Definition: Internal Control system is the arrangement of controls by the enterprise in the interest of the business of the organization in an organized and productive manner. It ensures obedience to management policies, protect assets and ensure the integrity and efficiency of the records as far as possible.

The specific components or elements of an Internal control system are termed as “controls” or “Internal control”.

Content: Internal Control

Internal control and the Auditor

The Institute of Chartered Accountants of India (ICAI) in its accounting standard on auditing (SA-315) has declared that the auditor must procure an awareness of the control environment. As a part of gathering this recognition, the auditor must figure out whether:

- Management with the surveillance of those charged with governance has constituted and retained a culture of integrity and virtuous behaviour, and

- The effectiveness in the control environment components simultaneously provide an appropriate base for the other elements of Internal control, and even if control environment weaknesses do not ruin those other elements.

- The duty of protecting the assets of the company is mainly that of the management, and the auditor is designated to commit the protections and Internal controls initiated by the management, despite he will surely take into account any faults he may identify therein while formulating his program.

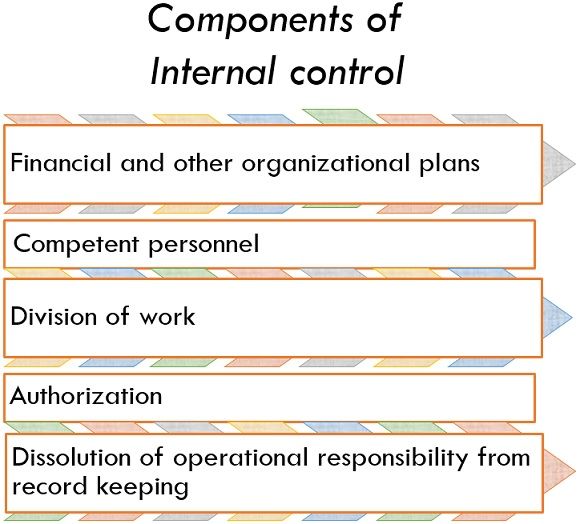

Components of Internal Control

An efficient system of Internal control must have significant basic components:

- Financial and other organizational plans: This can serve the form of manual, appropriately classified by the flow chart. It must mention the miscellaneous duties and obligations of both staff and the management, expressing the powers of the authority dwells with various members. This is essential as in the case of the absence of the staff, or alternatively, the correct movement of work and the Internal control system could be perverted by the improper implementation of the techniques by employees either innocently or purposely.

- Competent personnel: Personnel are the most significant components of any Internal control system. If the employees are skilled and dynamic in their accredited work, an Internal control system can be managed efficiently even if few other components of it are absent.

- Division of work: This attributes to the process of division of work accurately among the personnel of the enterprise. Every single work of the enterprise must be divided into various stages and must be assigned to the personnel according to their quality and skills.

- Authorization: Under the Internal control system, all the actions must be approved by an appropriate authority. The individual entity or association which can either holds specialized or general authority for business dealing must hold a position adequate with nature. The importance of business dealing and the policy for the aforementioned authority must be entrenched by the top management.

- Dissolution of operational responsibility from record keeping: If every department of an enterprise is being appointed to arrange its shape results for manifesting better performance. Thus, to ensure trustworthy records and information, record-keeping work is detached from the operational responsibility of the affected department.

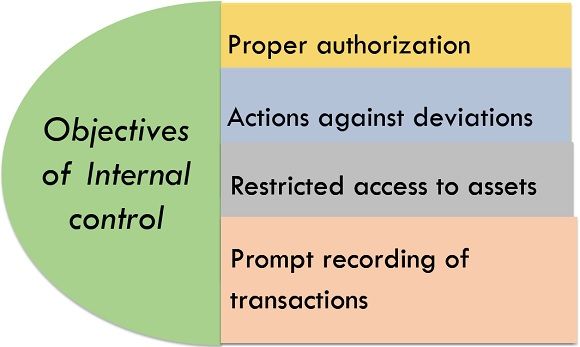

Objectives of Internal Control

The Internal control system is of elementary concern to the auditor because earlier than he can plan the tests he thinks to execute his audit program, he should decide the magnitude to which he thinks to depend on the system of the Internal control. However, before relying upon the Internal control system of the enterprise, the auditor must assure himself that the succeeding objectives of Internal control as per AAS-6 is attained by the enterprise:

- Proper authorization: Business dealings are performed with management’s regular and specific authorization.

- Prompt recording of transactions: All the deals are immediately recorded with the correct amount in the relevant accounts and in the accounting period in which they are completed so as to authorize the preparation of financial facts within the structure of recognized accounting policies and to retain accountability assets.

- Restricted access to assets: Admittance to assets is allowed only by means of management’s authorization.

- Actions against deviations: The indexed accountability for assets is correlated with the actual assets at feasible intervals, and suitable actions are taken with respect to any errors.

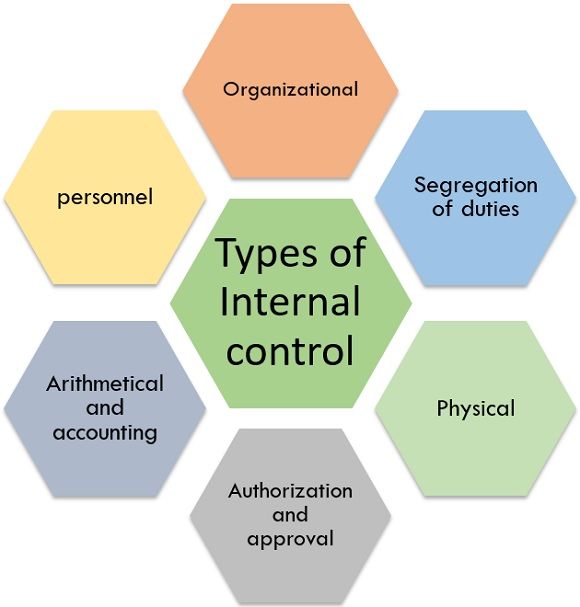

Types of Internal Control

It can be classified as follows:

1. Organizational

An organization must have a plan of enterprise which should

- Decide and allocate duties (each function must be under the supervision of a stated person who might be called a reliable or responsible official), and

- Analyze lines of reporting: In all situations, the assignment of responsibility must be clearly described. Personnel should always know the decisive powers assigned to him, the range of his control and to whom he should report.

2. Segregation of Duties

- No one will be accountable for the documentation and processing of the complete activity.

- The engagement of several people shortens the risk of deliberate manipulation or inadvertent error and increases the domain of checking of work.

- Partition of the operating activities of the organization should be removed, including authorization, initiation, execution, recording and custody.

3. Physical

- This involves the physical supervision of assets and affecting procedures arranged to limit entry to approved employees only.

- Entry can be direct or indirect.

- These controls are especially relevant in the state of portable, valuable, and desirable assets.

4. Authorization and Approval

- All the actions should require permission or consent from a suitable person. The confines to these permissions should be specified. For example, all credits need to be certified by the credit control department, or the work manager should accredit all overtime.

5. Arithmetical and Accounting

- These are the checks in reporting function which examines that the transactions have been certified, comprised and accurately recorded and prepared.

- Procedures involve examining the arithmetical veracity of the records, perpetuation and inspection of totals, control accounts, reconciliation of accounts for documents and preview.

6. Personnel

- Measures should be planned to ensure that the employees running a system are skilled and prompted to carry out the duty allocated to them, as the precise functioning of a system relies upon the capability and honesty of the operating employee.

- Methods contain suitable remuneration, advancement and career evolution outlook for future, selection of people with relevant personal attribute guidance and assigning of work to the right level.

7. Supervision

- All activities by all levels of team members must be supervised. This authority for surveillance must be clearly defined and broadcasted to the person being directed.

8. Management

- These are controls, applied by the management, which is external and apart from the daily routine of the system.

- They involve long-term administrative controls, the study of management accounts, resemblance with budgets, internal audit and any other major examination procedures.

Conclusion

An Internal Control system is the system of administering the business of the organization in an organized and effective manner, guarantees loyalty to management policies, secures the assets and safeguards the integrity and correctness of the records as far as possible.

Leave a Reply