Definition: Opportunity cost refers to the value of the other choice sacrificed while choosing a better or suitable alternative. It is also termed as alternative cost. There are limited resources or limited spending capacity and to direct these resources in the direction of deriving maximum satisfaction, we find out the opportunity cost.

Example: Let us now understand the concept of opportunity cost with the following illustration:

A person saves 5000/- per month, how can he utilise it to derive maximum satisfaction?

He can either buy an i-phone worth 30000/- on instalment at 0% interest. Thus, paying EMI out of his savings for six months.

The other option is that he may invest the money in mutual funds by contribution 5000/- each month as a Systematic Investment Plan (SIP).

At the end of the sixth month, his investment value appraises by 1800/-. He may withdraw the amount which is 31800/- and buy an i-phone with 30000/-. Now he can use additional 1800/- for some other purpose.

In any case, the person can opt for only one option, according to his priority and need.

Content: Opportunity Cost

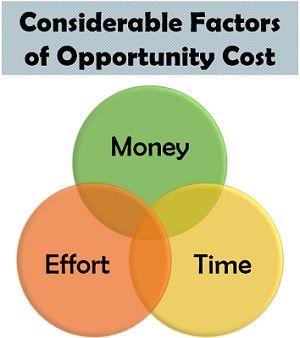

Considerable Factors of Opportunity Cost

While investing money, time and effort, the person has to look for the option of giving the highest possible return on investment. Thus, giving up the value he would have yielded from the second-best alternative. The monetary value invested in any opportunity must provide an adequate return to the investor. Therefore, money is an essential factor involved in opportunity cost.

The monetary value invested in any opportunity must provide an adequate return to the investor. Therefore, money is an essential factor involved in opportunity cost.

Time is a valuable asset, and once invested, cannot be reversed. The benefit which a particular opportunity provides over the period must be the highest as compared to the other alternatives.

The energy invested in the chosen alternative is equally essential and requires a lot of skills and evaluation.

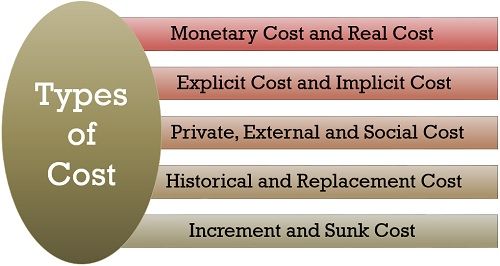

Types of Cost

Cost means the exchange of a specific value to gain something.

Thus, the cost is a crucial part of opportunity cost and to understand the different types of expenses associated with the opportunity cost are described below:

Monetary Cost and Real Cost

Monetary cost refers to the various expenses incurred on the purchase or creation of goods or services. Whereas, the real cost is the expense made on all the resources together with the value of the alternatives which are not chosen.

Explicit Cost and Implicit Cost

An explicit cost is an exact amount spent on acquiring goods or services. It is used for accounting purpose. On the contrary, an implicit cost is a cost which is unseen with naked eyes, i.e. the value which would have been generated if the amount is spent on another alternative.

Private, External and Social Cost

Private cost is the expense incurred in the production of goods by business firms or industries. However, an external cost is the cost that society has to bear as an outcome of the private cost. For example; industrial pollution The social cost comprises both; the private cost as well as the external cost. It is the total cost borne by business firms and society.

Historical and Replacement Cost

Historical cost is the expense incurred on acquiring an asset in the past. Whereas, replacement cost is the expense of replacing the old asset with a new one.

Increment and Sunk Cost

Increment cost is the additional amount spent for the enhancement of the existing assets or opting for a new product line, changing the obsolete assets, etc. Contradictory to this, a sunk cost is the past expense made on the assets which become outdated over the period and cannot be revived or altered.

Significance of Opportunity Cost

Opportunity cost is an inevitable part of any business activity since it triggers the process of decision making.

The primary reasons for which any business needs to determine the opportunity cost are as follows:

- Base for Decision Making: Opportunity cost provides support for making an appropriate choice while selecting one out of many available alternatives.

- Price Determination: Based on the expenses incurred in the procurement of any goods or services along with the cost which may have been committed to acquiring alternative options, the price of the products or services is determined.

- Efficient Resource Allocation: It helps in investing the resources in the right opportunity by analysing the opportunity cost of all the alternatives.

- Remuneration Decisions: In organisations, it played a crucial role in determining the expected value an employee would create for the organisation. It is acquired after his/her comparison to the other alternatives available, and thus, personnel remuneration is considered accordingly.

Related Terminology

- Alternatives: The various options available in front of a person to make the right choice is called alternatives.

- Trade-off: Trade-off signifies the compromise of single or multiple things one makes for acquiring the desired product or service.

- Law of Increased Opportunity Cost: The law of increased opportunity cost explains that as the production increases, the opportunity cost arises for producing the next unit. Thus, expanding the company’s opportunity cost.

Conclusion

Options are unlimited, but all of those may not fulfil the investing criteria of a person. Therefore, a decision for selecting the most appropriate opportunity out of all, depending upon the requirements, priorities and taste of the person, is necessary.

Leave a Reply