Definition: Absorption Costing is the oldest technique for estimating profit/cost per unit for Goods and Services. More precisely, it is a technique to determine the cost or profit of the manufactured products.

Here, production is taken as the base for the profit calculation. It identifies and combines all the production costs, whether Variable or Fixed.

After that, it imposes all these costs on Operations or Production during profit estimation. Consequently, Absorption Costing is alternatively called Total Cost Method and Full Costing.

The Absorption costing aims to recover Fixed Costs and some Returns on Investments.

Under this method, the categorization of costs happens as per their functional characteristics like: –

- Production

- Administration

- Selling and Distribution

Content: Absorption Costing

Profit Calculation Under Absorption Costing

Under Absorption Costing, firstly, we need to calculate Prime cost. We add direct expenses like Direct Material and Labour to obtain it.

The next step is to find out Factory Cost. For this, we add factory expenses to the prime cost.

After that, we get the Cost of Goods Sold by adding administration expenses. Lastly, we find out the Total Cost by adding selling and distribution expenses.

The calculation of profit is on the basis of variance between: –

- Total Cost and Sales

- Rate of profit on Cost/Sales

Absorption Costing Income Statement

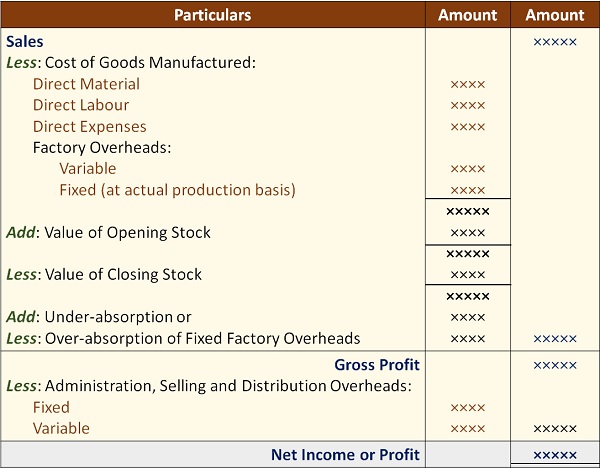

The format of the Income Statement under Absorption Costing is as follows:

Points to Remember

- The variable costs are directly charged in this costing method. In contrast, fixed costs are apportioned over different products manufactured over time.

- The per-unit cost remains constant when the output level remains constant from time to time.

However, the output level cannot remain stable over time, and so the per-unit cost. - With the changes in the output level, the per-unit cost also changes because of the portion of fixed costs in the unit cost.

But, the fixed cost remains the same even when the output level changes.

Features of Absorption Costing

Following are some of the features of the Absorption Costing: –

- Overhead Absorption Rate (OAR):

This technique uses Overhead Absorption Rate to allocate overhead costs to cost units. - Closing Inventories:

The closing stock of inventory is valued under Absorption Costing. In addition, the valuation includes Fixed and Variable costs. - Effects on Profit:

The profit is affected by the increase or decrease in the output levels. - Profit as Production Function:

The profit calculation is dependent on production rather than sales. - Cost Allocation:

During cost allocation, both fixed and variable costs are taken into consideration. - Oldest Method:

It is the oldest method used by managers for profit calculation. - Decision Making:

It is not helpful to the managers for effective decision-making.

Advantage

The benefits of using the full-cost method are as follows:

- Full-Cost Method:

This method considers all the production-related costs for profit calculation. Besides, it also focuses on cost recovery and price determination using total costs. - Computation of Profit:

This costing technique helps in the computation of Gross and Net profit for the year. - Works on Total Costs:

Under this method, we consider the total cost of production during profit calculation. Therefore, there is no requirement to separate fixed and variable costs. - Resources Utilization Indicator:

Absorption costing also provides a clear picture of the utilization of the resources. The over and under absorption of the factory expenses in the Income Statement discloses the usage of the resources. - Segregate Costs:

This technique clearly separates costs under Period and Product costs. - Levy Fixed Cost on Inventory:

Fixed costs are also imposed on the inventory to be sold in the future. - Reporting:

Managers use Absorption Costing while preparing inventory valuation reports. - Cost Control:

Helpful in controlling costs at cost centres and responsible managers thereof.

Limitations

Besides many advantages discussed above, this technique has the following limitations: –

- Inappropriate for Decision Making:

Absorption Costing is not useful for many decision areas about production. These decisions may include Make or Buy Decision, Product Line, etc. - Difficulty in Comparative Study:

As the output level influences the cost of the products, comparison becomes difficult. - Includes Past Costs:

Absorption costing includes past costs, but it can be irrelevant during price determination. - Not Feasible for Flexible Budget:

As there is no differentiation between fixed & variable costs, preparing a flexible budget becomes difficult. - Apportionment of Fixed cost:

The apportionment of fixed costs as per period results in misrepresenting the product’s overall cost. - No CVP Relationship:

This technique fails to develop a relationship between Cost, Volume and Profit.

Example

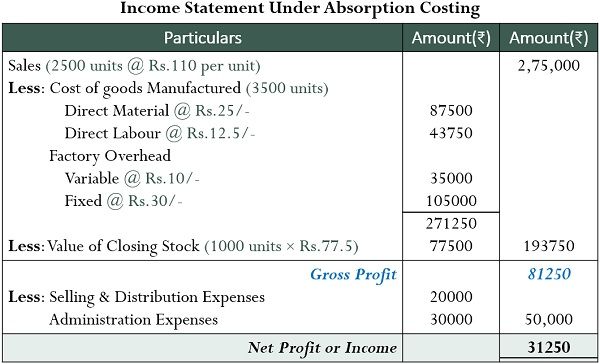

The operating data of a Hat manufacturing company for August 2009 is as follows:

- Product cost (per unit):

- Material – Rs.25/-

- Direct Labour – Rs.12.5/-

- Variable Factory Overhead – Rs.10/-

- Fixed Factory Overhead – Rs.30/-

- Total Factory Cost per unit 3500 units

- Production 2500 units

- Selling Price per unit Rs.110/-

- Selling and Distribution exp. Rs.20,000/-

- Administration Expenses Rs.30,000/-

Prepare Income Statement for August 2009 using Absorption Costing.

Solution:

The company earned a profit of Rs.31250/- for the month of August 2009.

Conclusion

It is a conventional technique for estimating the costs of the services and goods produced. Unlike variable costing, it covers fixed costs and inventories while calculating the cost per unit.

However, the managers prefer marginal costing over absorption costing for managerial decision-making.

Leave a Reply