Definition: Tax holiday refers to the temporary period when the government reduces or provides complete relaxation on tax payable on a specific range of products, income or property. It generally lasts for a day, or two days or a week. Some of the most prominent kinds of taxes included under this holiday initiative are sales tax, property tax, income tax and GST (Goods and Services Tax).

In developing nations, tax holidays play a significant role in drawing the attention of overseas companies for making the foreign investment. It ultimately contributes to the country’s growth and development by generating multiple employment opportunities.

Content: Tax Holiday

Objective of Tax Holiday

A tax holiday can be implemented to benefit the individuals (consumers) or the business entities to serve a specific purpose of the government or taxing authority.

This can either be to support people with low income or to attract more foreign companies to invest through offshoring, outsourcing or FDIs.

Sales Tax Holiday

One of the most common out of all tax holidays is of sales tax. The sales tax holiday is a definite period for which the consumer need not pay any sales tax on the listed products.

Objective of Sales Tax Holiday

The principal purpose of the sales tax holiday was to relieve people from the tax payments on specified products during a specific period. It can be for a day or two or the whole week.

The ‘Back-to-school’ Sales Tax Holiday allows tax relaxation on the school supplies and clothing at the time of school re-opening. This makes schooling affordable for the parents belonging to low or middle-income groups.

Categories of Sales Tax Holidays

The products considered for relaxation during sales tax holiday usually falls under the following heads:

- Back-to-school Supplies: School clothes, backpacks, footwear, stationery, books, computers and related supplies.

- Clothing and Footwear: Basic clothes and footwear, excluding all kind of clothing accessories.

- Energy-efficient Home Appliances: Appliances for domestic use, which qualify as power-saving items, i.e., Energy Star products.

- Severe Weather Preparedness Supplies: Items used in emergencies such as fire extinguisher, fire alarm, hurricane shelters, portable generators, etc.

- Second Amendment: Hunting equipment and supplies, firearms and ammunition are majorly exempted.

Example

In Alabama, there were sales tax holidays from July 19, 2019, to July 21, 2019, it was weekend, and therefore, people rushed out to grab the opportunity.

The computers, school computer supplies and software, were exempted from sales tax up to a single purchase amounting to or less than $750.

The school supplies, school art and instructional material, were allowed as tax-free up to a limit of $50.

The books were also relieved from sales tax if the MRP is less than or equal to $30 of each book.

Also, the clothing and footwear were tax-free, up to a sales price of $100.

Benefits of Tax Holiday

A particular objective always backs tax holidays. It is not only beneficial for the government but also for the whole nation.

Some of its significant advantages are identified below:

- Tax Relaxation on School Supplies: Sales tax holiday acquaint parents to purchase school supplies and clothing of their children at a tax-free price.

- Sales Tax Break on Other Products: Other than school items, it also provides a tax benefit on some essential products like clothing, footwear and home appliances.

- Facilitates Foreign Investment: Tax holiday acts as a strategy to upraise foreign investment which ultimately leads to employment generation in the country.

- Attracts Offshoring Companies: The foreign companies find the countries with property or income tax holidays more fascinating, for offshoring their business operations.

- Promote Economic Activities: Thus, when the retailers and consumers get benefited through such relaxation, there is a boost in trading and economic activities.

- Initiates Growth: With the increase in foreign investment and economic activities, the nation marks consistent growth and development.

- Maximizes Long-term Tax Revenue: In the long run, the companies get a breakthrough for growing their business which ultimately generates a higher taxable revenue in future.

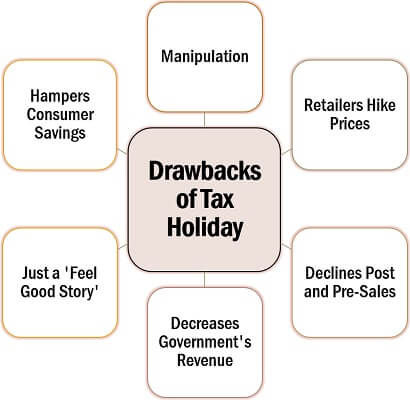

Drawbacks of Tax Holiday

While discussing the cons of the tax holiday, we notice that the purpose of this exemption is not fulfilled to the desired extent.

Some of the related disadvantages of tax holiday are as follows:

- Manipulation: The tax holidays lead to manipulation by some retailers who get into the habit of avoiding tax payments unethically.

- Retailers Hike Prices: During the tax holidays, the retailer takes undue advantage by increasing the sales price of the products.

- Declines Post and Pre-Sales: People usually purchase in bulk during this period and thus, the pre and post-sales fall gradually.

- Decreases Government’s Revenue: Tax holidays directly hit the government’s earning by declining the tax collected within the specific period.

- Just a ‘Feel Good Story’: The overall amount saved by the consumers is not that high since retailers usually increase MRP. Therefore, tax holiday only sounds useful rather than being a worthful relaxation.

- Hampers Consumer Savings: Many people with low income, withdraw their savings to make purchases during the tax holidays, which ultimately declines their investments.

Conclusion

On thoroughly analyzing the concept of tax holidays, we found that the ones who benefit the most out of it are the retailers, rather than the consumers.

On the one hand, the retailers mark high sales during this period. And, on the other hand, they apply various manipulative tactics like price rise, tax avoidance, etc. to make more gains.

Whereas, the consumers mostly land up, saving a small portion of their income, and the government sacrifices a remarkable share of the tax revenue.

Leave a Reply