Definition: A Public Provident Fund (PPF) Scheme is one of the Indian government saving schemes which aims at regulating the small savings of the individuals to convert such savings into investments yielding returns with tax-saving benefits. It is considered to be one of the safest investments.

The Public Provident Fund scheme was initiated in India in the year 1968 by the National Savings Organization.

Content: Public Provident Fund (PPF)

PPF Guidelines

The guidelines for Public Provident Fund (PPF) Scheme, declared by the Central Government under the regulation of the National Savings Organization are specified as follows:

- Type of Investment: It is a long-term investment.

- Account Type: A PPF account is a single holder account.

- Modes of Deposit: A PPF account deposit can be commenced through means of cash, demand draft, cheque, online fund transfers.

- Investment Limit: Investment in a PPF account can be made through 12 monthly instalments where the minimum investment value is 500/- and the maximum is 150000/- within a year.

- Citizenship: To open the account, an individual must be an Indian resident. If an individual begins a PPF account before he becomes NRI, then he is allowed to continue that account till maturity and is restricted from extending such account.

- Maturity Period: The period of maturity of Public Provident Fund is 15 years.

- Loan on PPF Account: The holder can also avail the facility of credit from the PPF account only after completion of the third year of investment up to the sixth year of investment. The loan granted can amount to 25% of the balance in the preceding financial year.

- Tax Exemption: The PPF account deposits and the interest earned on it are exempted from income tax under section 80C of Income Tax Act. Even the withdrawals made from PPF account are free from wealth tax. Tax exemption is also received on the amount deposited into the spouse’s or child’s PPF account.

- Transfer of Funds: PPF scheme facilitates secure fund transfer among accounts in different bank branches or post office accounts without any processing fee. It is only facilitated if the accounts belong individually to the holder.

- Interest Rates: The central government announces a fixed rate of interest on PPF account annually. In India, the interest rate on PPF account as in August 2018 is 7.6% p.a.

- Initial Investment Value: An investor can open a PPF account with an initial investment of 100/- but needs to deposit a minimum of 500/- in a financial year.

- Withdrawal: The funds can only be withdrawn on maturity, i.e. after 15 years. However, it facilitates partial fund withdrawal (50% of the ending balance of the fourth year), if needed by the account holder, only after completion of six years.

- Account Closure: The PPF account holder is unable to close the account before maturity. Even if the account turns inoperative, it is not possible to withdraw the amount before the end of the fifteenth year.

- Extension of PPF Account: PPF account can be renewed within one year of its maturity, for five years or more.

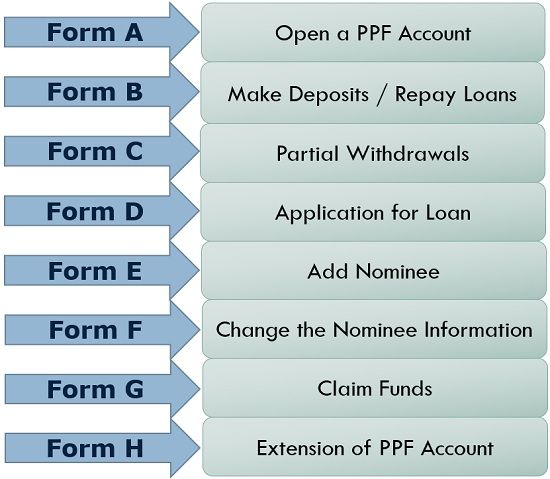

PPF Forms and Their Purpose

There are different PPF forms available for various purposes. Many of these can also be downloaded online now. The name of the forms and their respective purposes can be seen below:

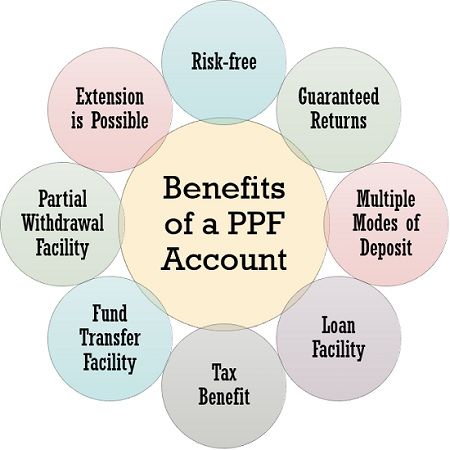

Benefits of a PPF Account

Though PPF does not fetch high returns when compared to other investment options, it has numerous other benefits which are mentioned as follows:

- Risk-free: The PPF scheme is considered to be the most secured investment giving nominal returns since it is initiated by the Ministry of Finance of India.

- Guaranteed Returns: PPF scheme ensures guaranteed returns to the account holder at a fixed rate of interest declared by the central government.

- Multiple Modes of Deposit: Amount in a PPF account can be invested through cash, demand draft, online fund transfers or cheques.

- Loan Facility: The account holder can also ask for a loan against his PPF account up to a certain percentage of the account balance.

- Tax Benefit: A person can get tax exemptions on the amount deposited and interest earned on PPF account of oneself, spouse and child.

- Fund Transfer Facility: Funds can be transferred from the account in one branch to another or among post offices. Only if, all the accounts belong individually to the PPF holder, without any processing fee.

- Partial Withdrawal Facility: Funds can be partially withdrawn after the sixth year of the PPF account.

- Extension is Possible: A PPF period can be extended for five years or more to earn interest without depositing any sum for this additional period.

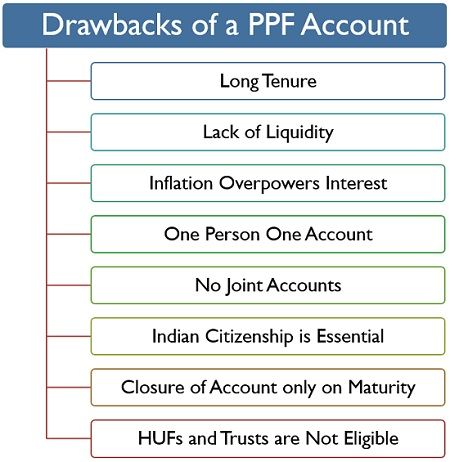

Drawbacks

PPF was initially started by the government to provide retirement benefits to the self-employed individuals; its diminishing rate of interest has made it less popular among investors. Other than this, PPF has multiple other drawbacks too, which are as follows:

- Long Tenure: The amount deposited in the PPF account is blocked for fifteen years, though partial withdrawals can be made in case of necessity but only after completion of the sixth year of PPF account.

- Lack of Liquidity: PPF account deposits cannot be quickly withdrawn or converted in liquid cash, unlike shares and securities.

- Inflation Overpowers the Interest Earned: The PPF interest rate keeps on reducing annually. This makes it difficult to stand against inflation.

- Indian Citizenship is Essential: Non-Resident Indian is restricted to open a PPF account.

- One Person One PPF Account: An individual is allowed to open a single account under his name.

- No Joint Accounts: The Joint account cannot be opened under the PPF scheme; it can only b opened on an individual’s name.

- Closure of Account Only on Maturity: A PPF account can be closed after its maturity, i.e. after 15 years of opening it; and not before that.

- HUFs and Trusts Are Not Eligible: Unlike before, now PPF account cannot be opened under the name of HUFs and Trusts.

Conclusion

A Public Provident Fund account is an excellent option for the individuals belonging to high-income groups due to its tax-saving benefits. It is also suitable for those who prefer secured investment, average returns and long-term savings as retirement benefits.

Leave a Reply