Definition: Forfeiture of shares is the annulment (cancellation) of the shares owned by a shareholder as a penalty because of the non-payment of allotment and calls due to the company.

Along with the shares, the amount already paid to the company also get forfeited. The company can either Dispose of or Reissue the forfeited shares.

Post forfeiture, the company removes the shareholder’s name from the register. Also, his membership in the company comes to an end.

The power to forfeit the shares lies in the hands of the company’s director. The authorization is given by stating the procedure and provisions in the Articles of Association (AOA).

The director must inform the shareholder before cancelling the allotment of his shares. Therefore, he provides the notice stating the same, 14 days before passing the resolution.

It is the obligation of the company to follow the procedure given in the Articles of Association(AOA). At the same time, the AOA must include the procedure in good faith of the company.

Forfeiture may be misunderstood with the surrender of shares. But the surrender is the voluntary cancellation of shares by the shareholder himself.

The forfeiture of the shares results in:

- Discontinuation of shareholder’s membership.

- Reduction in the issued share capital of the company.

Content: Forfeiture of Shares

- Provisions

- Impact

- Procedure

- Accounting Treatment

- Journal Entries

- Reissue of Forfeited Shares

- Annulment of Forfeited Shares

- Pro-rata Allotment and Forfeiture

- Example

- Final Words

Provisions for Forfeiture of Shares

Share forfeiture provisions for a limited company are given in Clause 28 – 34 of Table ‘F’ containing Articles of Association.

These provisions provide all the information in case of default by the shareholder. It covers the conditions, procedure and treatment for share forfeiture.

Whereas, Table ‘A’ of the Companies Act 2013 empowers the Board of Directors for decisions making about forfeiture. These decisions cover:

- The sale of forfeited shares, or

- The disposal of the shares after forfeiture

Impact of the Forfeiture on the Company and Shareholder

- Reduction in the share capital of the business due to the cancellation of unpaid calls.

- Changes in the structure of the share capital of the company.

- The termination of the shareholder as a member.

- The shareholder is no longer eligible to avail of the rights associated with the shares.

- We record the forfeited amount to the “Forfeited Shares Account“. It comes under the liability side of the Balance Sheet.

Procedure of Forfeiture

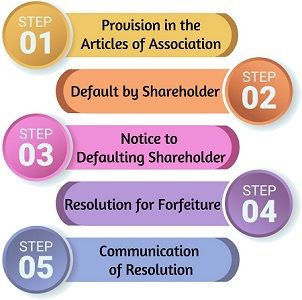

The procedure or conditions for forfeiture is as follows:

- The provision in the Articles of Association

The AOA of the company must grant the power to forfeit the shares in case of default. Thus, the necessary procedure and provisions must be clearly stated in the AOA. - Default by Shareholder

The company can only cancel the ownership in case of default in payment from the holder’s end. - Notice to Defaulting Shareholder

The company notify the shareholder to clear his dues along with interest. Also, provide notice before 14 days of forfeiting the allotted shares and the amount paid. - Resolution for Forfeiture

After necessary investigation, the director initiates forfeiture of shares by passing the resolution. - Communication of Resolution

The decision is conveyed to the shareholder about the forfeiture of his shares.

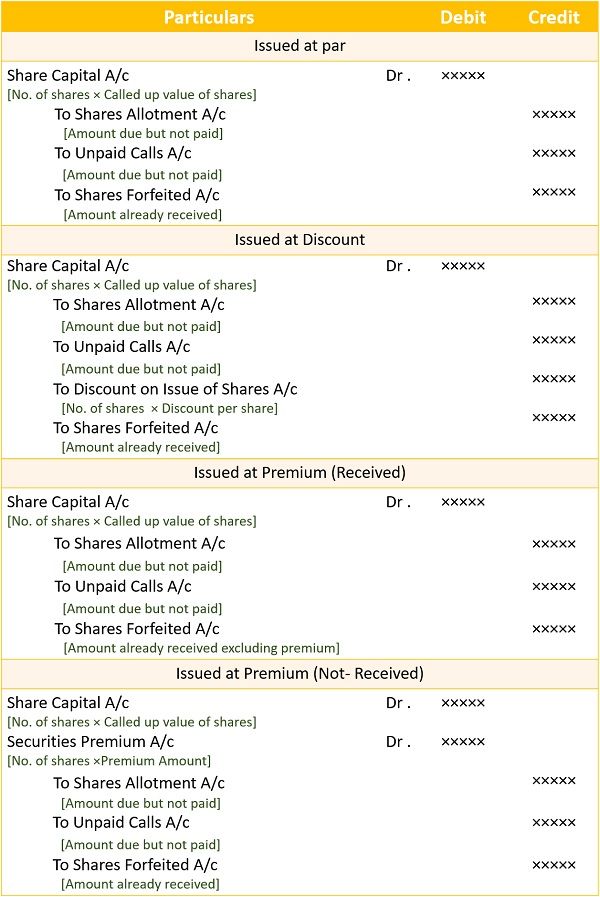

Accounting Treatment of Forfeiture of Shares

At the time of issue, we recorded the share capital on the credit side. While passing Journal Entries for forfeiture, we need to record it on the Debit side.

The accounting treatment of the forfeiture may differ in different cases. We need to analyze the initial conditions of the shares issued at the beginning.

The accounting treatment of shares offered by the company at:

- Par

- Discount

- Premium

Forfeiture of shares issued at Par

Here the shares were initially issued at Par, i.e. at face value. During forfeiture, we reverse the entries made at the time of issue.

The entries will be on the bases of the number of shares forfeited and the amount due to the shareholder.

Forfeiture of shares issued at Discount

In some situations, companies issue shares at discounted rates. While forfeiting, we cancel the discount offered by the company.

Thus, we credit the ‘Discount on the Issue of Shares’ account.

Forfeiture of shares issued at Premium

In this case, once the Premium has been paid, it cannot be reversed. However, if the shareholder hasn’t paid the Premium, it can be cancelled.

The journal entries are different in both cases.

- Case 1: Premium Received

Here the shareholder has already paid the amount of Premium. So the entries are like forfeiture at face value. - Case 2: Premium Not Received

In this, we need to cancel the Premium offered to the shareholder during forfeiture. Consequently, we debit the ‘Securities Premium‘ account with the amount offered as a premium.

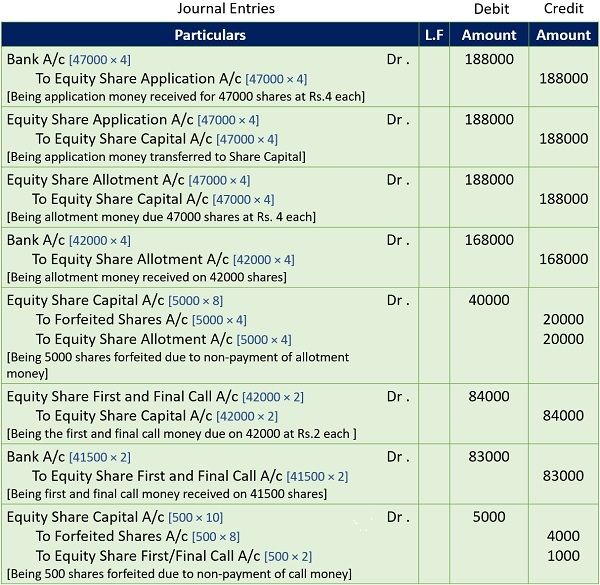

Journal Entries for Forfeiture of Shares

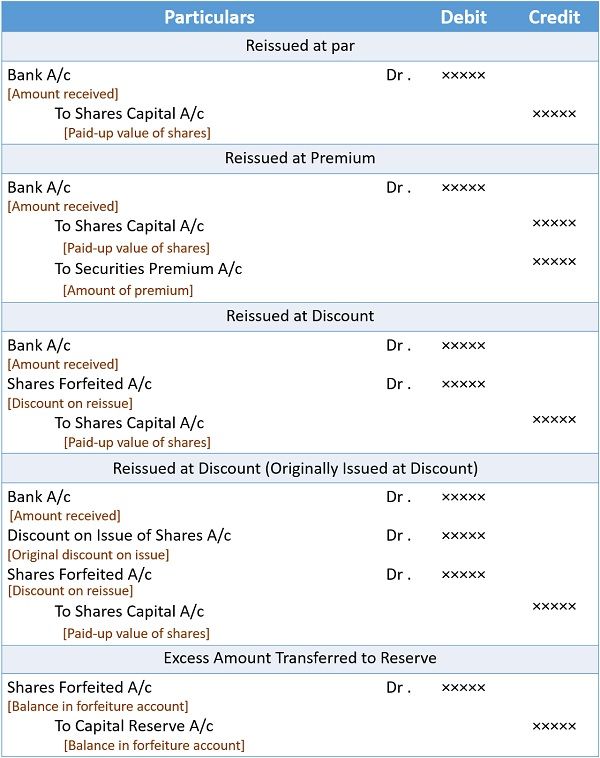

Reissue of Forfeited Shares

The company can compensate for the loss born due to defaulting shareholders. Consequently, they can again issue the forfeited shares for sale. We refer to it as a Reissue of Forfeited shares.

The authority to reissue the forfeited shares is with the Board of Directors of the company.

The company may reissue these shares at Par, Premium and Discount like fresh issues.

The reissue can be in the following ways:

- Complete reissue of the forfeited shares.

- Partial reissue of the forfeited shares.

Points to remember:

- Post reissue, we transfer the excess amount in the Share Forfeiture A/c to Capital Reserve A/c.

- At the time of Reissue, the loss must not exceed the unpaid amount.

- The unissued forfeited amount is an addition to Share Capital. Hence, it comes under the liability column of the Balance sheet.

- We transfer the profit by reissuing forfeited shares to Capital Reserve A/c.

Accounting Treatment for Reissue of Forfeited Shares

Annulment of Forfeited Shares

The faulty shareholder may put up a request to cancel the forfeiture of his shares. The Board of directors may discuss the annulment in a board meeting.

They can approve the cancellation of forfeiture only if the shareholder agrees to:

- Pay the amount due for his unpaid calls.

- Clearance of the Remission fees.

- Payment of interest charged on the unpaid calls.

Pro-rata Allotment and Forfeiture of Shares

Pro-rata is adjusting the oversubscription at the time of application into proceeding calls.

During forfeiture of such shares, the company:

- Find out the ratio of shares applied and allotted.

- Calculate the amount received in excess.

- Adjustment of this amount into share allotment and calls, respectively.

- Forfeiture of the remaining unpaid amount after the above calculation.

The formula for estimating the number of shares applied is as follows:

Example

Peterson ltd. accepted applications for Equity shares of Rs.50,000/-. The face value of these shares is Rs.10/- each, payable as follows:

- Application – Rs.4/-

- Allotment – Rs. 4/-

- First & Final Call – Rs. 2/-

The company received applications for Rs. 47000/- shares. And shares were allotted to all the applicants.

Amie, the holder of 5000 shares, failed to pay money on the allotment. Another shareholder Bob who owns 500 shares, was unable to pay the call money.

The company decided to forfeit the shares of Amie and Bob. Journalize the transactions in the books of Peterson ltd.

Solution:

Final Words

The company ask shareholders to pay the amount due on calls on time. But when the shareholder cannot make the payment, the company forfeits his shares.

We can understand forfeiture as cancellation or annulment in simple terms. The director of the company may reissue or dispose of these shares. The Articles of Association empower him to do so.

Forfeiture leads to the removal of the shareholder’s name from the register. Also, they lose all their rights as a shareholder of the company.

Leave a Reply