Definition: A zero-coupon bond, as the name suggests, it is a financial instrument which does not allow a regular interest payment to the investor. Moreover, it is a bond which is issued at a meagre market price (discounted price) in comparison to its face value. And it is redeemable on or after a specified maturity date at the par value itself.

It is known by many names like deep discount bonds, accrual bonds, discount bonds or pure discount bonds.

Content: Zero-Coupon Bond

What is a Bond?

A bond in simple terms is a financial instrument for long-term investing. It is a mutual agreement among two parties, i.e., the investor and the issuer, where the former lends money to the latter for earning some interest on maturity.

Features of a Bond

When we say a bond, the first thing that clicks our mind is security. Let us see the various other characteristics of a bond:

- Face Value: The principal price at which a bond is issued is called its face value or par value.

- Coupon Rate: The coupon rate can be termed as the percentage of interest paid to the investor.

- Maturity Date: The date on which the investor is liable to receive the payment of principal as well as interest amount on the bond purchased, is its maturity date.

- Yield: The yield on a bond can be seen as the valid returns which the investor would receive on holding the investment for a specified period.

- Issuer: The organization which issues the bonds to raise funds as borrowings, is called as an issuer.

- Credit Rating: The bonds are well examined and rated by the credit rating companies to ensure their reliability.

- Coupon Payment Frequency: The intervals at which the payment of interest is made on the bonds is termed as coupon payment frequency. It is paid semi-annually or annually and even monthly or quarterly in some cases.

Advantages of Zero-Coupon Bond

A zero-coupon bond is a secured form of investment when done for the long term. The various benefits it can provide are mentioned below:

- Predictable Returns: The return on a deeply discounted bond after maturity, is pre-known to the investor in the form of par value or face value.

- Low Minimum Investment: As the name suggests, it is a deeply discounted financial instrument, whose value at the time of investment is quite small and affordable.

- Minimal Risk: If the investment is made with a verified and reputed issuer, the level of risk involved can be highly mitigated.

- Attainment of Long Term Financial Goals: A zero-coupon bond is a suitable option for the investors aiming at the fulfilment of long term (more than ten years) objectives such as child’s education, marriage, post-retirement goals, etc.

- Eliminates Reinvestment Risk: This is a unique type of bond which reduces the condition of reinvestment in the same coupon bond at a lower interest rate, adversely affecting the yield to maturity.

- Traded in Secondary Market: These bonds can be sold or purchased at prevailing market rates before maturity, in the secondary market.

Calculation of Yield to Maturity

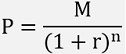

When the investor holds a financial instrument till its maturity date, it is termed as yield to maturity. The following equation is applicable to determine the yield to maturity for a zero-coupon bond:

Where,

Where,

‘P’ is the price of the bond;

‘M’ is the bond value on or after maturity;

‘r’ is the required yield annually divided by 2;

‘n’ is the maturity period in years multiplied by 2.

Note: The value is computed on a semi-annual basis in a zero-coupon bond. Therefore the rate is halved, and the period is doubled to balance the equation.

Zero-Coupon Bond Example

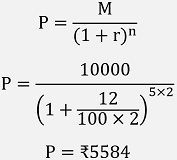

Z wants to purchase a zero-coupon bond issued by ABC & Co., with a face value of Rs. 10000. The required annual yield is 12% p.a. and it matures in five years.

Find out the price which Z needs to pay at present.

Solution:

Given below is the solution for finding out the price of this zero-coupon bond:

Therefore, on depositing a sum of Rs. 5584 in this deeply discounted bond, we will get an amount of Rs. 10000 after five years.

Thus, the total return on investment is:

Limitations of Zero-Coupon Bond

A zero-coupon bond has certain disadvantages too. These shortcomings should be known well in advance before investing in this form of bonds. Let us discuss each of these in detail below:

- Company’s Survival: Since the maturity period of a zero-coupon bond is quite lengthy; it is challenging for the investor to trust that a company would survive until the maturity date.

- Interest Rate Risk: If the interest rate of the bond falls, its issuer may redeem it through call provision before maturity and at a lower price. This price is pre-mentioned at the time of issuance.

- Secondary Market Rigidity: It is quite problematic to arrange funds by liquidating these bonds at a fair price in the secondary market, in case of any emergency.

- Annual Tax on Phantom Income: Annual income tax is applicable on the interest which is to be received by the investor in future, on the maturity of the zero-coupon bond.

- Long Maturity Period: A zero-coupon bond has a long maturity period, sometimes even up to forty years.

- No Regular Income: This investment perspective lacks a regular payment of interest; instead, the yield is receivable in lumpsum, only on liquidity or maturity of the deep discounted bonds.

Treatment of Income from Zero-Coupon Bonds

The income from investing in a zero-coupon bond is taxable either on the interest received or the capital gain yielded.

The bonds issued with a label of Original Issue Discount (OID) are liable for interest, which is not received regularly. Though, taxation on this phantom income is applicable in these type of bonds.

In the U.S., the investors can hold this instrument under tax-deferred retirement accounts to abstain themselves from such tax payment.

Whereas, in India, it is made compulsory by the law to present the interest of all zero-coupon bonds issued later to February 2002, as accrual interest.

Leave a Reply