Investment Decision is a part of Financial Management which deals with the allocation of the company’s valuable funds into investment projects or potential assets.

It involves identifying such projects or assets to invest in and generate returns from them. Besides, these decisions significantly affect the profitability and stability of the firm.

Some essential investment decisions that organizations make are:

- Setting up new business

- Expansion of existing one

- Modernization of existing one

When we talk about Investment, we cannot ignore the risk associated with it. For better understanding, we can refer to it as an Investment Risk.

The selection of the assets is a critical task as the risk and return profiles vary.

There exists a direct relationship between risk and return. The more the risk, the higher will be the return and reverse. Thus, the top-level management must take strategic investment decisions with calculated risks.

For firms, investment decision plays an integral part in achieving their long-term goals. Usually, the amount invested is huge, and so is the associated risk. Along with value creation, it generates revenue and eases the firm’s survival.

Firms take investment decisions for both the long and short term.

In finance terminology, long-term decisions are termed Capital Budgeting Decisions. Similarly, short-term decisions are termed Working Capital Decisions.

We have discussed these decisions at length in the upcoming sections of this post.

The funds invested in the fixed assets remain blocked for a substantial period of time. In contrast, the investments in current assets are generally for one year or less.

Non-profit organizations also take some investment decisions. But, it is not for earning returns. They appropriate its funds to achieve their mission.

Content: Investment Decision

- What is an Investment?

- Process

- Types

- Nature

- Importance

- Example

- Investment Decision Maker

- Investment Decision Rule

- Common Errors

- Final Words

What is an Investment?

It means investing a particular amount of money in a project to produce profits after a specific tenure.

Both individuals and undertakings make investments with different motives. However, the goal of investing is to earn some amount of return.

Firms generate money for investments from short-term and long-term sources of finances. Moreover, these sources can be from within and outside the business.

Goal of Investment Decisions

The ultimate goal behind investment decisions is to maximize returns and enhance the firm’s profit-earning capacity. Also, it ensures optimum investment to deliver value for companies’ shareholders.

Investment decisions directly affect the profitability of the firm. It affects the current and future cash flows as well as the profit earned by the firm.

Process of Investment Decisions

The decision-making process for investments is conceptually simple but complicated in practice. Besides, risk assessment and mitigation is the important part of the investing process.

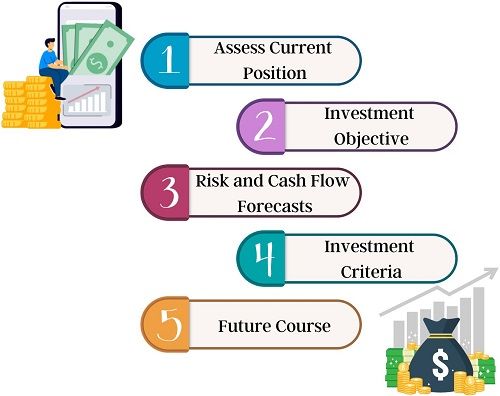

The steps involved in the decision process are as follows:

Step 1: Assessment of Current Financial Position

The first step in investment decision-making is assessing the existing financial position. It will depict a clear picture of the current allocation of funds.

Step 2: Set Investment Objective

The next step is to identify and select the investment objective. Here, the firms decide between short-term and long-term investments as per the requirement.

Step 3: Risk and Cash Flow Forecasts

The selected investment alternatives must be evaluated considering risk and expected cash flows. This eases the decision-making process and helps eliminate options with lower returns.

Step 4: Investment Criteria

Some techniques are available for selecting a suitable investment, also known as Capital Budgeting Techniques. It determines whether to accept or reject the investment alternative proposal.

Step 5: Future Course

At last, the firms need to examine the investment performance and related events constantly. For example, the effects of the investment made on the firms working capital.

Types

Investment decisions are categorized under two heads based on the duration of the investment. This is because, returns generated differ in the short and long term.

The two types of investments are explained as under:

Long-term Investment Decisions

These decisions are popularly known as Capital Budgeting Decisions or Capital Investment Decisions. This is because, it involves the investment in fixed or capital assets. These decisions are crucial because any wrong decision may endanger the firm’s existence.

The capital budgeting decisions include:

- Purchase of the fixed asset

- Replacement of an existing asset

- Expansion of business

- Setting-up new business

Factors affecting capital investment decisions are:

- Expected Cash Flow

- Rate of Return

- Investment Criteria

Short-term Investment Decisions

These investments are made on the current assets, which is why they are termed Working Capital Decisions. It plays a vital role in the smooth functioning of the firms. It involves investments in Inventory, Bills Receivables, Debtors and so on.

These decisions affect the firms’ earning capacity, profitability, liquidity and solvency. Cash management and inventory control are important parts of such decisions.

Besides, an inefficient working capital decision severely affects a firm’s liquidity.

The working capital decisions include:

- Inventory Investment

- Strategic Investment Expenditure

- Maintenance

Factors affecting working capital decisions:

- Nature of Business

- Business Cycle Fluctuations

- Seasonal Variations

- Technology and Production cycle

- Credit Policy

- Price Level Changes

- Market Competition

Nature

These decisions are generally sequential in nature. That is, it is not just a single decision, but involves a series of decisions during the entire process.

Also, the firms may need to make a series of decisions in the future depending on the related events. Thereby, making investing decision-making a complicated process.

However, there are techniques like decision tree analysis for such complex decisions.

Importance

Investment Decisions are crucial for firms as it deals with the most valuable resource for the business, i.e. money. The points given below explain the importance of these decisions:

- Irreversible Decision: Once the money is invested, it remains blocked for a specific period. In case of the wrong decision, the principle amount may reduce and even become zero.

- Substantial Amount of Funds: In firms, the money invested is usually large. If not invested strategically, it may even endanger the firm’s survival.

- Cash Inflow and Outflow: Investments affect both cash inflow and outflow. Consequently, it also impacts the financial position of the firms.

- Profitability: The returns generated out of investments determine the firm’s profitability. This, in turn, helps cut competition and induces the firm’s growth.

Example of Investment Decision

PQC ltd. is in biscuit manufacturing. Top-level management plans to set up a new plant by looking at the increasing demand in the previous financial years. For this, they have two alternative projects at different locations.

Project 1: This project is located a few miles from the current facility. Here, the land is quite expensive.

Project 2: It is located 20 km away from the current facility. This location comes under the special economic zone of the city.

Decision: PQC ltd. has decided to invest in Project 1. The reasons for selecting this alternative are as follows:

- The transportation cost is lower.

- There is no need for warehousing.

- Storage costs will be zero.

- Supervision is easy.

- Timely distribution and delivery to retailers.

- Reduced number of intermediaries.

Investment Decision Maker

Generally, top-level management takes these decisions. Some firms may appoint a designated person responsible for taking these decisions on behalf of the firms. These persons are referred to as Investment Decision Makers.

He is held responsible for strategically committing funds to potential assets and projects. He must also stress on the risk mitigation and profitability of the selected investments.

Investment Decision Rule

Firms must consider the following rules during the decision-making process:

- Maximization of the shareholder’s wealth.

- Consider the true profitability and returns from the project.

- Choosing the appropriate decision-making technique.

- Assure the regularity of cash flows.

Common Errors

Given below are some of the errors that investors might make while taking investment decisions:

- Wrong assessment of risk and return.

- Formulation of complicated investment policy.

- Influential decision-making.

- Naïve projections about profits and losses.

Final Words

All in all, the correct investment decision is necessary as it affects the success and failure of the firm. The firms must create an efficient asset base through investments. Consequently, it will enhance the profit-earning capacity of the firm.

Marhaendrata Tavip Irwanto says

theinvestorbook.com with the topic “Investment Decision” that good resource for me who’s looking for references for my thesis.

The title is “Pengambilan Keputusan Final Investasi dalam Pengembangan Lapangan Migas”

If you have any resource books or information related to the above topic please let me know.

Best Regards,

Tavip