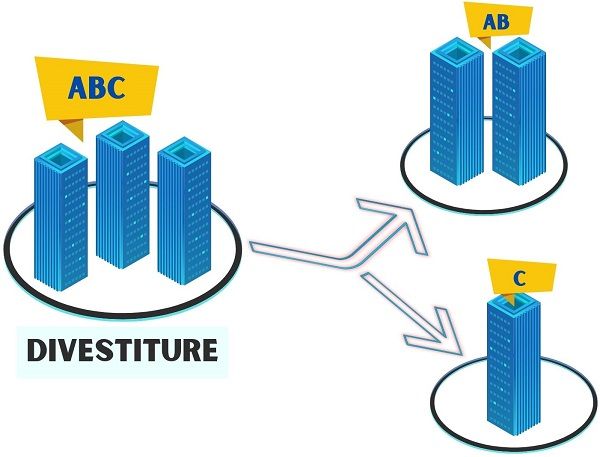

Definition: Divestiture implies the strategic move taken by the business’s management which involves discontinuation of a business unit either partially or fully by selling/separating a piece of asset, service, property or product line with the motive of being profitable and streamlining operations.

Simply put, the management decides to cease the operations that cannot make out to the core competencies. By doing so, businesses can focus on the profitable front.

Divesting is the synonym for Divestiture.

Shedding off non-core activities helps businesses in:

- Cutting Cost

- Repay Debts

- Focus on Core Activities

- Enhance Shareholders Value

Divesting belongs to the Merger and Acquisitions family that follows the addition-by-subtraction approach. However, it is exactly opposite to the above two.

The decision depends upon the business’s core and non-core activities. It is purely a management decision which may be triggered by elements such as Competition.

Mostly, Divestiture is encountered in firms with too many business lines. Thus, the majority of conglomerates go through this problem.

When firms grow, they expand horizontally as well as vertically. After a significant period, their structure become too large and complex. Eventually, the management team face difficulties in managing such a giant organization.

In the majority of cases, the separate entity becomes more valuable post-divestment.

Besides, a divested portfolio of assets is said to be an advantageous portfolio. Moreover, in some cases, it can save companies from slipping off the fiscal cliff.

Shareholders also get benefitted from this strategy. But, it depends on the type of divestiture and fraction sold.

Content: Divestiture

Example

Today, many firms use Divestiture as a business strategy yielding outstanding results.

It can be seen very often in Government Restructuring. You might have heard of the government privatizing some of its holdings to make them efficient or recover losses. Besides this, two more examples of divestitures are as follows:

Reliance Industries

It is an Indian conglomerate with a vast portfolio consisting of segments like:

- Energy

- Petrochemicals

- Natural Gas

- Retail

- Telecommunication

- Textile

- Mass Media

In November 2021, Reliance Eagleford Upstream Holding (REULP), a subsidiary of Reliance Industries, conducted a divestiture of the shale gas business in the US. They sold all the assets to Ensign Operating III.

The reason might be the decreased demand for crude oil plus the declining price of goods in the US.

Johnson and Johnson

It is a well-known conglomerate which is into various segments like:

- Pharmaceuticals

- Medical Equipment’s

- Consumer Goods

The management announced spinning off its consumer goods segment through an IPO. Therefore, they divested Kenvue (consumer goods segment) to focus on their pharma business.

Kenvue includes some famous brands like – Band-Aid and Neutrogena.

Divestiture Strategy

Conglomerates with unsuitable market conditions and competition may adopt a divestiture strategy. As, it helps them to separate the non-core activities and invest their resources in something productive.

It has the potential to generate value equal to Acquisitions. However, knowing when to opt for it is of utmost importance.

Most businesses consider it an exit strategy and choose to keep only the profitable divisions.

Actually, it is a growth strategy. As the non-performing part of business absorbing capital can be divested. By this, the firm can retain its capital and recover by selling the unit. Moreover, reinvest these funds in the business as a fuel to grow.

The implementation of the strategy demands considerable planning. Through planning, management can navigate the risk of the entities involved. Also, it absorbs the firm’s financial and human resources.

Before implementation, they can revisit the reasons before divesting like:

- Refocus on core competencies.

- Raise capital for starving units.

- Unlock the value of the business.

- Meet Antitrust Requirements, etc.

The success of the divestiture strategy largely depends on its execution. Also, the type of divestiture opted by the business is equally important.

Reasons

The core idea behind divesting is to achieve financial flexibility and optimize the asset portfolio. In addition, it allows sellers to concentrate on their core business.

The goal behind its implementation is to separate the underperforming unit from the business. More such reasons are explained below:

- Sliming the Business: Today, the business units are looking forward to streamlining their operations. Therefore, they choose to let go of the redundant business unit.

- Generate Funds: Firms need funds to keep businesses going and growing. They can sell some assets from the portfolio by divesting to generate funds.

- Resale Value: The parent company can create subsidiaries and sell them to a third party. This enables them to increase the resale value of the non-performing ones.

- Survival and Stability: To survive in the dynamic market, firms need to optimize their operations. Thus, they choose to divest the less promising part of the business and ensure its stability and survival.

- Set-off Losses: Some companies fall apart and reach the verge of liquidation. They accumulate a significant amount of debt and losses overtime. In such cases, the firms use this strategy to set off the losses.

- Insufficient Talent: Usually, large enterprises grow in structure extensively. So, the current staff cannot fulfil the requirement and needs to be more efficient. Thus, they divest the firm and appoint a separate management for the new entity.

Types

Management can implement Divestiture in several ways. It involves both selling a part of the business and segregating it into two free entities.

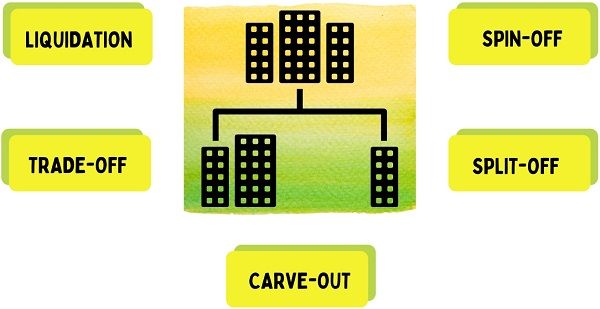

Following are various types of divestitures that one can opt for:

- Spin-offs: The existing parent company sells off a specific division known as a subsidiary company. So, it becomes altogether a different entity whose existing shareholders are allotted shares of the new company.

- Split-offs: It is similar to spin-offs. But the significant difference is that the shareholders can choose whether they want a stake in the parent company or the new entity.

- Carve-outs: Basically, it involves partial divesting. This is because the parent company only sells some of it’s parts through IPO. However, the parent company holds some stake in the subsidiary. Generally, the company sell a piece of their non-core operations.

- Trade-offs: In this type of divesting, the parent company sell-off a piece of its business or subsidiary to a third party. The transaction involves cash payment in the exchange process, which is generally taxable.

- Liquidation of Assets: It is the exit plan for the companies wherein they sell off some part of their assets portfolio.

Divestiture vs Disinvestment

Management uses Divestiture to acquire funds by separating sections of its overall portfolio. The firm can reinvest the sale receipts or funds generated inside or outside the business. Moreover, it is optional for businesses.

Whereas, Disinvestment means liquidating business assets, usually to the payoff of the liabilities. The funds generated are solely used to pay off debts. Hence, firms cannot reinvest it inside or outside the business.

Bottom Line

All in all, along with identifying the growing segments, firms must keep a check on the ones worth pruning. It will help them to remain financially fit and focused towards their core businesses.

It is the responsibility of the firm’s management to implement this strategy at the right time.

Today, many businesses practise Divestiture. But to get benefitted from it, management must plan and prepare in advance.

Leave a Reply