Definition: A mutual fund is an investment scheme which gathers money from various investors to pool in the collected amount into the equity, debt and other money market instruments. The Asset Management Companies (AMC) are the registered organizations which offer a variety of mutual funds for the investors.

The Asset Management Companies hire fund managers to plan, invest and monitor the performance of various companies under these funds.

Content: Mutual Fund

Example

Mr A decided to invest a lump sum amount of 25000/-. He was fascinated with the returns that share market yield and was planning to invest in the shares of HCL Technologies.

He met one of his friends Mr B, who was a financial advisor. On knowing the investment plan of Mr A, Mr B explained to him that if he invests his amount entirely in a single company, he will be exposed to high risk and restricted returns.

Instead, he should diversify his fund into various companies to earn fair returns at minimal risk. He further suggested Mr A invest in mutual funds.

Now, Mr B designed an investment portfolio for Mr A. The collection included Invesco India Multicap Fund (G) which has a mix of shares belonging to various companies of different sectors like banking, software, construction, consumer durables, finance, retailing and many more.

Here the stocks of companies like HDFC Bank, HCL Technologies, Infosys, Voltas, MRF, V-Mart Retail, etc. were blended.

Thus, the mutual fund helped Mr A to invest his limited fund into so many different companies letting him rejoice a much better return at low risk.

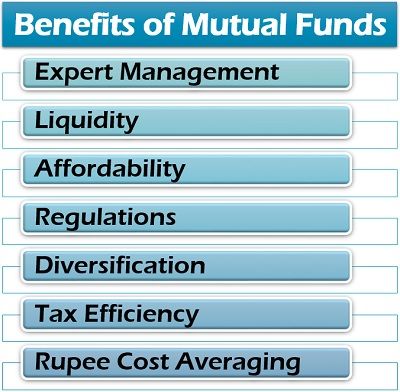

Benefits of Mutual Funds

Mutual funds are considered to be the most consistently performing investment options for young investors. To understand the various advantages of mutual funds, read below:

Expert Management: The investor need not indulge in the research and allocation of funds himself. In the case of mutual funds, the fund manager or the asset manager is responsible for making investment decisions and earning a high return for investors.

Liquidity: Except for close-ended mutual funds, the buying and selling of mutual funds are comfortable and convenient. The investor can withdraw his sum at any point of time by selling out the units fully or partially.

Affordability: Mutual funds have an option of Systematic Investment Plan (SIP) where investors can invest a sum as low as 500/- each month. This makes it quite affordable, even for the person belonging to the low-income group.

Regulations: The mutual funds are registered under the regulatory authorities to protect the investors from fraudulent practices. The regulatory body monitors the operations of Asset Management Companies (AMC) regularly and makes them adhere to its rules and regulations. In India, the Stock Exchange Board of India (SEBI) regulates the trading of mutual funds.

Diversification: A well-planned portfolio diversifies the investment into two or more mutual funds, each of which comprises various companies from different sectors. This strategy minimizes the risk of loss and enhances the returns for the investor.

Tax Efficiency: The investor is liable for a tax deduction if he opts for tax-saving mutual funds.

Rupee Cost Averaging: The SIP allows the investor to invest a fixed sum each month, irrespective of the price of per unit of the mutual funds. Therefore, when the unit price falls at the time of economic crisis, the investor can buy more units and relish high return after financial stability.

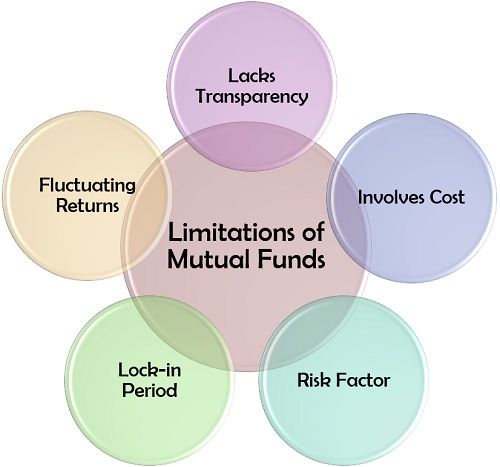

Limitations of Mutual Funds

An investor must have an investment objective, according to which his investment portfolio is designed. Every investment opportunity has some pros and cons.

Before starting a mutual fund investment, one must know the following associated drawbacks:

- Lacks Transparency: Sometimes, mutual fund advertisements misguide the investors with its title. Also, the investors are unaware or negligent of the companies in which their money is being invested by the AMCs.

- Involves Cost: The fees of the fund managers are quite high, i.e. 2% to 3%, even the mutual funds include a lot of hidden costs which makes it inefficient.

- Risk Factor: Mutual funds are not free of the risk factor since the money is ultimately invested in the shares which are subject to risk.

- Lock-in Period: The mutual funds yield high returns only if they are invested for a long-term and even have a lock-in period of 3 to 8 years. Thus, early withdrawal of funds may not be much beneficial for the investor.

- Fluctuating Returns: The amount of return is uncertain, in case of mutual funds. Mutual funds majorly invest in the share market where the returns entirely depend upon the performance of the companies.

Types of Mutual Funds

Every investor has a different investment goal or the reason for investing. Mutual funds offer different options to suit the investment objective of the investors. These can be classified as follows:

- Based on Investment Goals:

- Growth Funds

- Liquid Funds

- Income Funds

- Tax-Saving Funds

- Based on Structure:

- Closed-ended Funds

- Open-ended Funds

- Interval Funds

- Based on Risk:

- High-Risk Funds

- Medium Risk Funds

- Low-Risk Funds

- Very Low-Risk Funds

- Based on Asset Class:

- Debt Funds

- Equity Funds

- Hybrid Funds

- Money Market Funds

- Specialized Mutual Funds:

- Sector Funds

- Real Estate Funds

- Asset Allocation Funds

- Inverse/Leveraged Funds

- Index Funds

- Funds of Funds

- Exchange-Traded Funds

- Global Funds

- International/ Foreign Funds

- Emerging Market Funds

- Market Neutral Funds

- Commodity-Focused Stock Funds

- Gift Funds

Who is a Mutual Fund Advisor?

A mutual fund advisor is an expert or professional who advises the investors, designs their portfolio and is also responsible for the management of this portfolio.

Leave a Reply