When we think of startup funding, we encounter the two very similar but incredibly different types of lenders, i.e., venture capitalist and angel investor. The significant dissimilarity between the two is that the former is a venture capital firm which invests the money of its customers. Whereas, the latter is an individual who is financially well versed and use his/her own money.

The final aim of both the sources of startup finance is to earn a profit or gain on the investment made in private companies. Also, the new business entity leveraged by any of these has a higher chance of success, in comparison to the ones individually set up.

Content: Difference Between Venture Capitalist and Angel Investor

- Difference and Comparison

- Example

- What is a Venture Capitalist?

- What is an Angel Investor?

- Advantages

- Disadvantages

- Summary

- Conclusion

Difference and Comparison

| Basis | Venture Capitalist | Angel Investor |

|---|---|---|

| Meaning | A professional associated to an investment firm who pools in the investors' (individuals and institutions) money, to finance pre-profit businesses. | A wealthy individual who seeks to fund potential pre-revenue businesses. |

| Identity | Professional investor, part of a Venture capital firm | Individual investor |

| Business stage | Growth stage | Startups or early stage business |

| Fund ownership | Money pooled from individuals and institutions | Own Money |

| Investment size | Huge | Comparatively Less |

| Risk level | Low | High |

| Due diligence | High | Low |

| Decision making | Experts team or specialized outside firm take decisions | Self decision-making |

| Investment duration | 10 years or more | 2-5 years |

| Investment type | Equity or Convertible Debt | Equity or Simple Agreement for Future Equity (SAFE) |

| Involvement | High | Less |

| Motivation | Financial gain | Personal achievement or mentoring startups |

| Potential return | 25-30% | 20-25% |

| Answerable to | Business partners or investors | Family |

Example

One of the most renowned Indian Senapathy Gopalakrishnan, who was the executive vice-chairman and co-founder of Infosys. He established a venture capital firm, named Axilor Ventures. This company financed some of the successful startups like Hunger Box and Planys Technologies.

Meena Ganesh is an angel investor who is also the CEO of Indian in-home healthcare services, Portea Medical. She has funded some of the most extraordinary startups, like Onlineprasad.com and HackerEarth.

What is a Venture Capitalist?

A venture capitalist is a professional who is a member of a venture capital company which acquires money from the third-party investors. On behalf of this firm, a venture capitalist analyzes and evaluates a startup business and finances it at the growth stage.

These firms can stay invested for ten or more years and hold a seat on the board of directors. They gain through convertible debts (into equity) at the time of dilution.

What is an Angel Investor?

An angel investor is an upscale individual who looks forward to investing their surplus funds in a startup (private company) at a pre-revenue stage of the business to gain through stakeholding.

Such investors usually grab investment opportunities which do not keep them engaged for more than five years. Moreover, they invest in the business idea and not on stability.

Advantages of Venture Capitalist

A venture capitalist leverages a startup’s financial requirements along with providing many other benefits to the entrepreneur, which are mentioned below:

- Raising Huge Capital: Venture capital is beneficial for those companies which are need of enormous funds for growing their business.

- Expert Advice and Guidance: A venture capitalist not only finances an organization but also provides the necessary support and guidance.

- No Monthly Installments: Unlike loans, the owner does not need to pay any monthly or fixed instalments (which is charged right from the borrowing date), in venture capital.

- Additional Funding: In case, the business requires more capital; venture capitalists can either invest themselves or recommend other such firms.

- No Collateral Required: Unlike other debt instruments, a venture capitalist does not ask for mortgaging any personal asset or valuables.

- Building Strong Business Network: It also helps the startups to develop a robust network, since venture capital firms have connections with the top entrepreneurs whom they have previously funded.

- Better Exposure and Publicity: A startup business backed by venture capitalists receives attention and recognition from the potential investors, partners, associates, customers and employees.

- Risk Management and Decision Making: The expert assistance and support to handle various situations in the initial stage of business reduces the risk level and provides for effective decision making.

- Operational Assistance and Superior Leadership: The chances of growth and success increase with an experienced team leading the operational and managerial activities of the organization.

Advantages of Angel Investor

Borrowing funds from an angel investor back a new business entity at the foundation stage itself. Some of its other benefits to the founder are discussed below:

- Leverage Startups: At the early stage of business, a startup can surely look up to an angel investor for the seed capital, rather than depending upon the traditional lenders.

- Future Funding Assistance: When a startup successfully reimburses the angel investor, it may provide a second round of funding for further business growth.

- Less Paperwork: Unlike traditional loans or venture capital, this means of fund acquisition requires fewer formalities and paperwork, usually limited to a Simple Agreement for Future Equity (SAFE).

- Develop Strategic Partnerships: For business growth and development, strategic partnership is necessary. Angel investors use their contacts to introduce startup owners with such companies.

- Applicable to All Industries: Angel investors take an interest in pooling their money in different industries like FMCG, health care, technology, financial service, etc.

- Mentorship and Guidance: The experience and knowledge of an angel investor can help the founder to tackle challenging situations and also enhance decision-making skills.

- No Monthly Payments: An angel investor does not demand any monthly instalments or interest, which helps the founder to support its business operations in the initial stage financially.

- Establish Business Network: Connection and alliance are the two significant components of business success. Angel investors link the startup with the potential business partners, team members and customers.

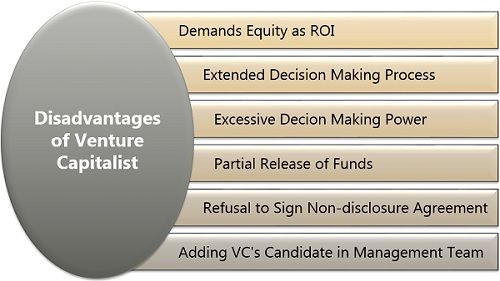

Disadvantages of Venture Capitalist

Venture capital is, though considered a good source of capital procurement in the growth stage of a business; it comes with many drawbacks. It’s limitations to the founder are as follows:

Demands Equity as ROI: Paying off the investment firm in terms of equity share, cost even higher than the interest on the loan paid on borrowings.

Extended Decision-Making Process: Due to an in-depth evaluation of the startup’s concepts, technology, legal and financial position and potential, sanctioning of funds can take months.

Excessive Decision-Making Power: A venture capitalist executes enormous control over the business operations and decision making, which hampers the entrepreneur’s authority.

Partial Release of Funds: Venture capitalist releases the promised amount partially after the analysis of the startup performance at different stages. It is based on various parameters like objectives, market position, customer acquisition, etc.

Refusal to Sign Non-disclosure Agreement: A successful entrepreneur usually frames a startup around an innovative idea. In this case, it is essential to maintain the firm’s secrecy, which may be violated if the venture capitalist denies signing the non-disclosure agreement.

Adding VC’s Candidate in Management Team: It is though beneficial to have an expert from venture capital firm to be a part of the organization, but too much interference may lead to internal conflicts.

Disadvantages of Angel Investor

A founder needs to wisely decide whether he/she should take money from an angel investor or not. This is because borrowing funds from an angel investor has the following shortcomings:

Small Amount: For the firms which need considerable capital investment, angel investing may not be a suitable approach.

Vague Terms and Conditions: Due to a dubious verbal agreement while finalizing a deal, both the parties lack a proper understanding of the terms and conditions.

Slow Funding: It is challenging to find a suitable angel investor if the founder does not have a strong business network.

Role Ambiguity: Sometimes, the angel investor lacks the required knowledge or experience, or he/she exercises extreme power in organizational decisions. It may lead to role conflict among the founder and the investor.

Excessive Control: After an agreement is signed, the founder cannot take strategic or significant business decisions alone. The angel investor has the power to intervene in all such decision making.

Demands Rapid Business Growth: A startup needs time to scale up. However, an angel investor seeks for fast growth and development of the business as well as the funds invested.

Invests in the Form of Convertible Debts: The investment is made in the form convertible debts (which can be converted into equity with premium at the time of dilution). Thus, at the time of the next evaluation, the founder may persist a minor business holding.

Lack of Attention: The angel investors pool their money in various startups, along with carrying out their own business. This devoids them from investing time to guide and mentor the startups funded.

Summary

The differences identified between a venture capitalist and an angel investor in the above table can be summarized as follows:

- A venture capitalist functions on behalf of a venture capital firm and puts third party money to fund the potential startups. On the other hand, an angel investor is a person who is wealthy enough to invest his/her own money to finance a new business.

- The former is a professional member of the venture capital firm; however, the latter is a prosperous individual investor.

- A VC only invest in the growth stage of a startup before its profit generation. But, an angel investor finances the startup at the initial level before it starts generating revenue.

- In venture capital, the funds belong to the third party who are client investors of the firm. Whereas, the angel investor uses his/her surplus money to fund a business.

- Where the former can invest a considerable sum, i.e., up to ten million dollars, the latter finances small amount usually lower than one million dollars.

- Since, a venture capitalist leverage an entity at the growth stage, that too, after proper evaluation and paperwork, the risk level is low. On the contrary, an angel investor is highly risky because of funding the startups at the ing stage and with not many formalities.

- The former invests a lot of time and efforts in evaluating and researching the prospective startup before funding it. But, the latter does not investigate the potential startup business to such an extent.

- In a VC, decision-making is a complete process involving experts, specialized firms, team members, etc. to make lending decisions. However, an angel investor makes all his/her decisions independently.

- A venture capitalist look for a stable investment, i.e., for ten or more years; on the other hand, an angel investor prefers investment opportunities with a duration of two to five years.

- The venture capitalist takes equity or convertible debt in exchange for the funds issued. Whereas, an angel investor invest in the form of equity or SAFE.

- The former acquire a seat on the board of directors and also takes active participation in managerial decision making. The latter shows a comparatively less involvement in the management and prefer to act more as a mentor.

- Venture capital is a firm which works for profit or returns, but an angel investor is a well-off individual who aims at superior goals like personal achievements, contentment and mentorship.

- The former has a higher return on investment in the long run, i.e., 25-30%, whereas the latter gains comparatively less, limiting to 20-25%.

- If the startup fails and the amount invested turns into bad debts, a venture capitalist is accountable to all the business partners and probably to the third-party investors. On the contrary, an angel investor shall only be answerable to his/her family in such a situation.

Conclusion

When venture capital is suitable for the startups aiming to be listed in the stock exchange, the angel investing helps to raise money for the small scale business units.

If you have a profitable business model, which has a high potential for attracting the investors; you may opt for any of the two startup funding sources, provided that you find one. However, analyze and understand the pros and cons of both these sources to avoid any adverse consequences in future.

Leave a Reply