Definition: Fixed cost is a cost that does not change with an increase or decrease in the number of goods and services produced. It is one of the two components of the total cost of goods and services along with the variable cost. These costs are applicable to all businesses doing any kind of business.

In economics, a business can achieve economies of scale when it produces enough goods to spread the fixed cost. For Instance: ₹ 1,00,000 lease spread over 1,00,000 products. i.e., each product carries ₹ 1 in fixed cost.

Content: Fixed Cost

- Formula

- Example

- Illustration

- Categories for Analysis Purpose

- Difference Between Fixed Cost and Variable Cost

- Conclusion

Fixed Cost Formula

![]()

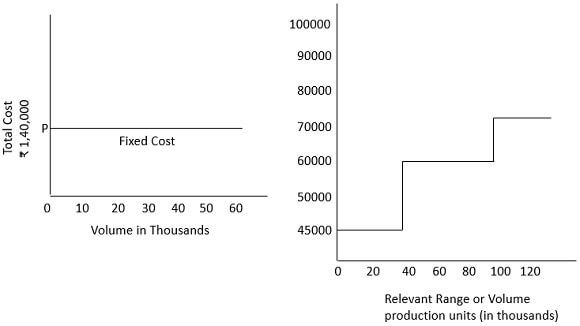

This cost can be described by a constant, although, it never changes in the amount, this statement is not precisely correct basically it implies non-variability of the cost related to a specific volume. These features of this cost will be displayed in the figure below for the various levels of productions given below:

First level

- ₹ 60,000 fixed cost amidst 40,000 and 1,00,000 units of production.

Second level

- ₹ 80,000 fixed cost in excess of 1,00,000 units. It is considered that the rise in production after a certain level (1,00,000 units) also needs to rise in fixed expenses which are pre-fixed. For example, Rise in cost of quantity control and supervision cost.

Third level

- ₹ 45,000 fixed cost from zero (0) to forty thousand (40,000) units, which denotes that if production level declines below 40,000 units, it may not be incurred fixed cost, like at the time of shut down of plant various fixed costs are not incurred like the cost of accounting functions, staff salary, etc.

Example of Fixed Cost

One of the examples of this cost is a company’s lease on a building. If a company has to pay 50,000 ₹ each month to cover the cost of the lease but does not manufacture anything during the month, the lease payment is still due for payment. These costs are not fixed for all time; they will change over time although not affect the quantity of production for the relevant period. For example, a company bears various expenses for the production of a particular product and the cost paid as the rent of the warehouse is fixed for a period of the lease.

Illustration

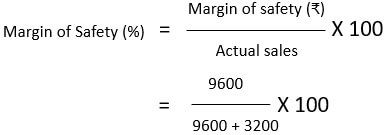

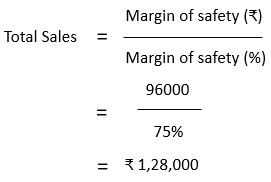

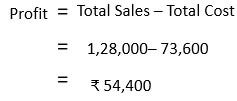

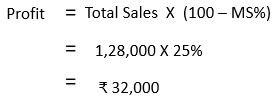

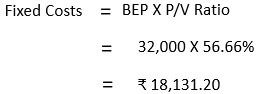

Margin of safety – ₹ 96000, Total cost – ₹ 73,600, Units of Margin of safety – ₹9600 units, Break-even sales – 3200 units. Calculate Fixed Costs.

Solution

- Step 1

- Step 2

- Step 3

- Step 4

- Step 5

- Step 6

Fixed Cost Categories for Analysis Purpose

Following are the categories of this cost for the purpose of analysis:

Committed Costs

To maintain the company’s physical existence and providing facilities, some costs incurred which are known as committed costs over which the company’s administration has no discretion. Some examples of committed costs are depreciation on assets, taxes, rent, insurance etc.

Managed Costs

These are the cost paid to the management and staff to ensure the continued operations of the company.

Discretionary Costs

Costs incurred in research and development programmes such as special policy decisions, new research programmes of the management are known as discretionary or programmed costs. Such costs can be eliminated or reduced if needed.

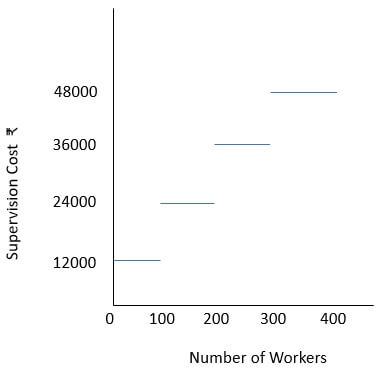

Step Costs

It is a constant cost for a particular amount of output which raises a fixed amount at a higher output level.

For Example, A company hires 100 labours at a salary of 12,000 per month for every 100 labours. If labour increases from 100 to 101, the cost will increase from 12000 per month to 24000 per month and will be constant at 24000 per month until the number of labour crosses to 200. Following diagram makes it more understandable to learn:

Difference Between Fixed Cost and Variable Cost

The following are some distinctions between fixed cost and variable cost:

- Fixed cost is a cost that remains fixed regardless of the quantity produced, i.e., whether the company increases or decreases the production of the product the cost of the product will remain the same whereas variable cost changes with changes in output.

- The nature of the fixed cost is time-related, i.e., for a particular given time it will remain fixed, but after a certain time, it will change because of change in environment and not because of change in the volume, whereas the nature of the variable cost is volume related, i.e., if the volume produced will change, the cost will also change.

- Fixed cost consists of various costs such as fixed production overhead, fixed selling and distribution overhead, fixed administration overhead. In contrast, variable cost is a combination of direct labour, direct material, direct expenses, variable production overhead, variable selling and distribution overhead.

- Examples of fixed costs are depreciation on assets, rent, remuneration, insurance, etc. whereas examples of variable cost are material consumed, wages, commission on sales, packaging expenses, etc.

Conclusion

Fixed cost is the cost that remains constant, whether activity increases or decreases. However, they are not fixed for all time to come. These costs are also known as standby costs as they accrue with the passage of time and not with the production of a product.

Leave a Reply