Definition: Bridge loan is a short-term financing facility provided by the financial institutions to the individuals or the company in case of immediate cash requirement before a long-term or regular loan is approved by the bank. However, whenever the regular loan gets approved, this bridge loan amount must be repaid to the bank along with the interest amount for the time it has been provided.

For example: If you have applied for a regular loan in a bank and it will take around 2 months to get approval for the loan, and you are in need of money immediately, the bank can provide you with a bridge loan to fill up the gap of time of financing. However, after 2 months, when the regular loan gets approved, this bridge loan amount has to be paid back along with the interest amount of 2 months.

Content: Bridge Loan

- Eligibility criteria required to apply for the Bridge Loan

- Salient Features of Bridge Loan

- Bridge loan in Real Estate

- Bridge Loan for Companies

- Conclusion

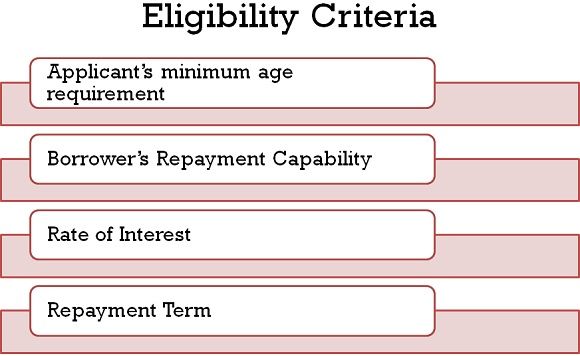

Eligibility criteria required to apply for the Bridge Loan

Following are some points necessarily considered before applying for the bridge loan:

- Applicant’s minimum age requirement: An applicant’s minimum age should be atleast 21 years.

- Borrower’s Repayment Capability: The amount of the bridge loan is decided based on the borrower’s repayment capability, which can be measured with their credit score. A borrower with a healthy credit score can get upto 80% of the bridge loan of the total projected value.

- Rate of Interest: The rate of interest which will be charged on the bridge loan may lie down somewhere between 12% to 18%, along with a few amount of processing fees, which may vary from institution to institution.

- Repayment Term: In general, bridge loans are provided for a short period of time, i.e., for 1-12 months to fill up the gap of loan financing.

Salient Features of Bridge Loan

Following are some of the relevant features of the bridge loan:

- A bridge loan is provided against collateral security presented by the applicant.

- Such loan is considered as short-term loans.

- In the case of a loan against real estate property, the rate of interest is decided on the basis of the estimated sale price of the collateral property.

Bridge loan in Real Estate

In general, when a bridge loan for an individual is talked about, it relates to the real estate sector. We will understand it with an example of Mr X, buying and selling the houses:

Suppose Mr X want to sell his current house where he is currently staying and wants to buy another property and got the best deal for a new house; however, the current house is not yet sold. Let’s say the price quoted by Mr X for selling his current house is 80 lakhs and the price of a new house which Mr X has to buy is 60 lakhs.

However, without selling the current house, Mr X doesn’t have enough sum that he can buy a new house. In this case, two conditions might arise:

- 1 case: If the current house is fully paid and has no mortgage or home loan

If the owner has 100% ownership in the house and does not have any mortgage or home loan and the current house is not yet sold, Mr X feels that he can sell it in the next 3 months. In that situation, you can take a bridge loan of 60 lakhs. And after 3 months when the current house of Mr X gets sold, then he can pay off the amount of bridge loan along with an interest amount for 3 months.

- Case 2: If the owner has already taken a home loan of 30 lakhs for the current house whose asked value is 80 lakhs.

In such a case, the equity portion of the current house is the remaining 50 lakhs, and when the current house is sold, the amount of only 50 lakhs will come into the hands of the owner after deducting the home loan amount of 30 lakhs. However, the amount of bridge loan taken by Mr X is 60 lakhs to buy a new house, and after 3 months when you sold the house and paid the mortgage amount, 50 lakhs can be paid for the new house and to pay off the remaining balance of 10 lakhs Mr X can take a home loan.

However, the loan of 10 lakhs may take time to get sanctioned. Let’s say it may take a time of 5 months, in that situation Mr X has to pay interest on 50 lakhs for 3 months, and interest on 10 lakhs for 5 months.

Bridge Loan for Companies

Suppose a company want to build their separate manufacturing department building, which will cost 15 crores and for that, the company issues a corporate bond to raise the money from the market, but it may take a time of 4 months. However, the company feels that they will not get this best deal for the land later, which they are getting now for making their manufacturing unit, and they want to start construction immediately. In that case, the company can take a bridge loan- from any financial institution.

However, they need not take a loan of the full amount of 15 crores; they may take a loan of some amount, let’s say of 5 crores, to start their construction work. After 4 months, when their corporate bonds are raised in the market, they have to repay the amount of the such loan, i.e., 5 crores with interest charged for 4 months.

Conclusion

A bridge loan is a form of extended loan provided by the financial institutions or banks to the borrowers who are in need of immediate cash to meet their expenditure. However, these loans are repaid after the regular loan gets sanctioned, or before 24 months whichever is earlier as 24 months or two years is a maximum limit decided to repay the loan amount.

Leave a Reply