Definition: A commercial paper (CP) can be viewed as an unsecured, short-term and negotiable money market instrument. It is issued by the companies with good credit rating to acquire quick working capital to meet its short-term liabilities like paying off bills or maintaining inventory. The issuing company promises to repay the borrowed sum on or before the mentioned maturity date with a specific return or interest to the investor.

The issuing company does not need to register a commercial paper with the Securities Exchange Committee (SEC) since it has a short-term maturity period, i.e., less than a year.

Content: Commercial Paper (CP)

Calculation

The corporates need to determine the cost associated with the issuance of a commercial paper. Even for the investors, it is necessary to find out the proposed profits of CP.

For this purpose, we can compute the following:

Calculation of Interest Rate on CP

The first thing we need to ascertain is the rate of interest which the company will pay, and the investor can earn on a commercial paper.

The rate of interest applicable to the company on issuing a commercial paper is calculated after the deduction of related expenses and before the deduction of tax.

The formula for calculating the rate of interest on commercial paper is as follows:

![]()

Net Amount Realized: The net amount realized by the borrowing company is the amount which is received after deducting all the related discount and charges. These charges include stand by facility charges, stamp duty, dealing bank fee, agent charges, credit rating charges, etc.

The formula to determine the net amount realized is:![]()

Calculation of Net Cost

The final cost incurred by the company on issuing a commercial paper, after adding up the brokerage and deducting any profits earned through the acquired funds, is termed as the net cost of CP.

The formula for finding out the net cost of CP is:![]()

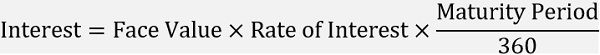

Interest on CP: The interest charged on the commercial paper, payable by the issuing company to the investor is the interest in CP.

Following is the formula to determine the amount of interest charged:

Additional Return on Investment: Sometimes, the companies issue a commercial paper for more than the required number of days and accumulates the refundable sum much before the mentioned maturity date.

In such a situation, companies take this additional period as an opportunity to make some extra money from the available funds by investing the amount into short-term gain schemes like market securities.

For finding out this additional return on investment, the following formula is given:

Example of Commercial Paper

A business entity issues a commercial paper worth ₹1000000, which will be redeemable after completion of 100 days. If the discount is 1% and other charges worth ₹15000 were applicable. Find out the rate of interest on this commercial paper.

Also determine the net cost incurred by the organization, if brokerage charged was 1%. The company utilized the sum for 70 days only, and the remaining 30 days, the amount was invested in the share markets which yield returns @ 21% p.a.

Solution:

Net Amount Realized=Face Value-(Discount and Other Charges)

Net Amount Realized=1000000-[(1% of 1000000)+15000]

Net Amount Realized=25000

Rate of Interest=[(Face Value-Net Amount Realized)/Net Amount Realized]×(360/Maturity Period)

Rate of Interest=[(1000000-25000)/25000]×(360/100)

Rate of Interest=10.83%

Interest on CP=Face Value×Rate of Interest×(Maturity Period/360)

Interest on CP=[1000000×(10.83/100)]×(100/360)

Interest on CP=₹30083

Additional ROI=Investment Amount×Rate of Return×(Investment Period/360)

Additional ROI=1000000×(21/100)×(30/360)

Additional ROI=₹17500

Net Cost=Interest+Brokerage Fees-Additional Return on Investment

Net Cost=30083+(1% of 1000000)-17500

Net Cost=₹22583

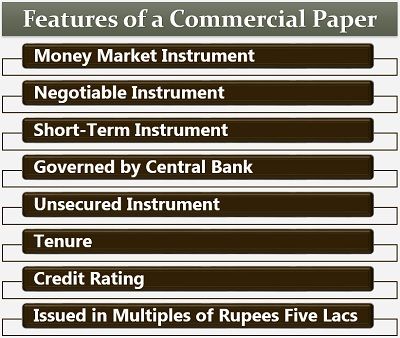

Features of Commercial Paper

What exactly is a commercial paper? What are its characteristics which differentiates it from other financial instruments?

A commercial paper is a convenient means of short-term fund acquisition for the companies and profitable short-term investment for the investor.

Let us now have a look at the various features of a commercial paper:

Money Market Instrument: The banks, companies and the government can avail enormous funds for a short-term period at a low cost, through it. Thus these are considered as money market instruments.

Negotiable Instrument: It is a form of the negotiable instrument where the payer’s name, sum borrowed and maturity date are mentioned clearly. Thus, establishing a future promise to pay a certain amount by the payer to the bearer of the instrument.

Short-Term Instrument: A commercial paper is a short term investment since it is redeemable within one year as per its maturity date.

Governed by Central Bank: The central bank (i.e., RBI in India) controls the transactions of the commercial paper. This is because of the facts that these are unsecured instruments and are mainly used in the banking industry.

Unsecured Instrument: This type of instrument is generally not backed by collateral or any security of repayment by the company; therefore, it involves a higher level of risk.

Tenure: As we have already seen that the commercial paper is a short-term instrument, the maturity period needs to be more than seven days or less than than a year.

Credit Rating: Credit rating analyzes the credibility of an individual, firm, bank or government body. Thus, only those entities which have a high credit rating determining their ability to pay back the borrowed sum are allowed to issue a commercial paper.

Issued in Multiples of Rupees Five Lacs: In India, the minimum value of a commercial paper is ₹500000, and it is always issued in the multiples of this value.

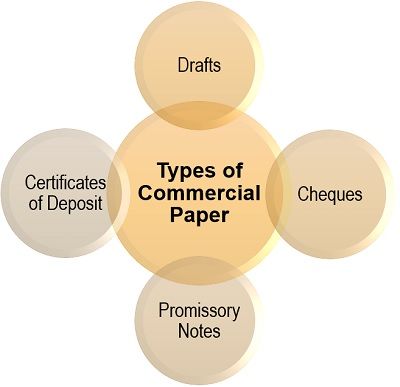

Types of Commercial Paper

A commercial paper includes all those financial instruments which are issued for a short term period and yields interest for the investors. The most common forms of CP are the bill of exchange, promissory note, cheques, certificate of deposit, etc.

Let us now understand each of these CPs in detail below:

Certificates of Deposit (CD)

Any commercial bank can issue a certificate of deposit (only those which matures within one year). It is though similar to a savings account; the interest yield is quite higher than that of a savings account. In a CD, the amount is blocked with the issuing bank, and the depositor cannot even withdraw the interest, till the maturity date.

Cheques

A cheque is that commercial paper which holds an unconditional order duly signed by the bank account holder to pay on demand to or to the order of the instrument bearer, the mentioned sum, on or after the specified date. The different types of cheques include self, post-dated, crossed, bearer, open, order and traveller’s cheques.

Drafts

A draft refers to a written unconditional order made by the buyer (payer or drawer) to direct the drawee (i.e., the bank where the payer holds an account) to pay the specified sum to the payee (seller or creditor) on or after a specific date or period.

Promissory Notes

A promissory note is that commercial paper which holds an unconditional promise made by the drawer to pay off a certain amount specified on the instrument, to the drawee or his/her order, on the mentioned date or the demand of drawee.

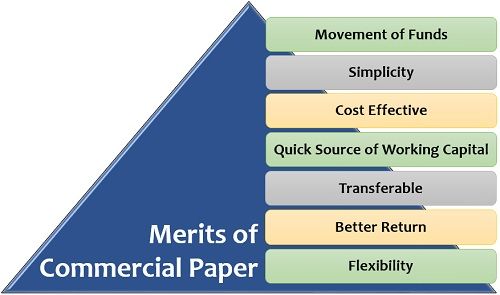

Merits of Commercial Paper

There are numerous benefits of issuing a commercial paper to the companies, and at the same time, it is a good investment idea for the depositors.

Following are some of the significant advantages of a commercial paper:

- Movement of Funds: A commercial paper supports the economy by ensuring the flow of funds from the surplus source to those who have a deficit of funds.

- Simplicity: It is the easiest way of acquiring funds by the companies which have high creditworthiness.

- Cost-Effective: The cost of issuing a commercial paper is quite low when compared to other money market instruments, such as bank loans. Thus, making it a low-cost source of working capital for the companies and banks.

- Quick Source of Working Capital: Issuing of a commercial paper is not a lengthy process. Instead, it is quite fast and convenient for the companies fulfilling all the conditions.

- Transferable: It can be easily transferred to a third party as a means of making payments or clearing the dues.

- Better Return: Investing in a commercial paper, yields a higher rate of interest in a short period as compared to other investment opportunities.

- Flexibility: The date of maturity of a commercial paper is determined by the issuing company depending upon its cash flow and financial liabilities.

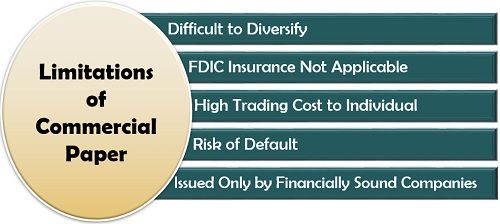

Limitations of Commercial Paper

A commercial paper is not always beneficial; it may even lead to loss due to various reasons. One needs to be cautious while investing in any money market instrument.

Let us discuss the various shortcomings of a commercial paper:

- Difficult to Diversify: Since a particular company issues the commercial paper, the investment portfolio of an individual does include a variety of products to diversify the risk involved.

- FDIC Insurance Not Applicable: A commercial paper is not insured under the Federal Deposit Insurance Corporation (FDIC). In case of any loss or failure of repayment, the depositor cannot claim for FDIC insurance.

- High Trading Cost to Individual: The trading of a commercial paper takes place in a massive volume by the companies. But when traded by an individual investor who entirely depends on a broker for such investment, he/she would end up paying off high brokerage and other trading costs.

- Risk of Default: At times of financial crisis or economic downturn, the companies are unable to meet their credit liabilities. Moreover, in the absence of any FDIC insurance or collateral, there is a risk of loss to the investor.

- Issued Only by Financially Sound Companies: Every company cannot avail the benefit of releasing a commercial paper to acquire working capital. Only those firms, which are financially sound and hold a high reputation, can go for it.

Commercial Paper in India

In India, a commercial paper came into existence in 1990 and was regulated under the governance of the Reserve Bank of India (RBI). It is mostly available in the mode of a promissory note.

The aim of introducing this money market instrument was to empower the corporates to obtain immediate funds for working capital as well as multiply the sources of short-term borrowings. It also added on to the investment portfolio of the investors and depositors.

Following are the precise terms and conditions which the issuing companies need to fulfil to issue a commercial paper in India:

- The company’s tangible net worth should be at least ₹40000000, as stated in the recent balance sheet (only the one which is audited).

- The company has been allowed a specific working capital limit by the banks or all India financial institutions.

- The financing banks or institutions have considered the company’s borrowings account as a Standard Asset.

- The company has obtained a credit rating of A-2 or higher, from the RBI specified credit rating agency (CRA).

A CP can be issued in the value of ₹500000 or its multiples, and the company has to issue it within two weeks period from the date of opening.

The Issuing and Paying Agent (IPA) for a CP is always a scheduled bank. Moreover, a CP is available for active exchange in the Over The Counter (OTC) market.

Anyone can invest in the commercial paper, including the individuals, corporates, banking companies, non-resident Indians (NRIs), etc.

The foreign institutional investors (FIIs) are though allowed to invest in Indian CPs; their assess have been limited from time to time by the Securities Exchange Board of India (SEBI).

Leave a Reply