Valuation of Goodwill is estimating the company’s monetary worth besides its asset built over the years by exceptional business practices or dedicated efforts towards customers.

But, you might be thinking that why is goodwill valuation necessary?

Despite being an intangible asset, we can trade goodwill. But one can only realize it through sale/purchase considerations during acquisitions.

The reason being, it is an asset that is inseparable from the business. Consequently, making the valuation a complex process.

However, goodwill is not built overnight. It comprises multiple factors, including reputation, honesty, purchase experience and so on.

Once created, firms can enjoy the economic benefits attached to it in the near future. But, they need to maintain it constantly considering the market fluctuations and competition therein.

Due to the intangible attributes of goodwill, the firms have the potential to earn an additional profit above normal profits. We refer to this surplus profit as Super Profit.

Content: Valuation of Goodwill

Need for valuation of Goodwill

It is not just the company’s good name, but it’s the monetary value generated through intangible factors.

Therefore, the firms are interested to learn their worth in the market. It is vital, especially at the time of purchase or sale of a business.

The need for valuation differs as per the form of business organization.

- Sole Proprietorship

- Sale of the Business

- Admission of a Partner

- Death of the Sole Trader

- Amalgamation

- Partnership

- Admission, Retirement, Death of a Partner

- Changes in the Profit-sharing Ratio

- Dissolution or Amalgamation

- Conversation into Company

- Joint Stock Company

- Amalgamation or Absorption of Company

- Sale or Purchase of Company

- Valuation of Shares

- Government Takeover

- Controlling Interest in another company

- Goodwill Account appearing at Fair Price besides being written-off

Methods of Valuation of Goodwill

Evaluating the value of goodwill is difficult due to its abstract nature. Also, financial managers strive to compute the amount of goodwill in the total purchase consideration.

You can calculate the value of goodwill with the help of the following methods:

- Average Profit Method

- Super Profit Method

- Capitalization Method

The critical point we need to emphasize in the upcoming formulas is the ‘Number of Purchase Years‘. People often misunderstand it with the total number of years of profit.

The number of purchase years is the benefit of current goodwill to be received in the upcoming years.

Average Profit Method

-

Simple Average Profit Method

Here goodwill is the product of the average profit of certain years and the number of purchase years in the past.

To get the actual value of goodwill, one must consider the average profit of at least four to five years.

Formula

Example

Calculate the value of goodwill based on 4 years’ purchase of 5 years’ average profit. The profit for five years is as follows:

| Year | Profit (₹ ) |

|---|---|

| 2003 | 80000 |

| 2004 | 30000 |

| 2005 | 60000 |

| 2006 | 45000 |

| 2007 | 50000 |

Solution:

Average Profit = 80000 + 30000 + 60000 + 45000 + 50000 / 5 = ₹ 53000/-

Goodwill = Average Profit × No. of purchase Years

= 53000 × 4 = ₹ 212000/-

-

Weighted Average Profit Method

In this method, we assign weights to the past years’ profit. To calculate goodwill, first, we need to calculate the Weighted Average Profit of the past few years. Subsequently, multiply it by the number of years of purchase.

Note: We allot higher weights to the most recent years.

Formula

Example

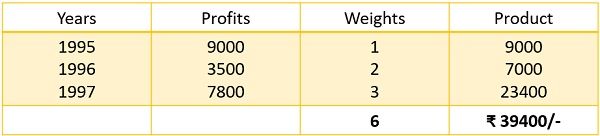

Fuchsia Ltd. earned the following profit in the last 3 years:

| Year | Profit (₹ ) |

|---|---|

| 1995 | 9000 |

| 1996 | 3500 |

| 1997 | 7800 |

Assign weights to the above profits 1, 2 and 3 respectively. Determine goodwill using the Weighted Average Profit Method for 4 years of purchase.

Solution:

Weighted Average Profit = Total of Weighted Profits/Total of Weights

= 39400/6 =₹ 6567/-

Goodwill = Weighted Average Profit × No. of Purchase Years

= 6567 × 4 = ₹26268/-

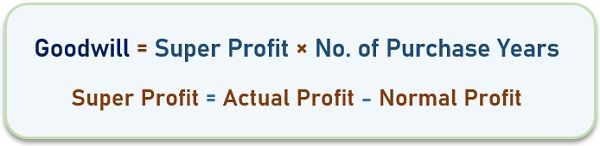

Super Profit Method

The firms operating in the same industry earn average profits, known as Normal Profits. However, some firms make surplus profits beyond normal profit, known as Super profits.

This method calculates goodwill based on the super profit earned by firms.

-

Purchase Method

To determine the value of goodwill, we multiply the super profit by the purchase years.

Formula

Example

Compute goodwill for Vishal trading for 6 years of purchase by applying the Super Profit Method.

The books showed the profit for the previous 3 years as:

| Year | Profit ( ₹ ) |

|---|---|

| 2000 | 50000 |

| 2001 | 81000 |

| 2002 | 49000 |

The normal profit as per the industry average is ₹110,000/-.

Solution

Average Profit = 50000 + 81000 + 49000 / 3 = ₹180000/-

Super Profit = Average Profit – Normal Profit

= 180000 – 110000 = ₹70000/-

Goodwill = Super Profit × No of Purchase Years

= 70000 × 6 = ₹420000/-

-

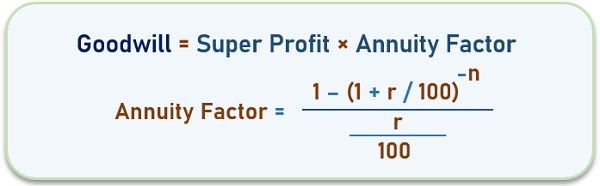

Annuity Method

Here we give due consideration to the time value of money. Therefore, we calculate the discounted value of super profit to determine goodwill. For this purpose, we consider the average super profit of certain years.

Formula

Example

A hardware company employed a capital of ₹200000/-. Further, it remained profitable consistently for the past few years as mentioned below:

| Year | Profit (₹) |

|---|---|

| 2018 | 190000 |

| 2019 | 110000 |

| 2020 | 85000 |

| 2021 | 15000 |

Besides, the expected rate of return is 10%. And the PV of the annuity of ₹1/- is ₹3.78/-. Find the value of goodwill.

Solution:

Average profit = 190000 + 110000 + 85000 + 15000 / 4 = ₹100000/-

Normal Profit = 200000 × 10/100 = ₹20000/-

Super Profit = 100000 – 20000 = ₹80000/-

Goodwill = 80000 × 3.78 = ₹302400/-

Capitalization Method

-

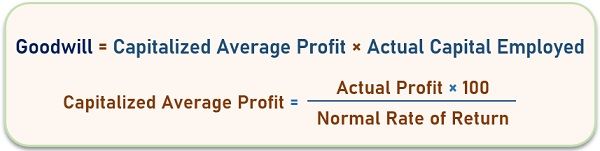

Capitalization of Average Profit Method

It assesses the capital required to generate such average profit. Therefore, to compute goodwill, we deduct the capital employed from the capitalized value of Average Profit.

Formula

Example

Determine goodwill based on the information given below:

- Four years average profit is ₹10000/-

- The expected NRR is 10%

- Capital Employed is ₹70000/-

Solution

Capitalized Average Profit = 10000 × 100 / 10 = ₹100000/-

Goodwill = 100000 – 70000 = ₹30000/-

-

Capitalization of Super Profit Method

Here we assume that the firm will generate Super Profit for an extended period. Here, we need to capitalize the super profit during the year with the normal rate of return.

Formula

Example

Rumen ltd. had an average profit of ₹17000/- from 2001 to 2003. Net tangible assets on the assessment date were ₹50000/-. The expected NRR on capital employed was 10%. Evaluate the Goodwill of Rumen ltd by the capitalization of the super profit method.

Solution

Normal Profit = 50000 × 10 /100 = ₹5000/-

Super Profit = 17000 – 5000 = ₹12000/-

Goodwill = 12000 × 100 / 10 = ₹120000/-

You must choose the best method for the company’s requirements and trading practices.

Also Read: How to calculate Goodwill?

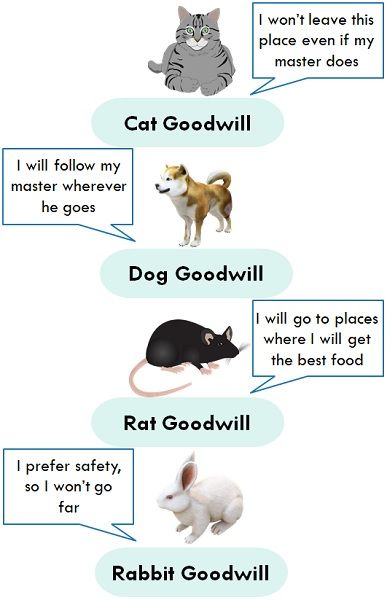

Nature of Goodwill

The nature of goodwill is explained in the context of the zoological characteristics found in humans:

- Cat Goodwill: Cats prefer old homes and don’t leave even if the master leaves. Here, we can refer house as the location of the business. So, the customers who go to old business places continue to visit even if the ownership changes.

- Dog Goodwill: The basic trait of a Dog is that he is loyal to his master. Similarly, the customers remain faithful to the owner irrespective of the place. Such goodwill is personal in nature and is non-transferable.

- Rat Goodwill: A Rat frequently moves here and there and doesn’t stay in one place. Accordingly, some customers do not stick to a particular brand or owner; instead, they keep switching. Here, the value of goodwill keeps on changing frequently. Hence, it is also known as Fugitive Goodwill.

- Rabbit Goodwill: Rabbit prefers a safe place to live and tries to stay close to his home. The value of such goodwill is less and fugitive in nature.

Types of Goodwill

Goodwill is of the following two types:

- Purchase Goodwill

- Self-generated Goodwill

Purchased Goodwill

It is a type of goodwill that is acquired while purchasing a business. Moreover, it is part of the total consideration left after the net value of assets purchased.

Purchased Goodwill = Purchase Price of Business – Net Value of Assets Purchased

Where, Net Assets = Assets – Liabilities

Note: It appears on the assets side and needs amortization.

Self-generated Goodwill

This type of goodwill is created by firms internally over a significant period with the help of numerous factors. It is alternatively known as ‘Internal‘ or ‘Inherit Goodwill‘.

Note: It can be both positive and negative.

Characteristics

The characteristics of Goodwill are as follows:

- It is intangible in nature, i.e. it doesn’t have a physical presence.

- The value of goodwill is not fixed. Rather it keeps on fluctuating.

- It is an element that enables firms to generate super profits.

- The valuation of goodwill is a typical task as it is formed from intangible attributes.

- It is inseparable from the business it does not have any individual value.

- The value of goodwill is only realized when any consideration is paid in cash or equivalent to cash.

- It is a valuable asset and vital for the stakeholders.

Factors affecting Goodwill

As discussed earlier, goodwill is a conglomerate of several components or factors. It empowers firms to earn super profits for years without any further effort.

Some factors that affect the company’s goodwill to a great extent are listed below:

- Location: The businesses located at prime locations attract more customers than those at inferior locations.

- Time: The credibility of the old businesses is more in comparison to the new ones.

- Nature of Business: It includes the types of products it offers, the risk involved, accessibility to raw materials, etc.

- Owner’s Reputation: The owner’s reputation also affects the firm’s goodwill. As due to a bad reputation, the customers may not develop trust in the firm.

- Market Situation: The economy is dynamic, so the demand for products keeps fluctuating. Consequently, the product price increases and sales reduce.

- Profit Trends: The increasing and decreasing trends of profits may influence the customer’s purchase decisions.

- Quality of Products and Processes: The good quality and performance of products create a positive image in the customer’s mind. This ultimately helps in creating and maintaining goodwill.

- Customers and Industrial Relations: It is the most important out of all the factors, as a satisfied customer regenerates sales. In addition, good industrial relations build credibility in the market.

- Competition: Serving customers better than its competitors improve the firm’s reputation in the market.

Advantages of Valuation of Goodwill

The valuation of goodwill is advantageous to the firm in the following ways:

- Ensures the longevity of the business

- Increase sales

- Creates worth among shareholders

- Eliminate competition

- Builds brand image

- Depicts the business’s financial health

Final Words

To summarise, Goodwill is the firm’s positive image or distinct reputation. It helps firms in standing out, generate additional profits and boost sales.

Thus, its evaluation in monetary terms is a must. They say, ‘if goodwill is lost, firms lose everything.

Leave a Reply