Definition: Job costing or Job Order Costing is a costing method wherein production is measured in terms of Jobs (customer orders). Moreover, it is a system of costing for customer-specific manufacturing.

The selection of this costing method purely depends on the manufacturing process involved. This is because customized orders require a different amount of input.

Here, the production takes place based on the orders received and not for stock. Like other systems, the products pass through various processes and workstations. For Example, customization of furniture and outfits as per client requirements.

Every job is different from one another and considered as a separate entity during costing. So, the unit cost for each job must also be determined separately.

The record of each job is maintained separately, as the cost involved in the production varies.

All costs relating to the job must be recorded on a Job Cost Sheet or Job Cost Card. It is vital in job order costing as it provides information about the cost of material issued and labour costs paid.

Since the orders are based on customer requirements, there are no standard production units. Therefore, batch costing is not applicable here.

In comparison to other costing methods, it is quite expensive due to customization. Manufacturers must opt for it in circumstances where it is really required.

Content: Job Costing

- Objectives

- Formula

- Example

- Features

- Applicability

- Pre-requisites

- Elements

- How to calculate Job Costing?

- Advantages and Disadvantages

- Job Costing Systems

- Job Costing v/s Process Costing

- Final

Objectives

Identifying profit or loss from each job is the main goal of job order costing. Besides, it is used to provide customer quotations for the requested jobs.

The objectives of job costing are to:

- Verify the price quotations

- Recognize the profitable jobs

- Control costs and minimizes the losses

- Determine the cost of production per order

- Ascertain efficiency by comparing the actual cost with estimates

Formula

The formula given below calculates the Total Job Costs.

Example

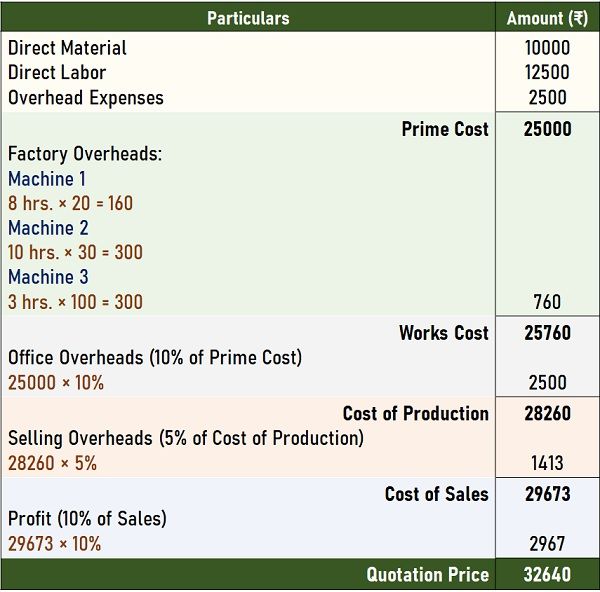

Prepare a quotation for a job in the job cost sheet with the requirements listed below:

- Direct Material Cost – Rs.10000/-

- Direct Labour Cost – Rs.12500/-

- Overhead Expenses – Rs. 2500/-

The job will pass through three machines. It will take 8 hours in Machine 1, 10 hours in Machine 2 and 3 hours in Machine 3. And the machine hour rate is Rs.20/-, Rs.30/- and Rs.100/- respectively.

Overhead apportionment will be:

- Office overheads – 10% of Prime Cost

- Selling overheads – 5% of the Cost of Production

Solution:

Features

The points given below explain the differentiated features of Job Order Costing:

- Customer-Centric: Here, the production is based on the orders placed by the customers.

- Job Characteristics: Jobs are as per customers’ requirements. Therefore, each job has different characteristics.

- Job Duration: The duration of jobs may differ, i.e. short or long-term (beyond one year). Mostly, it is for a shorter duration.

- Prime Cost: In this method, only the computation of prime cost takes place. However, the overhead costs are split between jobs.

- Uniqueness: Every job is unique, i.e. it differs from each other in terms of nature and inputs.

- Job Number: A specific number is assigned to each order, referred to as the Job Number.

Applicability of Job Costing

This method applies to industries with unique jobs. Some of such industries are listed below:

- Printing Press

- Automobile Garage

- Repair Workshops

- Ship Building

- Foundry (Casting related services)

Pre-requisites for Job Order Costing

The documents required during the cost calculation are:

- Manufacturing Order: It is basically a work order issued to the manufacturing department. It specifies the details about the production, which further takes the form of a job.

- Cost Sheet: Another essential document is a cost sheet. All the relevant costs regarding the jobs will be recorded on this sheet. Moreover, manufacturers can also combine a manufacturing order and cost sheet.

- Others: The other documents or sheets which are a part of the control mechanism are also important. Like – Tool Orders, Time Tickets and Inspection Orders.

Elements

The total production cost is ascertained based on four major elements:

- Direct Material Cost: The cost incurred in acquiring the material to be used in production.

- Direct Wages Cost: The amount paid to the forepersons to complete the job.

- Manufacturing Overheads: It refers to the cost other than direct cost, i.e. material and labour. For Example, machine hour rate and office expenses.

How to calculate Job Costing?

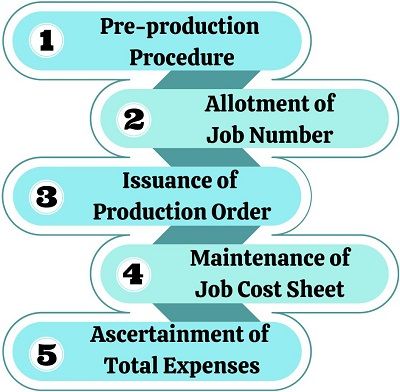

Step 1: Pre-production Procedure

The procedure begins with the preparation of the Estimation Sheet. For this purpose, the job requested by the customer is critically examined.

After making cost estimates by the design & estimate department and the costing department, the quotation is given to the customer.

Step 2: Allotment of Job Number

Manufacturers allocate a separate job number to all the orders received from the customers. It will be the identity of the job until the completion of the production process. Job numbers are also vital from the accounting and administrative viewpoint.

Step 3: Issuance of Production Order

The production planning department issues a production order to the factory to manufacture a job. It is issued to the foreman of the concerned department and the costing department.

Step 4: Maintenance of Job Cost Sheet

For each order, a different cost sheet is created. It is maintained as per the allotted job number specifying relevant costs and elements. Also, it determines the profit or loss from each job.

Step 5: Ascertainment of Total Expenses

On completion of the job, add overhead charges to determine total expenditure.

Advantages and Disadvantages

The benefits of job costing are as follows:

- Determines the amount of profit generated from each job.

- It helps in making cost estimates for jobs of similar nature.

- It provides in-depth knowledge about the inputs at each job.

- With job costing, manufacturers can optimize their production efficiency.

- Manufacturers can quickly identify the bottlenecks and rectify them at their origin.

The disadvantages of using job costing are:

- It is an expensive costing method.

- The chances of errors increase due to the involvement of major clerical work.

- For efficient working, it requires a high-end control system.

- Cannot avail the advantages of the historical cost.

Job Costing Systems

The manufacturers produce multiple products at the plant. Moreover, the production volume is also high, making it a complex procedure.

To reduce the complexity and ease the clerical work, manufacturers use Job Costing System. This is the software specially designed for the cost estimation of multiple jobs at the manufacturing unit.

Job Costing v/s Process Costing

Job costing differs from process costing in the following ways:

| Basis | Job Costing | Process Costing |

|---|---|---|

| Purpose | It is carried out for a specific products | It is performed for homogenous products |

| Identity | Each job has an individual identity | Due to the continuous production flow, products cannot be identified individually |

| Cost Aggregation | Costs are disaggregated | Here, costs are aggregated |

| Cost Computation | Post the completion of the concerned job | Cost calculation is done on completion of the cost period |

| Managerial Control | It requires effective control as each job is different | Less supervision is required as the production processes are standardized |

| Volume | Suitable for the production at small scale | Suitable for large-scale production |

| Number of Products | Production of multiple products takes place | Usually, a single product is produced |

Final Words

It is the method for ascertaining the cost and profit for customer-specific orders called jobs. These estimations appear on the job cost card pervasively for all jobs. Besides, this method is suitable for specific circumstances as it is complex and costly.

Leave a Reply