Definition: Departmental accounting is an accounting system used by organizations to manage the accounts of their various departments in separate books, i.e., for every department separate trial balance and profit and loss account is prepared, and at the end of the year balances of each department gets transferred to general profit and loss account, prepared to find out the profitability of a firm as a whole.

Content: Differential Pricing

- Methods of Departmental Accounting

- Advantages of Departmental Accounting

- Objectives of Departmental Accounting

- Illustration

- Conclusion

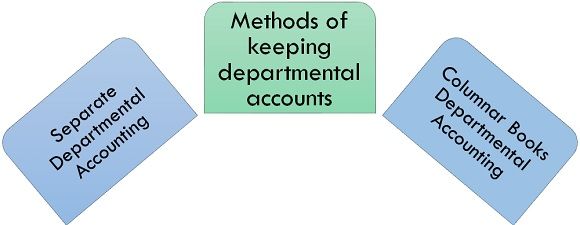

Methods of Departmental Accounting

To ascertain the profit or loss incurred by every department, trading and profit & loss accounts are prepared by the organizations, and the account of each department gets closed by transferring its profit or loss to the general profit and loss account. Such departmental accounts can be kept by following two methods; they are as follows:

- Separate Departmental Accounting: In general, this method is adopted by large organizations having various departments or if the law has asked to prepare separate department accounts. In this method, accounts of each department are kept independently, and each department is considered as a separate unit of an organization. This method is a more expensive method than the columnar method of departmental accounting.

- Columnar Books Departmental Accounting: This method is adopted by the small business organizations in which they do not maintain a full book-keeping system; however, it only maintains records of some transactions such as purchases, sales, stock details and expenses incurred by the departments. Trading and profit & loss account contain different columns for each department, and expenses pertaining to respective departments are recorded in their particular column, and if the expenses are of common nature, they get distributed amongst all departments according to the concerned ratios.

Advantages of Departmental Accounting

Following are some of the advantages of departmental accounting:

- If the organization prepares departmental accounts, it becomes beneficial for them to improve the department wise efficiency by ascertaining and reducing the operating expenses of each department.

- Departmental accounting enhances the profits of each department every year.

- Departmental accounts are reviewed for preparing the departmental budgets of an organization.

- Departmental accounting proves beneficial to compute the stock turnover ratio of every department.

- It is advantageous to compute the performance of the employees working in each department to reward them accordingly.

- Departmental accounting helps to enhance the competitive spirit of each department’s personnel which as a whole benefit the organization.

- It is beneficial for the investors as it provides detailed information to them about each department.

- It helps in the comparative study of stock turnover ratios and sales of every department.

Objectives of Departmental Accounting

Some primary objectives of departmental accounting are as follows:

- To compare the performance of each department with their previous year performance as well as with the other departments of the organization to measure the efficiency of the departments.

- It helps the organizations to identify high profit serving departments.

- Departmental accounting clarifies the picture of the higher operating departments of the organization.

- It helps the organization in decision making regarding expansion or closure of the departments, i.e., which department should be continued and which should be shut down.

- Commissions of the department managers are decided on the basis of the department’s profit or loss.

- It helps the organization to form policies to optimize the profits of the departments.

Illustration

From the following information, prepare the departmental trading and profit & loss account and general profit and loss account.

Following are the two departments of the clothing store:

- Ladies Cloth Department

- Gents Cloth Department

Particulars Amount (₹)

1. Opening Stock-Ladies Clothes 1,24,900 -Gents Clothes 96,400 2. Purchases-Ladies Clothes 3,45,800 -Gents Clothes 3,52,400 3. Carriage Inwards 26,420 4. Salaries 96,000 5. Rent and Rates 1,20,300 6. Discount Allowed 12,600 7. Advertising 52,000 8. Accounting Charges 6,000 9. General Expenses 39,600 10. Insurance Premium 12,000 11. Discount Received 18,200 12. Sales-Ladies Clothes 6,00,000 -Gents Clothes 5,62,000

|

- Other Information:

- Salaries to be distributed equally to both department employees.

2. Closing stock

-Ladies Clothes 1,62,400

-Gents Clothes 1,24,900

3. An Insurance premium is paid for the concerned policy taken by the proprietor.

4. Occupied area ratio 2:1

5. Carriage Inward will be distributed in the purchase ratio.

6. Discount Received will be distributed in the purchase ratio.

Solution:

Departmental Trading and profit & loss Account

For the year Ended—-

| Particuliars | Ladies | Gents | Particular | Ladies | Gents |

|---|---|---|---|---|---|

| To Opening Stock | 1,24,900 | 96,400 | By Sales | 6,00,000 | 5,62,000 |

| To Purchases | 3,45,800 | 3,52,400 | By Closing Stock | 1,62,400 | 1,24,900 |

| To Carriage Inwards ( 3458:3524) | 13085 | 13335 | |||

| To Gross profit c/d | 278615 | 224765 | |||

| --------- 762400 --------- | --------- 686900 --------- | --------- 762400 --------- | --------- 686900 --------- |

||

| To Salaries | 48000 | 48000 | By Gross profit b/d | 278615 | 224765 |

| To Rent and Rates (2:1) | 80200 | 40100 | By Discount Received | 9014 | 9186 |

| To Advertising ( 600:562) | 26850 | 25150 | |||

| To General Expenses ( 600:562) | 20448 | 19152 | |||

| To Discount Allowed ( 600:562) | 6506 | 6094 | |||

| To Net Profit c/d | 105625 | 95455 | |||

| --------- 287629 --------- | --------- 233951 --------- | --------- 287629 --------- | --------- 233951 --------- |

||

General Profit & Loss Account

For the year Ended—-

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To Insurance | 12000 | By Net Profit - Ladies - Gents | 105625 95455 |

| To Accounting Charges | 6000 | ||

| To Net Profit (Transferred to Balance Sheet) | 183080 | ||

| --------- 201080 --------- | --------- 201080 --------- |

Conclusion

Departmental accounting is a method of maintaining financial records of an organization’s every department separately so as to ascertain the exact income earned by each department. It also helps the organization to keep control over each department. However, at the end of the year, profit or loss earned by each department gets combined and transferred to the general profit and loss account to ascertain the overall profit/loss of the business during a year.

Rebecca yohanna nayi says

Thanks for making me to know more, keep it up