Definition: Depreciation is the partial reduction of the value of fixed (tangible) assets used to carry out business operations, resulting out of its limited life span. It is set off against the revenue generated by such consumption each year. Every asset which is of a fixed nature tends to face obsoletion and physical deterioration due to its regular use. These assets include furniture, fixtures, machinery, tools, equipment, etc.

Every business organization needs to find out the depreciation expense for the assets it holds. Depreciation is an essential element of the financial accounts and is shown on the debit side of the Profit and Loss A/c as an expense.

Content: Depreciation Methods

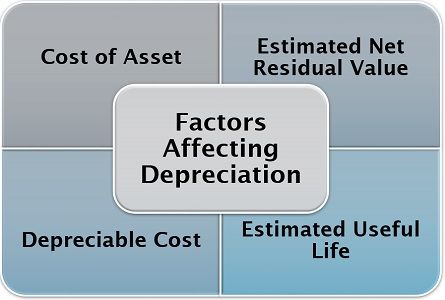

Factors Affecting Depreciation

Whenever we talk about depreciation, we consider it harmful to the business. However, the fact is that every asset is tangible and degrades in value as well as quality with its rigorous use.

Business organizations analyze and prepare for such reduction at the time of purchase of an asset.

Following are certain essential factors for computation of the depreciation on any asset:

- Cost of Asset: The cost of acquiring an asset which includes purchase cost, installation charges, transit cost, transit insurance, commission, registration expense, etc.

- Estimated Net Residual Value: It is the presumed scrap value of the asset at the time of its disposal or selling off. This value is estimated after deducting all the related expenses at the time of such disposal.

- Depreciable Cost: The depreciable cost is the net value of the asset on which the depreciation is to be charged. It is computed after deducting the estimated net residual value from the original cost of the asset.

- Estimated Useful Life: The estimated useful life of an asset is that period for which the asset remains in usable condition by the company to carry out business operations.

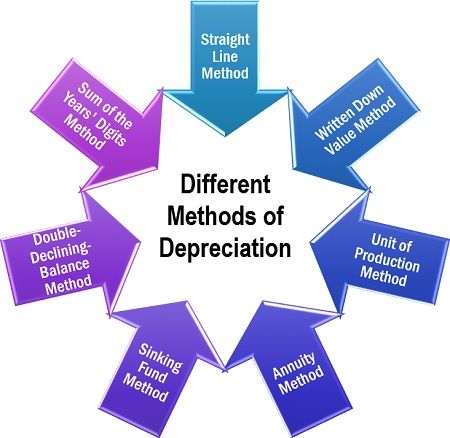

Different Methods of Depreciation

Method of finding depreciation expense vary from company to company and industry to industry. However, the straight-line method and the diminishing balance method are widely used techniques for calculating depreciation.

Further, we will understand the seven different methods of calculating depreciation, with the help of practical examples:

Straight Line Method

Under the straight-line depreciation method, the amount of reduction remains the same throughout all the accounting years. It is also called as the fixed instalment method.

Formula:

To compute annual depreciation under the straight-line method:![]()

To determine the rate of reduction (in percentage) under the straight-line method:![]()

Where, acquisition cost includes all the expenses incurred on purchase, transportation and installation of the asset.

Example:

Let us suppose that Mr A bought a transportation truck costing Rs. 800000, which has an estimated life of 10 years and the scrap value is Rs. 50000. Find out the annual depreciation expense.

Also, find out the rate of depreciation.

Solution:

Annual Depreciation=(Acquisition Cost-Estimated Scrap Value)/Estimated Life in Years

Annual Depreciation=(800000-50000)/10

Annual Depreciation=Rs. 75000

Rate of Depreciation=(Annual Depreciation Amount/Acquisition Cost)×100

Rate of Depreciation=(75000/800000)×100

Rate of Depreciation=9.38%

Diminishing Balance Method / Written Down Value Method

The diminishing balance method is one of the most efficient depreciation methods. It is widely used for the assets which are more productive in the initial years and less becomes less efficient gradually.

The essential feature of this method is that the depreciation is charged on the book value of the asset; and not on its original cost.

Formula:

To calculate the annual depreciation through the written down value method:![]()

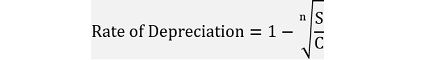

To find out the depreciation rate under the written down value method:

Where n is the estimated life in years;

S is the estimated scrap value;

C is the acquisition cost.

Example:

A soap manufacturing company purchased a machine on April 1, 2015, for Rs. 500000, which has an estimated useful life of 5 years. If its estimated scrap value is Rs. 100000, determine the rate of depreciation and annual depreciation for each year, using the written down value method.

Solution:

Rate of Depreciation=[1-n√(S/C)]×100

Rate of Depreciation=[1-5√(100000/500000)]×100

Rate of Depreciation=[1-0.72477966368]×100

Rate of Depreciation=27.5%

Let us find out the depreciation value for each year with the help of simple accounting method:

Annual Depreciation=Book Value of Asset×(Rate of Depreciation/100)

Year 1: Annual Depreciation=500000×(27.5/100)

Annual Depreciation=Rs. 137500

Year 2: Book Value=500000-137500

Book Value=Rs. 362500

Annual Depreciation=362500×(27.5/100)

Annual Depreciation=Rs. 99687.5

Year 3: Book Value=362500-99687.5

Book Value=Rs. 262812.5

Annual Depreciation=262812.5×(27.5/100)

Annual Depreciation=Rs. 72273.44

Year 4: Book Value=262812.5-72273.44

Book Value=Rs. 190539

Annual Depreciation=190539×(27.5/100)

Annual Depreciation=Rs. 52398.24

Year 5: Book Value=190539-52398.24

Book Value=Rs. 138140.75

Annual Depreciation=138140.75×(27.5/100)

Annual Depreciation=Rs. 37988.7

Unit of Production Method

In the unit of production method, an asset’s life is estimated by the number of units which can be produced by employing it. Depreciation is determined according to its usage, instead of a particular period.

Formula:

To compute depreciation expense with the help of the unit of production method:![]()

Example:

ABC Ltd. purchased a machine worth Rs. 1200000, whose salvage value is 300000. The machine can produce 100 units of a product per hour. If the whole useful life of the machine is 40000 hours, calculate the depreciation for that annual year in which it was used for 4000 hours.

Solution:

Depreciation Expense=(Number of Units Produced/Life of Asset in Units)×(Asset Cost-Salvage Value)

Number of Units Produced=Number of Hours of Usage×Units Produced Per Hour

Number of Units Produced=4000×100

Number of Units Produced=400000

Life of Asset in Units=Total Life in Hours×Units Produced Per Hour

Life of Asset in Units=40000×100

Life of Asset in Units=4000000

Depreciation Expense=(400000/4000000)×(1200000-300000)

Depreciation Expense=Rs. 90000

Annuity Method

This method of depreciation is based on the concept of opportunity cost. Here the depreciation is computed in regards with the interest which the amount used to purchase the asset would have generated if it was invested somewhere else.

Formula:

To find out the annuity depreciation:![]()

Where C is the acquisition cost;

i is the interest rate (in decimal);

n is the estimated life in years.

Example:

XYZ Ltd. purchases a machine worth Rs. 700000, which has an estimated life of 7 years. If this sum were invested somewhere else, it would have earned the firm interest of 10% p.a. Calculate the annuity depreciation.

Solution:

Annuity Depreciation=[C×i×(1+i)^n]/[(1+i)^n-1]

Annuity Depreciation=[700000×(0.1)×{1+(0.1)}^7]/[{1+(0.1)}^7-1]

Annuity Depreciation=136410.2/0.9487

Annuity Depreciation=Rs. 143786.44

Sinking Fund Method

Under the sinking fund method, a company needs to maintain a sinking fund account whenever it purchases a new asset. Every year a fixed amount is charged as depreciation (on P&L A/c). The same fund is withdrawn from the profit to be accumulated in the sinking fund A/c to replace the asset in future.

The firm can even invest this fund to earn interest until the time of asset replacement.

Formula:

To calculate the sinking fund depreciation:![]()

Where C is the acquisition cost;

i is the interest rate (in decimal);

n is the estimated life in years.

Example:

RS Ltd. bought a crusher worth Rs. 780000 on March 1, 2008. It has an estimated useful life of 12 years. The company adopted the sinking fund method and invested the sinking fund in a fixed deposit scheme for 12 years to earn 8% p.a. Interest. Compute the sinking fund depreciation.

Solution:

Sinking Fund Depreciation=[(C×i)/{(1+i)^n-1}]

Sinking Fund Depreciation=[(780000×0.08)/{(1+0.08)^12-1}]

Sinking Fund Depreciation=62400/1.5182

Sinking Fund Depreciation=Rs. 41101.30

Double-Declining Balance Method

Double-declining balance method of depreciation is an accelerated form of depreciation. Here, the asset is reduced laboriously in the initial years to decrease the burden of tax and other expenses in the later years.

Formula:

To determine the annual depreciation using the double-declining balance method:![]()

Example:

ABC Ltd. bought a machine worth Rs. 600000 is depreciated @12% p.a. Find out the depreciation expense in the first year using the double-declining balance method.

Solution:

Depreciation for a Period=2×Straight Line Depreciation Rate×Book Value at Beginning

Year 1: Depreciation=2×(12/100)×600000

Depreciation=Rs. 144000

Year 2: Depreciation=2×(12/100)×(600000-144000)

Depreciation=0.24×456000

Depreciation=Rs. 109440

Year 3: Depreciation=2×(12/100)×(456000-109440)

Depreciation=0.24×346560

Depreciation=Rs. 83174.4

Year 4: Depreciation=2×(12/100)×(346560-83174.4)

Depreciation=0.24×263385.6

Depreciation=Rs. 63212.54

Year 5: Depreciation=2×(12/100)×(346560-83174.4)

Depreciation=0.24×263385.6

Depreciation=Rs. 63212.54

Sum of the Years’ Digits Method

Another form of accelerated depreciation is the sum of the digits method. The depreciation expense is computed as the percentage of the remaining life of the asset to the total of all the years of its estimated life concerning the present book value of the asset.

Formula:

To compute the depreciation expense through the sum of the years’ digits method:![]()

Where residual value is the estimated scrap value.

Example:

XYZ Ltd. bought a filtration machine worth Rs. 370000 and its scrap value was estimated as Rs. 40000. If the useful life of the machine was determined for five years, figure out the depreciation expense.

Solution:

Depreciation Expense=(Remaining Life/Sum of Years)×(Beginning Book Value-Residual Value)

Year 1: Depreciation Expense=[5/(5+4+3+2+1)]×(370000-40000)

Depreciation Expense=Rs. 110000

Year 2: Depreciation Expense=[4/(4+3+2+1)]×(370000-110000-40000)

Depreciation Expense=(2/5)×(260000-40000)

Depreciation Expense=Rs. 88000

Year 3: Depreciation Expense=[3/(3+2+1)]×(260000-88000-40000)

Depreciation Expense=(1/2)×(172000-40000)

Depreciation Expense=Rs. 66000

Year 4: Depreciation Expense=[2/(2+1)]×(172000-66000-40000)

Depreciation Expense=(2/3)×(106000-40000)

Depreciation Expense=Rs. 44000

Year 5: Depreciation Expense=[1/1)]×(106000-44000-40000)

Depreciation Expense=Rs. 22000

The organization can opt for one or more methods of depreciation, according to its accounting policy, business type, strategic approach and the asset type.

Car Depreciation Calculator says

I reviewed your blog it’s really good. thanks a lot for the information about this blog. I want more information