Definition: An investment portfolio manager is the one who is responsible for generating the highest possible value out of the client’s fund keeping in mind the objective of investment, preferred period, risk-taking capacity and expected returns. The client could be anyone; an individual, families, banks, companies, insurance agencies, etc.

Investment portfolio managers are experienced and professionally trained people. They keep a long-term view of the stocks and their performance, and they work by elaborated research of the financial market to give better results.

Content: Investment Portfolio Manager

Roles and Responsibilities

- Customization of the Client’s Portfolio: An investment portfolio manager understands the client’s investment objective and thus builds a balanced portfolio considering all the factors.

- Formulation of Portfolio Strategy: He develops a strategy and opts for either active portfolio and passive portfolio depending on the client’s need.

- Making Client Aware of Each Investment Option: It’s the primary responsibility of the Portfolio Manager to provide complete information about the chosen investment options to the client.

- Being Updated with Financial Market: The investment portfolio manager has to regularly follow the financial market and keep himself updated with the current changes and fluctuations.

- Safety and Security of Client’s Wealth: It is the responsibility of the investment portfolio manager to protect the client’s fund and invest it safely and wisely.

- Sensible Asset Allocation: The portfolio manager is responsible for the selection of the assets or investments based on their calculations and prior experience.

- Diversification of the Client’s Portfolio: The portfolio manager has to diversify the client’s portfolio well to create maximum value from different opportunities and minimise the risk exposure.

- Rebalancing the Portfolio: The investment portfolio manager periodically reviews the investment portfolio and rebalances the investment options to achieve the desired asset allocation.

Eligibility Criteria

The investment portfolio manager is a profession. There are specific criteria for an individual to qualify as an investment portfolio manager. The basic ones are mentioned below:

Educational Qualification

- Bachelor’s Degree: It is essential to hold an undergraduate degree in business, accounting, finance, statistics or economics for becoming a portfolio manager.

- Master’s Degree: A master’s degree in accounting, business, finance, or risk management is though not obligatory but will be an added advantage for the profile.

Certification Courses

- CFA Program: One of the most popular certifications for investment portfolio management is the Chartered Financial Analyst Program. It is a globally recognised certificate course.

- CFP Program: Another one is the Certified Financial Planning Program, which is a certificate of excellence in the financial planning platform.

License

An investment portfolio manager must acquire a permit from the Financial Industry Regulatory Authority (FINRA), a regulatory body governing securities in the USA.

In India, an investment portfolio manager needs to get the certificate of registration under the Securities and Exchange Board of India (SEBI).

Experience

The experience of working as a financial advisor is necessary to develop the skills and expertise required for becoming a portfolio manager.

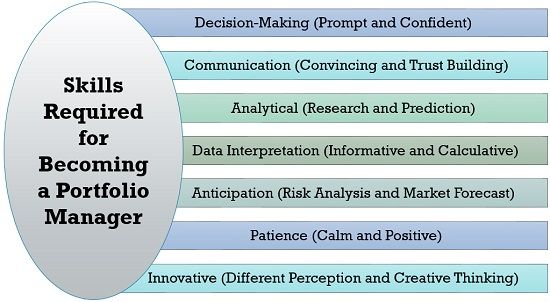

Skills Required

- Decision-making: The investment portfolio manager must possess a quick and confident decision-making ability.

- Communication: Communication skills are necessary to convey the analysis and opportunities to the clients and to maintain a long-term relationship with them.

- Analytical: An investment portfolio manager needs to research the financial market and thus must have the skills of analysing the current situation to predict future possibilities.

- Data Interpretation: A investment portfolio manager needs to be fully loaded with the present data on the financial market and economics. He must be able to interpret and analyse such data for the client’s benefit.

- Anticipation: A portfolio manager must be able to anticipate the risk involved or the chances of loss, by keeping oneself updated on significant policies and events news which may affect the financial markets.

- Patience: A lot of patience and positivity is required to deal with clients as well as for making the right decisions.

- Innovative: An investment portfolio manager has to be creative and innovative in building up a different combination of the investment options to create value for clients.

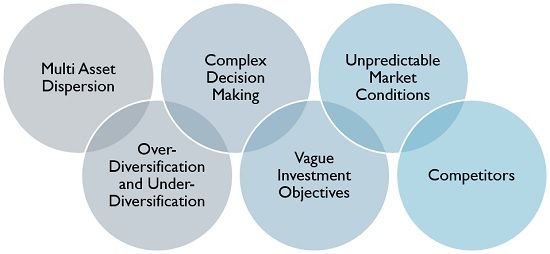

Challenges Faced by a Portfolio Manager

- Multi-Asset Dispersion: An investment portfolio manager faces the challenge of understanding numerous possible outcomes of the prepared portfolio and taking decision accordingly.

- Over-Diversification and Under-Diversification: The investment portfolio manager faces the challenge of balanced diversification of the client’s portfolio to avoid risk exposure. He has to look after the number of selected investments, kind of investments chosen and the period for which the investment is made.

- Complex Decision Making: For an investment portfolio manager, decision making has been a complicated task as to selecting a proper mix of assets and a balanced portfolio.

- Vague Investment Objectives: Sometimes, the investor is not very clear with his investment objectives. In such a situation, an investment portfolio manager is not able to generate value to the investor.

- Unpredictable Market Conditions: Volatile market conditions leads to uncertain changes in stock prices. The investment portfolio managers need to keep an eye on the financial market all the time, which is indeed a challenging task.

- Competitors: An investment portfolio manager faces a lot of competition since the deviation in the portfolio’s return may lead to changing of the investment portfolio manager at times. Moreover, gaining and maintaining the client’s trust and confidence is a difficult task.

Conclusion

In the present scenario, when inflation is increasing at a high rate, it is essential to make money from money to maintain a sound financial position and future security. It is crucial to take the help of an investment portfolio manager to generate the highest possible returns at optimal risk level.

Leave a Reply