The bill of exchange and promissory note are negotiable instruments used for carrying out various economic activities. However, they vary from each other in many ways. The significant difference between them is that a bill of exchange is a written order drafted by the drawer on the drawee to receive the mentioned sum within the specified period. Whereas, a promissory note is a written promise made by the borrower or drawer to repay the amount on a specific date or order of the payee.

According to the traditional concept, cash is an inevitable part of every transaction. But in the present scenario, whether it is trading, banking, financing or any other economic activity, bill of exchange and promissory note make the transactions convenient even in the absence of immediate cash.

Content: Difference Between Bill of Exchange and Promissory Note

- Difference and Comparison

- Example

- What is a Bill of Exchange?

- What is a Promissory Note?

- Classification

- Summary

Difference and Comparison

| Basis | Bill of Exchange | Promissory Note |

|---|---|---|

| Meaning | A bill of exchange is a written order drafted by the drawer on drawee to pay a specific sum within a mentioned time period without any condition. | A promissory note is a written promise made by the drawer to pay a definite amount to the payee on a specified date. |

| Drawn by | Creditor | Debtor |

Parties Involved | Drawer, drawee and payee | Drawer and payee |

| Order/promise | Order to pay | Promise to pay |

| Drawn in sets | Yes | No |

| Need for acceptance | Yes | No |

| Stamp duty requirement | Yes | No |

| Payable to bearer | Yes | No |

| Defined under | Section 5 of Negotiable Instrument Act, 1881 | Section 4 of Negotiable Instrument Act, 1881 |

| Liability on drawer | Secondary and conditional | Primary and absolute |

| Printed form | Not necessary | Compulsory |

| Protest in case of dishonor | Yes | No |

| Notice of dishonor | Yes | No |

| Can the same person be drawer and payee? | Yes | No |

Example of Bill of Exchange

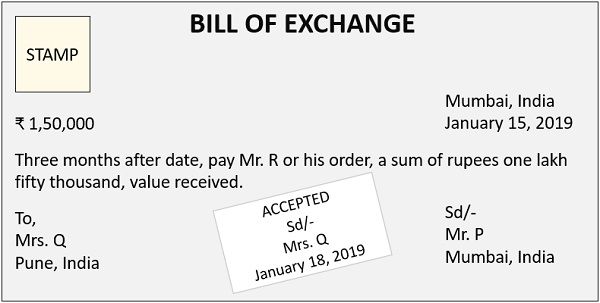

Case 1:

Mr P sold goods worth ₹150000 to Mrs Q on credit for three months. At the same time, Mr P had purchased raw material worth ₹150000 from Mr R on credit for three months. Henceforth, Mr P drafts a bill of exchange ordering Mrs Q to pay ₹150000 to Mr R, after three months. This draft was duly signed and accepted by Mrs Q, making it a legal Bill of Exchange.

Here, Mr P is the drawer; Mrs Q is the drawee and; Mr R is the payee.

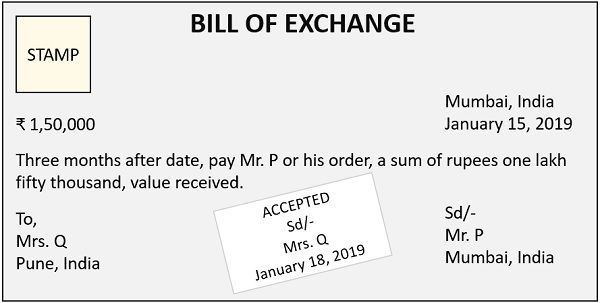

Case 2:

Now let us assume that Mr P sold the goods worth ₹150000 to Mrs Q on credit for three months and drafted a bill of exchange duly signed and accepted by Mrs Q, it looked something like this:

In this case, Mr P is both the drawer as well as the payee, whereas Mrs Q is the drawee.

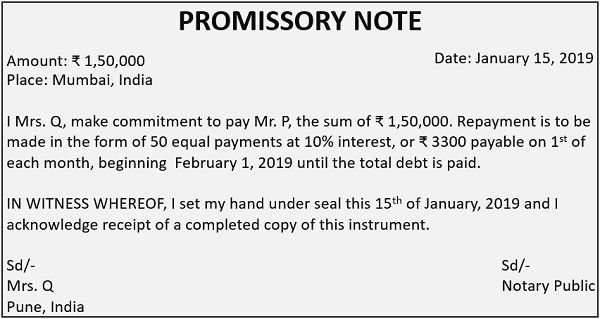

Example of Promissory Note

Mrs Q wants to start a garment business but does not have sufficient capital. Mr P is a well-established businessman and agrees to finance Mrs Q’s business idea. Mr P provides a loan of ₹150000 to Mrs Q at 10% interest to be paid in 50 equal monthly instalments of ₹3300 each.

Mrs Q wrote a promissory note where she promised Mr P to pay the total debt on time. This promissory note looked something like this:

What is a Bill of Exchange?

A bill of exchange is a negotiable instrument in a written format which orders the drawee or the debtor to pay a certain sum within the given period to the drawer or the creditor or the payee.

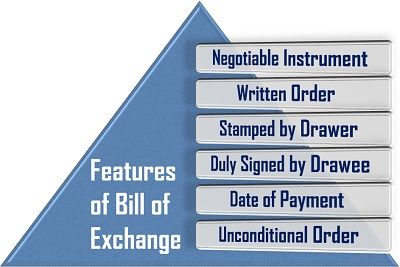

Features of Bill of Exchange

A bill of exchange is a unique instrument used for non-cash transactions. The following characteristics differentiate it from other negotiable instruments:

- Negotiable Instrument: A bill of exchange is a negotiable instrument which holds legal obligation on the drawee to pay the specified amount.

- Written Order: It is a written order drafted by the drawer on the drawee.

- Stamped by Drawer: It holds a legal stamp to ensure its validity.

- Duly Signed by Drawee: A bill of exchange is duly accepted and signed by the drawee who owes the sum to the payee.

- Date of Payment: The date of payment is mentioned on the bill of exchange.

- Unconditional Order: The bill is an order which needs to be fulfilled irrespective of the condition prevailing on the date of payment.

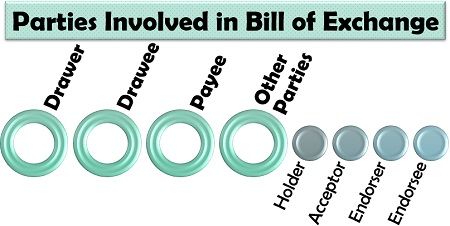

Parties Involved in Bill of Exchange

Though a bill of exchange majorly involves only three parties, there are various others whose role is equally important. These parties are classified as follows:

- Drawer: The drawer or the creditor is the person who creates the bill of exchange and is entitled to receiving the sum in return of the goods sold on credit.

- Drawee: The drawee is the one on whom the bill is drawn and who owes the amount to the drawer or the payee.

- Payee: The person who is liable to receive the sum as mentioned in the bill of exchange is known as the payee. The drawer can be the payee if he/she does not endorse the bill to someone else.

- Other Parties: Apart from the above mentioned three parties, some more people are also associated with a bill. They are as follows:

- Holder: A holder is a person who has the possession of the bill or is the bearer of it and is liable to recover the amount. Both payee or endorsee can be the holder of a bill of exchange.

- Acceptor: The person on whom the bill is drawn, i.e. the drawee who owes the amount to the payee and therefore accepts to pay the same by signing the bill of exchange.

- Endorser: The holder who transfers the bill of exchange in the name of some other person, making him/her the payee is known as an endorser.

- Endorsee: An endorsee is a person on whose name the bill of exchange is transferred by the endorser and who becomes the payee and holder of that bill.

What is a Promissory Note?

A promissory note is a debt negotiable instrument written by a borrower (drawer) who promises to pay the lender (payee), a specific sum on-demand or on a particular future date which is predefined.

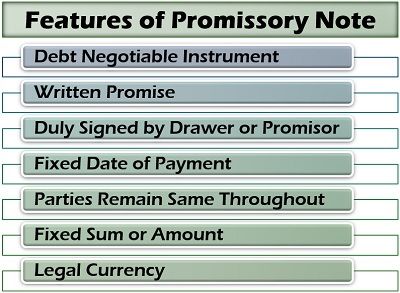

Features of Promissory Note

What is a promissory note? How is it different from other negotiable instruments? To get the answers, let us go through the following features of a promissory note:

- Debt Negotiable Instrument: A promissory note is a debt instrument made at the time of providing loan other than bank loans.

- Written Promise: The promise made by the drawer to pay off the sum is in a written format.

- Duly Signed by Drawer or Promisor: This note holds the signature of the drawer abiding by all its clauses.

- Fixed Date of Payment: The promissory note states a particular date of repayment on which the promise has to be fulfilled.

- Parties Remain Same Throughout: The parties to a promissory note unlike a bill of exchange does not change throughout the execution of it.

- Fixed Sum or Amount: The amount is mentioned in the monetary denomination on a promissory note.

- Legal Currency: The exchange of money while execution of a promissory note is done in legal currency.

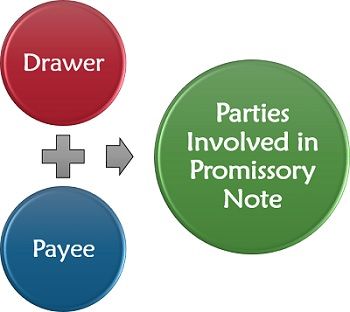

Parties Involved in Promissory Note

A promissory note strictly involves two parties, i.e. a drawer and a payee. To know more about each one in detail, read below:

- Drawer: The drawer or the maker of a promissory note is the one who borrows the sum and promises to pay a certain amount in return on-demand or a specified date.

- Payee: The payee or the drawee is the person who lends the sum to the drawer and is liable to receive a certain amount in return, on his/her demand or the date specified on the promissory note.

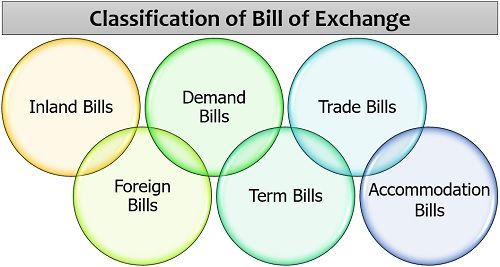

Classification of Bill of Exchange

A bill of exchange can be categorized into various kinds, based on the residential status of the parties, date of maturity and purpose of the bill. These types are explained in detail below:

- Inland Bills: A bill of exchange drawn within the geographical boundaries of a country, when the drawer, drawee and payee resides in that particular country, is known as an inland bill.

- Foreign Bills: When a drawer makes a bill in one country to be accepted and payable by the drawee in some other country, this bill of exchange is called a foreign bill.

- Demand Bills: These bills of exchange do not have a specific date or period of repayment; instead, these are payable on demand of the payee or holder.

- Term Bills: The bills of exchange payable on a specific date or after a definite period are called term bills.

- Trade Bills: Trade bills are those who are drawn by the seller or creditor at the time of selling goods on credit to the drawee.

- Accommodation Bills: The bill which is drawn by a lender to provide financial support or aid to the drawee or the borrower is known as an accommodation bill.

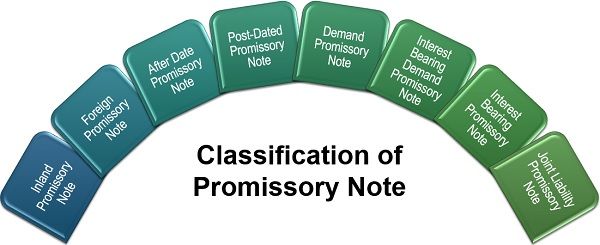

Classification of Promissory Note

A promissory note is divided into the following types, based on the residential status of the parties, date of payment, interest and liability:

- Inland Promissory Note: If the parties involved in a promissory note, i.e. the drawer and the payee belongs to the same country, the draft is referred to as an inland promissory note.

- Foreign Promissory Note: A promissory note in which the drawer and the payee both belong to different countries is termed as a foreign promissory note.

- After Date Promissory Note: An after date promissory note is the one on which the drawer states its life or period of repayment. According to this period and the date of issue, the due date can be calculated.

- Post-Dated Promissory Note: The promissory note which reveals a date of repayment belonging to the next period, i.e. the next month or year, is known as a post-dated promissory note.

- Demand Promissory Note: The note which is payable on demand of the payee, i.e. the payee can claim the amount on any day as per his/her choice is termed as a demand promissory note.

- Interest Bearing Demand Promissory Note: As a mutual understanding between the payer and the payee, the interest on the amount is decided which is payable by the drawer along with the principal amount as and when claimed by the payee.

- Interest Bearing Promissory Note: Again with a mutual understanding a specific rate of interest is decided among the parties, which is payable by the drawer in addition to the principal sum on the due date to the payee.

- Joint Liability Promissory Note: The joint liability promissory note is the one in which involves two or more drawers unanimously liable to pay the specified amount to the payee on the due date.

Summary

To understand the differences between a bill of exchange and a promissory note in detail, let us elaborate on the above comparison chart:

- A bill of exchange is an unconditional written order made by the drawer on drawee to receive the specified sum within the mentioned period. Whereas, a promissory note is a written promise made by the borrower or drawer to repay the amount on a specific date or order of the payee.

- The former is drafted by the creditor or lender who is liable to receive the amount. On the contrary, the latter is made by the borrower or the debtor who is liable to pay the sum.

- There are usually three parties associated with a bill of exchange, i.e. a drawer, a payee and a drawee. Whereas, a promissory note strictly involves a drawer and a payee.

- When the former is an order directing the payment, the latter is a promise assuring the payment.

- A bill of exchange is drawn in sets by making a duplicate, triplicate copy to make a claim convenient even if one bill is lost. However, a promissory note cannot be drawn in sets and only the original instrument is available.

- The former needs to be compulsorily accepted by the drawee to make a legal instrument. However, the latter is drafted by the payer himself and does not require any such acceptance.

- A bill of exchange does not need any stamp, whereas a promissory note needs to be duly stamped.

- The former can be endorsed, and the payee is the one who holds the bill on maturity. However the latter is strictly payable to the payee mentioned initially in the note.

- A bill of exchange is defined under section 5 of the Negotiable Instrument Act, 1881, whereas a promissory note is stated under section 4 of the Negotiable Instrument Act, 1881.

- When the former holds a secondary and conditional liability on the drawee, the latter has a primary and absolute liability on the drawer.

- A bill of exchange can be handwritten, whereas, a promissory note is always in a printed form.

- When a bill of exchange holds a legal obligation and can be protested in the case of dishonour, the same is not possible in the fact of a promissory note.

- If the former is dishonoured, the drawer can issue a notice to the drawee legally; however, if the latter is dishonoured, no such action can be taken.

- In a bill of exchange, the drawer and the payee can be the same person if the bill is not endorsed. The same is not possible with a promissory note.

The bill of exchange and promissory note facilitates credit purchase and loans for the individuals, traders and the government. It also provides for economic and industrial development in a country by promoting trade activities.

Leave a Reply