The financial planning process is like a life jacket to fight back against financial challenges. It is foreseeing one’s financial future and having complete control over the present financial situation.

Today, everyone, including corporations, understands the importance of Wealth creation. Additionally, they try to upskill themselves to plan their investments and prepare for unforeseen circumstances.

Therefore, they develop a comprehensive financial blueprint for short and long-term financial goals.

The financial planning process is unique for everyone and has a broad scope. As, the constraints based on which the plan is developed are different for everyone. For this reason, a tailor-made plan is needed for each individual and corporation.

This post discusses the financial planning process for Individuals, Clients and Businesses.

Content: Financial Planning Process

- What is Financial Planning?

- What is the Financial Planning Process?

- Steps in the Financial Planning Process

- Example

- Final Words

What is Financial Planning?

It is a systematic process to develop a course of action to accomplish financial goals. It has a holistic view that encompasses a broad spectrum of activities related to money management.

Financial planning navigates us from the current situation to the planned or expected state. Therefore, it helps us to achieve life goals and manage finances efficiently.

Corporates and individuals both conduct financial planning at regular intervals. This is because, it is necessary for personal and professional money management.

What is the Financial Planning Process?

The Financial Planning Process implies a step-by-step procedure to form a suitable financial plan with a futuristic approach. It aims at achieving efficient money management for present and future financial contingencies.

The outcome of this process is a solid financial plan that is capable of fighting financial hurdles and challenges.

The basic framework of this process can be summed up in three broad steps:

- Evaluating the current financial situation.

- Identifying short and long-term goals.

- Developing and implementing the plan.

The process is continuous as the financial goals keep changing with time. It happens because the priorities, circumstances and challenges change over time.

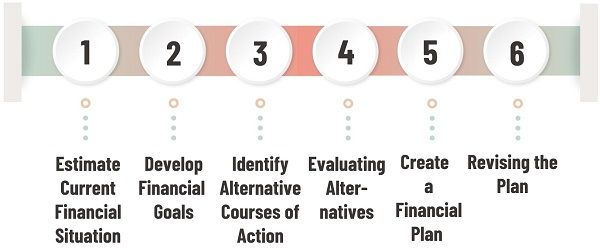

Steps in the Financial Planning Process

The steps in financial planning are activities in which one is engaged continuously. The process has six steps for Individuals, Clients or Businesses. However, they differ from each other in some aspects.

Personal Financial Planning Process

It is conducted by individuals or a family collectively. They develop a purposeful, realistic plan for their personal money management.

There are six stages in this process explained below:

Step 1: Determine the current financial situation.

The process begins with the determination of an individual’s current financial position. For this purpose, you need to gather all the details regarding:

- Income

- Assets

- Debts

- Liabilities, etc.

Step 2: Develop financial goals.

In the second step, you need to figure out where you want to reach in the future. Based on this, list down and prioritise your goals. Also, quantify these goals in monetary terms to estimate long-term financial plans.

Besides, identify the gaps and issues that must be considered during planning.

Step 3: Identify alternative courses of action.

The third step is identifying the means to accomplish the previously set goals. These are the potential and the best ways to meet the listed goals. Moreover, it integrates the elements necessary for a sound financial future. It must ensure:

- Continuity of ongoing actions.

- Value addition in the current situation.

- New and improved courses of action.

- Creativity in decision-making.

- Identification of possible alternatives.

Step 4: Evaluating alternatives.

Now, you need to evaluate the identified alternatives. Therefore, conduct a thorough comparison based on each alternative’s cost and benefit.

Here, due consideration must be given to the areas like risk tolerance and tax benefits.

Step 5: Creating and implementing a financial plan.

Post evaluation, create a comprehensive financial plan to meet the short- and long-term goals. It must clearly reflect the asset allocation and its impact in the long run. Further, make realistic strategies to implement this plan.

Step 6: Re-evaluating and revising the plan.

The last step in the process is the re-evaluation of the formulated plan. The deviations may arise due to changes in goals and market conditions. It triggers the need to review the strategies and withdraw the non-profitable investment options.

Financial Planning Process for Client

Financial planning is complex, and only some people are skilled enough to conduct it independently. Therefore, they hire a financial advisor who offers financial planning services.

Hiring a professional eases the planning process and efficiently manages their finances. Consequently, individuals and organizations can achieve personal, economic and financial satisfaction.

While planning, the financial advisor gathers all the information about the client’s financial situation. After that, make recommendations and plan strategies considering a holistic view.

The steps that financial planning professionals follow are as follows:

- Collect all the relevant data from clients along with background information.

- Conduct a detailed analysis of the client’s present financial situation.

- Prepare a suitable financial plan considering the client’s long- and short-term goals.

- Convey the designed strategies to clients that will help them attain their goals.

- Implement the plan.

- Monitor and update the plan regularly.

Financial Planning Process for Business

All business, either big or small, performs financial planning. It is an iterative process that plans and controls the inflow and outflow of funds.

The planning involves forming a detailed futuristic plan for departments and organizations as a whole. Also, it forms organizational goals, programs, policies and procedures.

Mostly, it is conducted in-house by the finance department headed by Chief Financial Officer. However, small businesses can hire an expert for the same.

People might misunderstand it with asset management. But, asset management deals with the management of client’s investments.

The financial planning process for the organization is the same as the core process. But three crucial components should be kept in mind during planning as follows:

- Statement of Income and Expenses

- Cash Flow Statement

- Balance Sheet

Example

Today, individuals withdrawing high salaries hire a Chartered Accountant (CA) to plan their finances.

The process begins with disclosing all the information like Income, Investments, Loan and Debts. After accumulating data, he analysed it, keeping the client’s long-term goals and risk tolerance in mind. Next, he will draft a comprehensive plan for his client and make necessary recommendations.

CA also guides his clients in areas like:

- Making investments

- Saving Taxes

- Filing Returns

- Managing Portfolio

Final Words

All in all, everyone needs a financial plan to achieve their life goals. Through this, they frame a course of action that serves as a path toward a secure future.

It not only deals with investing money and wealth creation, but it has a much broader scope. Thus, it is a holistic plan that includes credit, tax obligations, daily expenses, family planning, etc.

Victoria Addington says

It’s great that you discussed that the client’s long-term goals and risk tolerance must be kept in mind. My friend wants to plan his income. I should advise him to turn to an expert in income planning solutions to ensure reliable guidance.