Definition: A line of credit can be seen as a revolving account opened with the bank or other financial institution. It allows the borrower (customer) to withdraw the required amount as a loan, partially or wholly, up to the given maximum limit mentioned in the agreement. The principal feature of a line of credit is that the interest is chargeable only on the sum withdrawn by the borrower and not on the total credit limit.

Another essential feature is that the rate of interest on the line of credit keeps on varying from time to time. However, the repayment of the principal amount is quite flexible and lenient as compared to the other loans.

Content: Line of Credit (LOC)

Example

Mr A plans to renovate his house. His interior designer Mrs B proposed a budget of $10K for the purpose and informed that the expenses might slightly exceed than the proposal. Mr A approached his bank and applied for a line of credit worth $12K.

With a good credit score and sound financial history, the bank agreed to provide a line of credit to him with a maximum limit of $12K. The agreement was signed by both the parties mentioning a rate of interest of 10% on the sum withdrawn.

Mr A initially withdrew $2K. Thus interest was chargeable only on this sum which was paid each month by him. After some time, he again departs $6K; now the benefit is payable on an aggregate of $8K.

Unlike other loans, the bank won’t charge interest on complete $12K, until and unless Mr A wholly withdraws the sum.

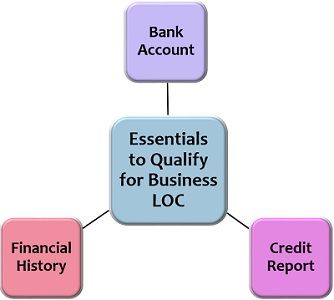

Essentials to Qualify for Line of Credit for a Small Business

A business line of credit is quite common among small business entities which struggle to meet their day to day expenses on the bad times. Let us quickly go through the following requirements for availing a business LOC:

Bank Account: The lending institution requires the bank account information of the borrower or the business entity. This is to analyze the dues, history of bounced cheques, average balance, monthly cash flow, etc. to find out whether the firm will be able to repay the loan or not.

Credit Score or Credit Report: Along with the credit score, the lending institution also requires the credit report of the business in case of a business LOC. These reports are prepared by the credit bureaus by tracking the loan application made by the firms and their approval and rejection status.

The financial institutions use this information to find out the creditworthiness of the individual or the firm before sanctioning a LOC.

Financial History: Usually, the lending institutions allow a LOC only to the firms which can present the financial reports and statements of two or more years. These include bank statements, income tax return, balance sheet, etc.

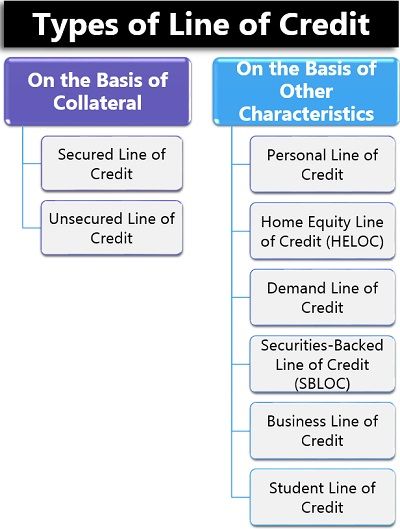

Types of Line of Credit

A line of credit is another debt instrument offered by the financial institutions to facilitate its customers in various ways. They are categorized based on two features; one is the collateral or security and the other is the unique characteristics. Let us understand each category in detail below:

On the Basis of Collateral

Based on the need for security or collateral kept or mortgaged by the borrower with the lending institution, the line of credit can be classified as follows:

Secured Line of Credit: A secured LOC essentially requires collateral or security. These include savings account balance, certificate of deposit, property or other valuables to be mortgaged with the lending institution for availing the loan.

The interest rates are usually low in such LOC. On failure of repayment, the borrower may even lose the collateral kept with the lender.

Unsecured Line of Credit: An unsecured LOC does not require any such collateral from the borrower, and therefore its rate of interest is comparatively high.

On the Basis of Other Characteristics

Each LOC holds some features to suit the requirement of the borrower. Based on these characteristics, a LOC can be divided into the following types:

Personal Line of Credit: A personal LOC is an unsecured form of LOC which is taken by an individual to meet marriage expenses, travel expenses, overdraft protection, etc.

Home Equity Line of Credit (HELOC): HELOC is a secured LOC where an individual mortgages his/her house as collateral and can avail a LOC limit of up to 75-80% of the market value of the house.

Demand Line of Credit: In this type of LOC, the lender can ask for repayment anytime as per its requirement. Also, the borrower is supposed to pay the amount on the demand of the lender. This can either be secured or unsecured LOC.

Securities-Backed Line of Credit (SBLOC): This is a special secured demand LOC. Here, the lender can avail a limit between 50-95% of the securities (kept as collateral) and the borrower cannot use this amount for trading in the stock market. The lender can demand repayment if the value of the borrower’s portfolio falls below the specified LOC limit.

Business Line of Credit: The LOC, which is taken by the business entities to fulfil their working capital requirement, is known as a Business LOC. The lender evaluates and analyzes the financial position, profitability, credit report, market value, etc. of the firm before allowing the LOC.

Student Line of Credit: The student LOC is the credit taken by the students to meet their post-secondary education expenses.Such as hostel fees, food, books and stationery, transportation and tuition fees.

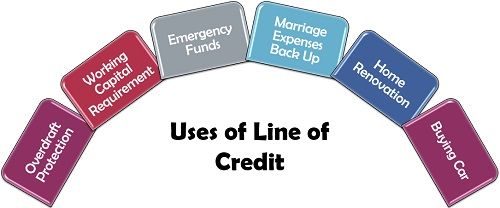

Uses of Line of Credit

There are some ways in which a person or a firm can utilize the line of credit effectively to fulfil their financial requirements. Some of the benefits are given below:

- Overdraft Protection: Linking the line of credit to the bank account protects the borrower from massive overdraft fee in case of insufficient balance in the account at the time of cheque clearance, ATM withdrawal, wire transfer, etc.

- Working Capital Requirement: It is difficult to estimate the requirement of working capital for a new startup business. Thus, problems, like meeting up day to day expenses on doom days or investing a lump sum on raw material for big credit orders, can be solved through LOC.

- Emergency Funds: At the time of unexpected situations like a medical emergency, personal LOC can prove to be a lifesaver.

- Marriage Expenses Back-Up: Line of credit is used as a backup option for the excess money required at the time marriage at a low rate of interest. It is fruitful, since the marriage expenses are usually uncertain, and standard loans would cost much higher to the borrower.

- Home Renovation: A person can use the LOC amount for renovating the house by withdrawing as per the requirement and paying interest only on the borrowed amount.

- Buying Car: A line of credit also facilitates the buying of a car or other durable goods on credit, just like a credit card does.

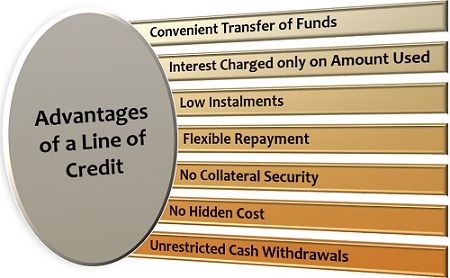

Advantages of a Line of Credit

Unlike other debt instruments, a LOC provides multiple benefits to the borrower. Some of these are stated below:

- Convenient Transfer of Funds: In a line of credit, funds can be easily transferred to the bank account and accessible conveniently through debit cards.

- Interest Charged only on Amount Used: The interest on a line of credit is low as compared to other credit options. It is because, unlike other loans, the borrower does not pay interest on the full amount allowed.

- Low Instalments: The repayment of a LOC can be made through small, easy monthly instalments (EMI). If the borrower lacks money, he/she can pay only the interest amount that month.

- Flexible Repayment: Along with the flexibility of withdrawals, LOC also provides easy payback options through instalments.

- No Collateral Security: Unsecured LOC facilitates the borrower to avail the loan without any collateral or security.

- No Hidden Cost: LOC allows for the frequent withdrawal of funds, without any additional charge associated with it.

- Unrestricted Cash Withdrawals: The borrower, i.e. the individual or the firm can withdraw the sum up to the limit of LOC allowed, anytime; and thus, can be secured for the rainy days or emergencies.

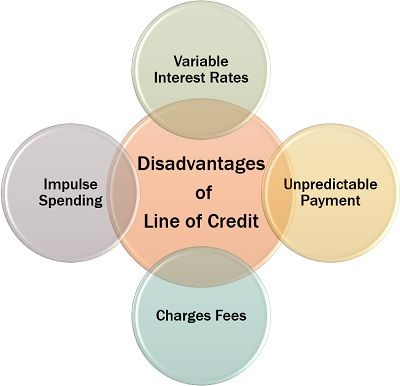

Disadvantages of Line of Credit

A LOC also holds some drawbacks, which makes it unsuitable at times. These are as follows:

- Variable Interest Rates: The rate of interest for a line of credit keeps on varying with the change in monetary policy as per the guidelines of the central bank. These fluctuating interest rates may impose excess liability on the borrower.

- Unpredictable Payment: Frequent withdrawals sometimes lead to losing track of debt, and the repayment amount at the end of the month can be unpredictable by the borrower.

- Charges Fees: The lending institution charges various fees such as the monthly service fee and the establishment fee for the LOC, which may lead to a financial burden on the borrower.

- Impulse Spending: The borrower may misuse a line of credit for making unnecessary expenditure which is challenging to be repaid, and therefore landing into trouble.

Conclusion

Eventually, a line of credit is a revolving credit instrument which ultimately creates a financial burden on the borrower. Though, it is an ideal option for the ones, who have the paying capacity or regular income and even for the small business enterprises.

Variable Home Loan Rates says

Thanks for making a blog about line of credit. I really how well written this article is really helpful.