be possible that some budget becomes rigid and doesn’t allow them to go beyond it.

- Restricts Accountants: It may restrict companies by budget targets and policies. Consequently, it will significantly affect their freedom and work culture.

- Expensive: The preparation of the Budget requires expertise. Hence, it is costly and adds to costs for the company. Also, its implementation is unaffordable for small vendors.

- An Instrument of Management: It is just a tool for management but cannot be treated as a replacement for it.

Important Points to Remember

- Must have top management support for effective budgetary control implementation.

- Forecasts must be accurate as they are the pillars of budgetary control.

- Must collect data from authentic sources to generate accurate results.

- Its success depends on the enthusiasm of the employees. Therefore, they must be motivated periodically using monetary and non-monetary benefits.

- The budgetary control must contain scope for modification as per circumstances.

- For efficient control, supervision during Budgeting is necessary.

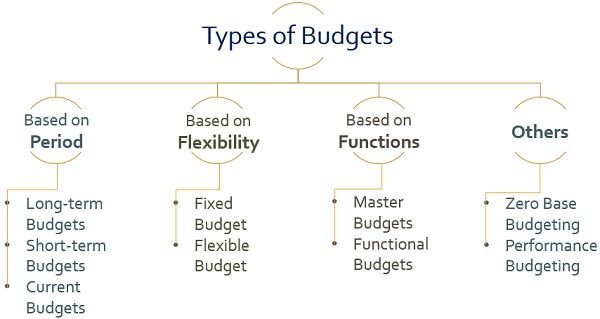

Types of Budgets

The budgets are categorized under groups furnished below:

Based on the Period

- Long-term Budgets: The budgets managers prepare for the duration of five to ten years are the long-term ones. In other words, the budgets are designed to fulfil long-term goals.

- Short-term Budgets: In contrast, the ones prepared for the duration of one to five years are the short-term ones.

- Current Budget: However, managers also prepare some budgets for very short, say one to twelve months. We can refer to such budgets as the current Budget.

Based on the Flexibility

- Fixed Budget: It refers to a budget prepared for a fixed output level. Thus, a flexible Budget remains constant and is assumed to be accurate.

- Flexible Budget: It is a complete contrast to the flexible Budget. As Flexible Budget varies according to the changes in the output level.

Based on the Functions

- Master Budget: It is the accumulation of several functional budgets that are duly approved. Besides, a budgeted balance sheet is also prepared to depict Budgeted Profit and Loss. However, it is further sub-divided into:

- Operating Budget

- Finance Budget

- Functional Budget: The budgets are prepared based on Functions or Departments. These are additionally known as Departmental budgets and Subsidiary Budgets. Functional Budgets are further classified as under:

-

- Sales Budget

- Production Budget

- Cost Budget

- Cash Budget

- Capital Expenditure Budget

Other Budgets

- Zero-Based Budgeting (ZBB)

- Performance Budgeting

Note: Among all managers are much concerned about the Sales Budget.

Conclusion

To sum up, companies use Budgetary control to exercise control over their operations. Besides, it involves a constant comparison between actual and planned results. Also, Managers conduct variance analysis and take suitable measures.

To remain successful, companies plan their expenses and income through Budgetary control.

Leave a Reply