Definition: Cheque truncation system is an arrangement which facilitates the electronic processing of a cheque with the use of Magnetic Ink Character Reader (MICR) data and the scanned image of the instrument without involving any physical exchange or movement of the financial instrument.

Truncation, as we know, refers to the shortening of the process and therefore, CTS has reduced the time taken in payment processing of a cheque.

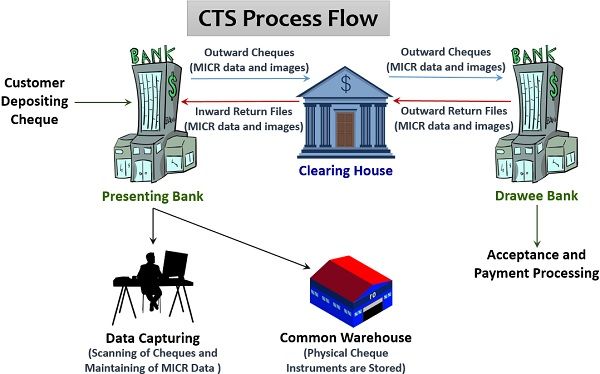

To better understand the working of a cheque truncation system, we must go through the following CTS process flow:

Parties Involved

To understand how the CTS functions, we must know about the parties involved in it. There are majorly following three parties involved in the cheque truncation system:

- Presenting Bank: The bank which represents the payee in the whole CTS process is known as the presenting bank. Usually, the presenting bank is that bank where the payee holds an account. We can also say that often the service bank represents the payee in the CTS.

- Drawee Bank: The drawee is the person who is liable to pay, so the drawee bank is that bank which represents the payer and is liable to pay on his/her behalf.

- Clearing House: The Clearing House acts as a link between the above two parties, i.e., the presenting and drawee banks to ensure effortless negotiation of cheque transactions.

Content: Cheque Truncation System (CTS)

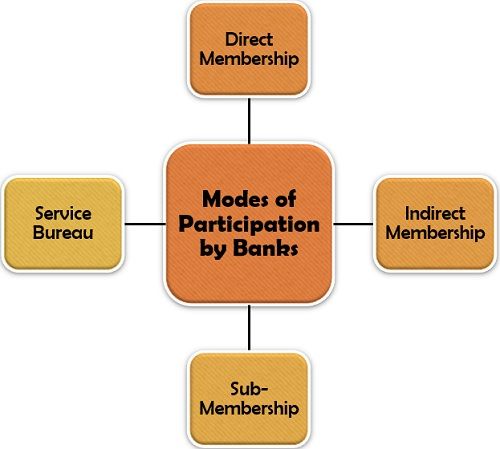

Modes of Participation by Banks

There are four ways in which a bank can participate in the cheque truncation system. These are as follows:

- Direct Membership: After fulfilling all the conditions essential for participating in the CTS like opening a settlement account with the settlement bank, the banks can become immediate members of the CTS.

- Indirect Membership: To participate indirectly, some banks utilize the CHI infrastructure of the other banks to carry out CTS activities even after having their capture infrastructure.

- Sub-Membership: In sub-membership, the banks can add themselves as sub-members under the direct members of the Clearing House and use their CTS infrastructure.

- Service Bureau: Some banks use the capture infrastructure, set up by the service bureau, i.e. the vendor in collaboration with the third party bank to avail the services of its CHI infrastructure.

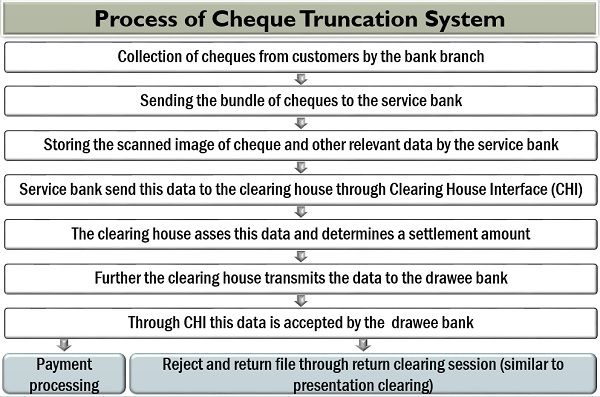

Process of Cheque Truncation System

Cheque truncation system is a step by step process to simplify the conventional means of cheque clearance. Following is the systematic procedure of CTS:

In the last step, the drawee bank, after going through the data and image thoroughly can accept the cheque and further proceed with making payment.

Or, it can even reject the data for various reasons like a signature mismatch and incomplete information by returning the file back to the presenting bank through the same process in the reverse order.

Following are some of the essential functions performed by the parties involved while carrying out the cheque truncation system:

Collection of Cheques: The bank branches initially accepts cheques from its customers and sends these accumulated instruments to their service bank.

Capturing of Data: At the service bank, the essential information related to the cheque including the cheque no., MICR code, drawee’s name, etc. is maintained along with a scanned image of the cheque. This data is then sent to the Clearing House through a secured Clearing House Interface.

Security of Data: Public Key Infrastructure (PKI) is used to ensure data security. Moreover, while transferring the information and cheque’s image to the Clearing House (from where it is sent to the drawee bank), this data is encrypted and duly signed by the presenting bank.

Clearing House Interface: CHI is a gateway which connects and facilitates the transfer of data between the presenting bank and the drawee bank.

Presentation Clearing: The Clearing House analyzes the data and determines the settlement amount.

Processing of Payment: It then forwards the data and image to the drawee bank for payment processing. In case, the cheque is rejected for some reason, the drawee bank returns the data to the Clearing House and then to the presenting bank through return clearing session.

Completion of Cycle: After the successful execution of the presentation clearing and the return clearing session, i.e. after payment processing or returning of data, the process completes.

Role of MICR in Cheque Truncation System

MICR, i.e., Magnetic Ink Character Reader is vastly used in the CTS to identify the data printed on a specified stationary used for a cheque. The MICR has defined specific guidelines which needs to be followed by the banks while designing a cheque instrument.

The cheque must have the following features:

- Light background colour to highlight the text printed on it.

- The banks must avoid the use of highly creative or artistic design and tiny letters.

- Monos, logos or holograms should be on the front and promptly visible.

- The data generated by the MICR after processing the cheque is exchanged or transferred inward and outward between the parties through the gateway called as the Clearing House Interface.

- The MICR is capable of automatically mending the data which it detects to be slightly unclear for generating a better output.

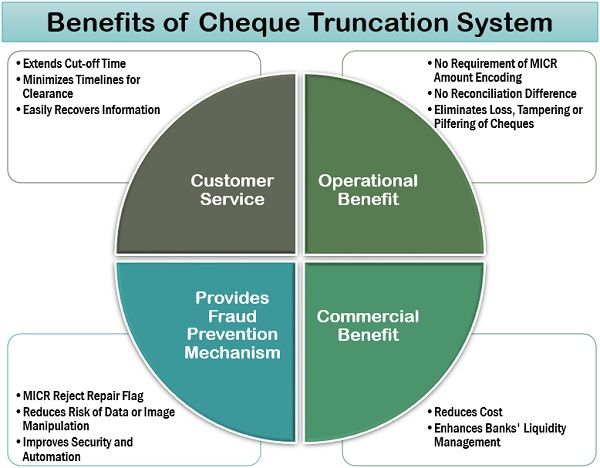

Benefits of Cheque Truncation System

The CTS has multiple advantages to the banks. Moreover, it has modified the conventional cheque clearance process to save the time and efforts of the banking personnel. Following are some of the ways in which CTS benefits the banks:

Customer Service

Customers are the lifeline of any business. Therefore, in the banking industry, also it is essential to enhance their experience. In this context, CTS serves the following purposes:

- Extends Cut-off Time: The CTS provides a longer cut-off time for the customers to deposit their cheques in their banks.

- Minimizes Timelines for Clearance: Due to CTS, the time taken for cheque clearance have reduced tremendously. Now, the payment of cheques is possible within 24 hours.

- Easily Recovers Information: Since the data is stored in the electronic form, it can be conveniently retrieved whenever required.

Operational Benefit

With technological advancement, every industry is becoming quicker; thus CTS too eases out the banking process of cheque processing and payment in the following ways:

- No Requirement of MICR Amount Encoding: The banks are not required to encode the cheque amount in the MICR in CTS, thus saving time and efforts.

- No Reconciliation Difference: The CTS enables prompt and simultaneous processing of the cheques by letting the MICR and image data which removes the reconciliation difference.

- Eliminates Loss, Tampering or Pilfering of Cheques: When the cheque is transmitted in electronic form instead of physical form, the chances of it being misplaced, forged or stolen eliminates.

Commercial Benefit

Everything which is done manually involves a high expenditure of resources on clerical work and stationery. CTS has reduced the burden of banks in the following ways:

- Reduces Cost: The physical transfer of the paper instruments from one place to another involves specific cost which has been eliminated by the use of CTS.

- Enhances Banks’ Liquidity Management: By implementing grid CTS where the cheques from the different banks are sorted by the Clearing House of a particular grid. Such as CTS Chennai system, which clears the cheques of Mysore and Puducherry to save cost and manage the liquidity in operations.

Provides Fraud Prevention Mechanism

CTS is a quite secured and advanced method of carrying out an automatic cheque clearance process. To avoid fraudulent activities, CTS has the following add-on benefits:

- MICR Reject Repair Flag: The use of MICR reject repair technology is done under CTR to correct the mistakes and improve the data quality automatically.

- Reduces Risk of Data or Image Manipulation: The use of encryptions and digital signatures minimizes the risk of any manipulation or forgery.

- Improves Security and Automation: PKI ensures the security of data throughout the CTS process. The CHI provides for automated transmission of all the data.

Risk Involved in Cheque Truncation System

There is a high risk involved in the cheque truncation system. In CTS, cheques are manually scrutinized. This may lead to rejection of a genuine cheque, as a result of being over judgemental; or acceptance of fake cheque in carelessness. Even the verification of the signatures may face a similar issue.

Legal Issues

The Clearing House cannot be blamed for any fraudulent activity or forgery since it is there to facilitate transactions. It majorly functions through the MICR data and acts as a medium for transferring images.

The presenting bank in CTS can verify the credibility of the cheque by analyzing its evident features.

As state under the Negotiable Instruments Act, it is the right of the drawee bank to get a detailed briefing and physical instrument of the cheque for its further verification.

Leave a Reply