Definition: The joint cost refers to that cost which is incurred before the split-off point on the production or manufacturing of multiple products, by consuming the same inputs or factors of production (i.e., raw material and manufacturing process). This type of cost accounting is usually common in primary industries.

Split-off Point: The production stage at which all the joint products get separated and adapt their product lines is known as a split-off point.

Content: Joint Cost

Joint Products

Joint products are those products which are manufactured or extracted from the same raw material and with the help of same manufacturing process, in a changeable quantity (where the change in production quantity of one product may or may not affect the quantity of other).

Examples of Joint Products

In dairy products, the skimming of raw milk yields skimmed milk, cream and butter. Also, in the case of processing coconut, we get coconut water, coconut cream, desiccated coconut and jute.

Accounting for Joint Products

The estimation of the individual cost (usually direct cost) involved in the manufacturing or extraction of joint products is a complicated task. Since the expense over raw material, labour and processing of such products are incurred as a collective cost.

Thus a proper accounting procedure is followed to distribute such expenses equitably among all the joint products so obtained.

Following are some of the other significant reasons for apportionment of joint cost:

- To ensure a proper inventory valuation;

- To fix a fair selling price of each product; and

- To ascertain the profitability of each product line.

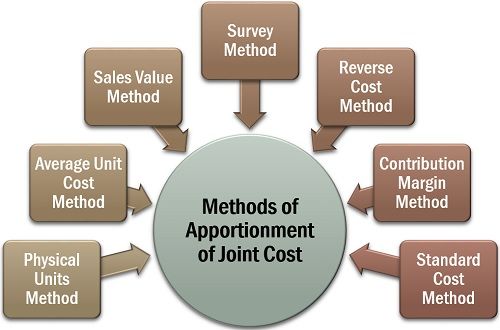

Methods of Apportionment of Joint Cost

When we undergo the apportionment of joint cost for accounting purpose, we will see that there are different methods available for determining it.

However, there is no formal logic for adopting a particular method of apportionment. An organization can opt for any of the methods available, depending upon the business type, uniformity of products, etc.

Let us now discuss each of these in detail below:

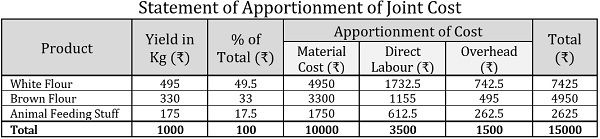

Physical Units Method

The physical units method is usually applied to the joint products which are similar in state and have a standard unit of measurement. In this method, the apportionment of the joint cost is done through relative quantity or weight of the joint products, at the split-off-point.

Example:

ABC Ltd. is a flour mill and processed wheat to get brown flour, white flour and animal feeding stuff. For each tonne of wheat, the company’s yield was as follows:

| Products | Yield in Kgs of Per Tonne of Wheat |

|---|---|

| White Flour | 500 |

| Brown Flour | 320 |

| Animal Feeding Stuff | 180 |

If the price of the wheat is ₹10000 per tonne and the per tonne direct wages and overheads are ₹3500 and ₹1500 respectively; using weight, find out of the following costs for each joint product:

- Material Cost

- Labour Cost

- Overheads

- Total Costs

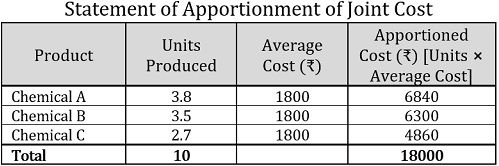

Average Unit Cost Method

One of the simplest methods to apportion joint cost is the average unit cost method. Here, the average cost per unit is calculated by simply dividing the total cost of all the joint products incurred before their splitting-off, by the total of the number of units produced all together.

To determine the cost of each joint product, the units produced of each joint product is multiplied with the average unit cost.

Example:

A chemical industry gets three joint products from 10 litres of chemical compound which cost ₹18000. The number of units of each joint product produced is given as follows:

| Product | Units in Liters |

|---|---|

| Chemical A | 3.8 |

| Chemical B | 3.5 |

| Chemical C | 2.7 |

| Total | 10 |

Solution:

Note: In the above statement, to ascertain the average unit cost or average cost, we have used the following formula:![]()

Hence, Average Unit Cost=18000/10=₹1800 per unit

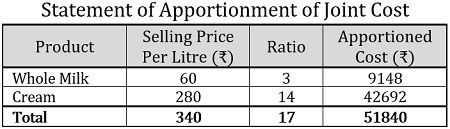

Sales Value Method

Under this method of joint cost apportionment, the sales value of each joint product is used to determine the cost incurred over it. There are following two ways of distributing the cost under this method:

- Based on Unit Prices: When the selling price is known, and the joint products are obtained in equal quantities, the unit prices are considered for applying the sales value method.

- Based on Sales Value: To apportion the joint cost, the ratio of weighted sales value is used. It is computed by multiplying the number of units produced with the selling price per unit, thus providing a satisfactory and fair result.

Example:

A dairy farm processed raw milk to acquire whole milk and cream.

- The joint cost incurred on one kilolitre of raw milk was ₹51840, and equal units of both the joint products have been acquired. Now, using the below information, apportion the collective cost based on unit prices:

Product Selling Price Per Litre (₹) Whole Milk 60 Cream 280 Total 340 - Using the below-given production quantity of each joint product, allocate the joint cost, i.e. ₹51840, based on sales value:

Product Selling Price Per Liter (₹) Production Quantity (Litres) Whole Milk 60 880 Cream 280 120 Total 340 1000

Solution:

Based on unit price, the following is the statement of apportionment of the joint cost:

Based on the sales value, the joint cost can be distributed as follows:

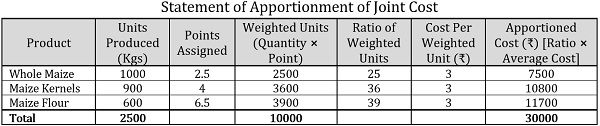

Survey Method

In survey method, the emphasis is laid on a technical evaluation where multiple factors are taken into consideration including qualitative factors, i.e., marketing process, quality of material, technical difficulties, etc.; and quantitative factors like selling price, volume, etc.

Example:

A farmer grows corns on his land which he uses in three different ways, i.e., for making whole maize, maize kernels and maize flour. Till the time of cultivation, the joint cost incurred was ₹30000.

Based on technical evaluation, the following points were allotted to each joint product:

| Product | Units Produced (Kgs) | Points Allotted |

|---|---|---|

| Whole Maize | 1000 | 2.5 |

| Maize Kernels | 900 | 4 |

| Maize Flour | 600 | 6.5 |

Apportion the joint cost using a survey method.

Solution:

Note: In the above statement, the cost per weighted unit has been calculated as follows:![]()

Cost Per Weighted Unit=30000/10000=₹3 per unit

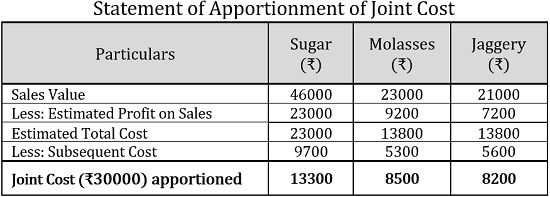

Reverse Cost Method

In the reverse cost method or net realizable value method, the net profit achievable from the sale of joint products is used to apportion the collective cost by determining the cost in reverse order, i.e., deducting estimated gains and subsequent costs from the sales value.

Example:

A sugarcane mill incurs a joint cost of ₹30000 to produce sugar, molasses and jaggery, from 100 tonnes of sugarcane. Out of which ₹12000 was spent on material, ₹8500 on labour and ₹9500 on overheads. The subsequent expenses incurred are as follows:

| Particulars | Sugar | Molasses | Jaggery |

|---|---|---|---|

| Material | 3000 | 2200 | 2000 |

| Labor | 3500 | 1600 | 1800 |

| Overheads | 3200 | 1500 | 1800 |

| Total | 9700 | 5300 | 5600 |

| Sales Value | 46000 | 23000 | 21000 |

If the estimated profit on sales is 50% on Sugar, 40% on Molasses and 34.27% on Jaggery, apportion the joint cost using reverse cost method.

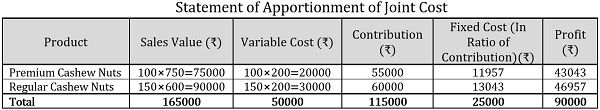

Contribution Margin Method

Under the contribution margin method, the joint cost apportionment is done through marginal costing technique where the contribution can be understood as the surplus of sales over the variable cost.

Moreover, the variable cost is determined with the help of units sold, and the fixed cost is ascertained through the contribution margin ratio.

Example:

A cashew nuts processing unit produces two varieties of cashew nuts, premium and regular, at a joint cost of ₹75000, out of which ₹25000 is the fixed cost. The quantity produced is 100Kg and 150Kg; and sold at ₹750 and ₹600 per Kg, respectively.

Apportion the joint cost using the contribution margin method.

Solution:

Note: To find out the variable cost, the following formula is used:![]()

Where,![]()

Total Production=100Kg+150Kg=250Kg

Average Variable Cost=₹50000/250Kg=₹200 Per Kg

Joint cost is an effective accounting procedure to determine the individual cost of those products which are produced or extracted together. It is the basis of individual price ascertainment of the joint products.

Siko says

Clear examples, short and understandable