Definition: Responsibility accounting is an accounting system that controls cost and revenue, by delegating responsibility to individuals or groups and apportionment of responsibility centres. It aims to achieve minimum variance between actual and planned goals.

Responsibility Accounting focuses on monitoring and controlling costs through personal responsibility within the organization. It manages persons rather than the product’s function and performance.

It is also called Profitability Accounting and Activity Accounting.

Individuals from all the responsibility centres report the performance of their respective divisions. These reports contain relevant information about the Cost and Revenue of the department.

Content: Responsibility Accounting

- Objectives

- Pre-requisites

- Features

- Importance

- Advantages

- Disadvantages

- Responsibility Centres

- Steps

- Responsibility Reporting

- Final Words

Objectives of Responsibility Accounting

The objective behind maintaining accounts by way of responsibility accounting is to:

- Examine the levels of responsibility.

- Bifurcate organizational objectives between departments.

- Create responsibility centres.

- Find out the contribution of the individual departments.

- Define accountability based on responsibility.

- Estimate the cost and revenue of the responsibility centres.

- Motivate departmental managers.

Pre-requisites of Responsibility Accounting

- Rational Budget

The budget planned must be realistic. The performance evaluation is based on comparisons with these budgets. - Strong Organizational Structure

The relationships in organizations must be clearly defined. The allocation of responsibility will largely depend on the organizational structure. - Organizational Environment

A healthy organizational environment is essential for a successful responsibility accounting. - Encouragement by Top Management

The top management should be supportive and unbiased towards its employee. This leads to a motivated workforce and the successful application of responsibility accounting. - Involvement of All levels

Here, all the levels of the organization from top to bottom are part of this accounting process. Responsibility calculations at each level of the organization enhance the overall performance. - Continuous Flow of Information

An organization should have a constant flow of information. So that the budgeted objectives and essential information reaches the centres on time. - Self-motivated Team

The responsibility accounting evaluates the human factor of the organization. The workforce must be self-motivated and dedicated to the work assigned to them.

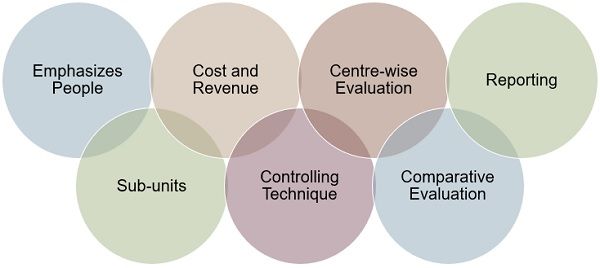

Features of Responsibility Accounting

- Emphasizes People

This concept emphasizes people over the product. The basis of evaluation is the responsibility assigned to centre managers. - Sub-units

The organization is subdivided into manageable operational units called responsibility centres. Each of these centres has a responsible individual called the centre manager.

The manager of the concerned centre is responsible for the activities of that centre. - Cost and Revenue

Cost and revenue play a vital part in responsibility accounting. We measure centre performance in cost, revenue, profits and capital investments. - Controlling Technique

It can also maintain control and discipline over the organization. The organization delegates authority through responsibility centres at all levels of management. - Centre-wise Evaluation

Responsibility accounting enables critical analysis for every responsibility centre. - Comparative Evaluation

The departments conduct a comparative evaluation of the actual with budgeted targets. That helps in estimating the responsibility of the centre manager. - Reporting

Higher authorities get a clear picture of the organization through responsibility reports.

Advantages

- It facilitates cost planning and control.

- Delegation of authority and responsibility to make managers more responsible.

- Helpful in maintaining organizational standards.

- It enables prompt decision-making by taking remedial actions on time.

- It is an effective tool for motivation for the organization.

Disadvantages

- The managers find difficulty in classifying the costs under controllable and uncontrollable heads.

- Required authority for assigned responsibility is not provided.

- Generating reports for each centre consumes plenty of time in communication and analysis.

- Conflict between departments may occur.

- Organizations must not rely entirely on this accounting system. Some areas must need extended and detailed investigation.

Responsibility Centres

This management accounting system focuses on achieving profitability and control by dividing the organization into minor divisions. These divisions are called responsibility centres headed by managers assigned to that centre.

We can categorize responsibility centres into:

- Cost Centre

- Revenue Centre

- Profit Centre

- Investment Centre

Cost Centre

The cost or expense centre looks after all the cost-related activities. The responsibility of the cost centre manager is to control costs, excluding revenues.

The cost centre in manufacturing units can be the service and production departments. For example, the maintenance and accounts department.

Revenue Centre

The revenue centre manager is responsible for generating sales revenue in the organization. They can control the expenses of the marketing segment but do not control the costs.

The duty of the revenue centre manager is to look after the sales, promotion and product mix.

Profit Centre

A profit centre aims at profit maximization by controlling costs and revenues. The profit centre manager manages the production and marketing activities.

The managers try to reduce costs and increase revenue to maximize profits. For example, Branches of business in a different city.

Investment Centre

The manager heading the investment centre is responsible for costs, revenue and investments. The department controls activity regarding acquisition and asset management.

The department also develops credit policies that impact debt collection in the organization.

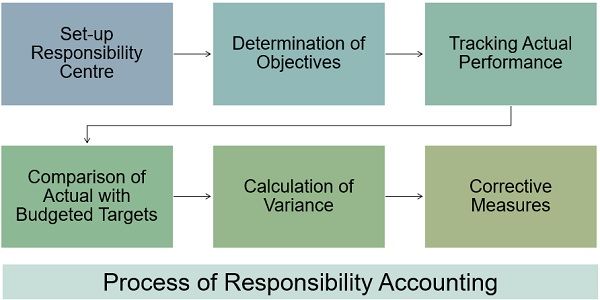

Steps Involved in Responsibility Accounting

In responsibility accounting, the firm splits into several responsibility centres. The employees are allocated the responsibility at each centre.

Comparing planned and actual performance evaluates the performance of that centre. The centre managers communicate results through responsibility reports.

Organizations can follow the series of steps discussed below for performing responsibility accounting:

- Set-up Responsibility Centers

The Investment, Profit and Cost centres are the sub-divisions of the firm. We refer to these divisions as responsibility centres.

The authorities appoint a manager for every centre. They are responsible for the performance of that centre. - Determination of Objectives

The objectives for each centre are determined and conveyed to the centre manager. It may consist of predefined standards, budgeted or planned targets. - Tracking Actual Performance

The managers track and record the actual performances of their respective centres. Following this, they report their actual performance to the concerned authority. - Comparison of Actual with Budgeted Targets

The authority conduct a detailed comparative analysis between the actual and budgeted performance - Calculation of Variance

After comparing the manager calculates, the variance between performance and standards.

The differences are expressed in the form of favourable-unfavourable or positive-negative responsibility. - Corrective Measures

In case, responsibility is unfavourable or negative, then authorities take necessary remedial measures. These measures help in improving responsible managers’ performance.

With these steps, the organizations can control costs. Also, it enhances the performance at each responsibility centre.

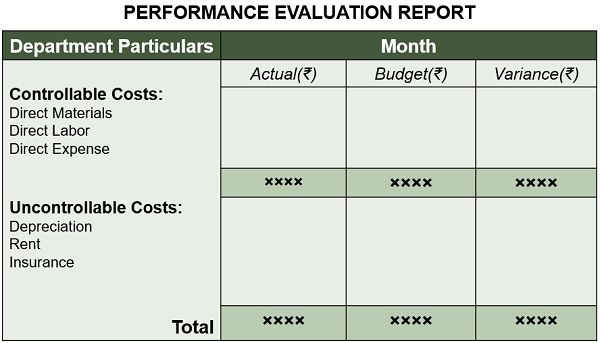

Responsibility Reporting

The assessment of departmental performance is done by preparing responsibility reports. The centre manager presents these reports to the higher authorities. The authorities use these reports for review and decision-making.

The performance report is another name for a Responsibility Report.

The authorities identify the deviations between budgeted and actual targets. Thereafter, they take necessary corrective measures.

Points to remember while reporting

- Categorization of costs must be under controllable or uncontrollable costs.

- The preparation of reports should be in a comparative form. It must depict the actual and budgeted costs.

- Costs reported should belong to the responsibility centre preparing that report.

- The recovery of cost with revenues must be for the organization. This recovery should be irrespective of the centres.

- Reports should be effective as well as visually attractive.

Final Words

Responsibility accounting is a management accounting system that analysis human resources. The evaluation is carried out based on the responsibility assigned to the manager.

Various responsibility centres are created by dividing the organization into units. The four responsibility centres generally created are Cost, Revenue, Profit and Investment.

Organizations go for responsibility accounting to conduct detailed analysis at every level. The organization take necessary corrective measures at an initial stage.

Leave a Reply