Definition: Pricing method can be seen as the process of ascertaining the value of a product or service at which the manufacturer is willing to sell it in the market. The cost, market competition and demand are the three significant factors which influence a product’s price.

Pricing of products or services is a crucial decision-making strategy of the firm. Since it has a long-lasting impact over the business and its existence. Hence, a suitable pricing method needs to be adopted for this purpose.

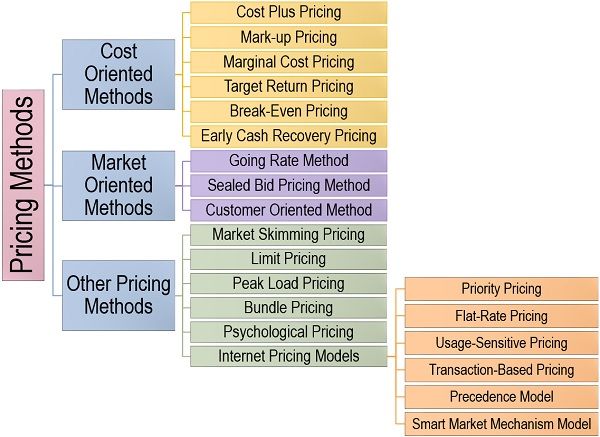

Content: Pricing Methods

We will further discuss the various models developed over the years for price determination, based on cost, demand and market determinants:

Cost-Oriented Methods

These are the traditional methods of product pricing. The major factors which influence the product price are the fixed cost, variable cost other overheads incurred in manufacturing the products.

Let us now go through the different cost-oriented pricing models below:

Cost Plus Pricing

Cost-plus pricing is one of the simplest ways of price determination. A certain percentage of cost is added as a profit margin to the value of the product to acquire the selling price.

Mark-up Pricing

It is a form of cost-plus pricing, but here the profit margin is presented as a percentage of expected return on sales. The formula for mark-up pricing is:

![]()

Example: If the unit cost of manufacturing a bag is ₹100 and the expected return on sales is 25%, determine the mark-up price.

Mark-up Price=Unit Cost (Fixed+Variable)/(1-Percentage of Expected Return on Sales)

Mark-up Price=100/1-25%

Mark-up Price=₹133.33

Marginal Cost Pricing

The primary aim of the company adopting this pricing method is to meet its marginal cost and overheads. The marginal costing method is suitable for entering the industries which are dominated by giant players, posing a fierce competition for the organization to sustain in the business.

Target Return Pricing

The pricing objective in target return method is to attain a certain level of ROI (Return on Investment). The formula for determining the target return price is:

![]()

To find out the desired return on investment:

![]()

Example: If the total business investment is ₹80000, the desired ROI is 25%; the total cost incurred is ₹30000 and the expected sales are 5000 units, determine the target return price.

Target Return Price=(Total Cost+Desired Return on Investment)/Total Sales in Units

Desired Return on Investment=Desired %ROI×Total Investment Value

Desired Return on Investment=25%×80000

Desired Return on Investment=₹20000

Target Return Price=(30000+20000)/5000

Target Return Price=₹10

Break-Even Pricing

This method is similar to break-even analysis, here the company needs to price the products such that it generates profit after recovering the fixed and variable costs. The selling price should be equal to or more than the break-even price (the point at which the sales revenue matches the cost of goods sold).

The formula for ascertaining the break-even limit is:

![]()

For instance, a company incurs ₹500000 as fixed cost and ₹25 as a variable cost. If the selling price is Rs.75, find out the break-even limit.

Break-Even Limit=Total Fixed Cost/(Selling Price Per Unit-Variable Cost Per Unit)

Break-Even Limit=500000/(75-25)

Break-Even Limit=10000 Units

Thus, the organization either needs to sell more than 10000 units or price the product higher than Rs.75 to earn a profit.

Early Cash Recovery Pricing

When it comes to rapidly growing technological products or the ones with a short life cycle, the cost needs to recover as early as possible. This method is very similar to target return pricing; the only difference is that it considers a high value of return on investment owing to a short recovery period.

Market-Oriented Methods

In a highly competitive market, the company cannot survive with cost-oriented pricing. Hence, it needs to price its products according to the market demand and competitor’s pricing strategy.

To understand the three primary market-oriented models of pricing, read below:

Going Rate Method

‘Follow the crowd’ method is based on market competition, where the company price its product similar to the competitor’s product price. If the market leader reduces the price of its product, the organization also needs to decrease its product price, even if the latter’s cost of production is high.

Sealed Bid Pricing Method

When it comes to industrial marketing or government projects, the supplier needs to bid specific product price, which he/she assumes to be the lowest, in a sealed quotation.

In other words, the organization needs to fill a tender, which indicates its costing and competitiveness. The pricing should be done smartly by estimating the profit margin at different price levels and enclosing the most competitive price.

Customer-Oriented Method

This method is also called perceived value pricing. It is demand-based pricing where the company determines the product price on value perception in terms of consumer demand for the particular goods or service. This perceived value is based on the following constituents:

- Acquisition Value: The acquisition value is based on the opportunity cost of a product or service, which is estimated through the comparison of the perceived benefit and the perceived sacrifice.

- Transaction Value: The comparison of the customer’s reference price (assumed or quoted price) with the actual price paid for the product or service is the transaction value.

The other methods to find out the perceived value are as follows:

- Direct Price Rating Method: The customers need to determine the price of products displayed to them, where each product belong to a different brand.

- Direct Perceived Value Rating: The buyers rate the different brand products on a scale of 0-100 according to their preference. The highest-rated product has the maximum perceived value.

- Economic Value to the Customer: To determine the target market segment, the companies correlate its total product cost to the consumer benefits of the current product.

- Diagnostic Method: The customers evaluate products of multiple brands on various parameters or attributes. Each attribute has an importance weight, and on multiplying it with the given ratings, the perceived value of each brand can be determined.

Other Pricing Methods

There are specific other methods for determining the price of a product or service, other than considering the cost or market competition as the basis. These are explained in detail below:

Market Skimming Pricing

The skimming method is usually implemented in case of speciality, luxury or innovative products.

Here, the company avails the profit opportunity in the initial stage of marketing by selling the products at a high price in a non-price-sensitive market segment. Later, the prices are dropped down gradually to sustain in the market.

Limit Pricing

This is defensive pricing strategy. The company price its products immensely low (and this price is known as entry forestalling price), to retain the monopoly in the market. It is done to discourage the entry of competitors by presenting the business as unattractive and non-profitable.

Peak Load Pricing

The peak load method is demand-based pricing, where the companies charge high prices in the peak seasons or period when the demand for the product is quite high. However, in the off-peak time or season when the demand falls, the prices are kept low.

It is applied for seasonal product pricing, airline travel pricing, tourism package pricing, etc.

Bundle Pricing

Bundling refers to compiling of two or more products together and selling it as a single product. The company prices the complete bundle at a single price known as the offer price.

An organization can either opt for pure bundling, where the products in a bunch are strictly not available individually. Or it may go for a mixed bundling, i.e. the products in a bundle can be sold separately but at a higher price.

Psychological Pricing

This pricing method aims to influence the consumers mentally by posing a low product price.

Here, the product is priced slightly less than a round figure, for instance: a product is priced at ₹99 instead of ₹100 or 1.98$ instead of 2$. This makes the consumer assume that the product price lies within the range of ₹100 or 2$ and therefore it is worth buying.

Internet Pricing Models

Internet is a modern communication platform and therefore, provides vast scope for carrying out marketing activities. The different pricing methods for internet services (as a product) are as follows:

Priority Pricing: The consumer’s priority for service quality determines the price of internet services; thus, the price increases with the quality of internet service.

Flat-Rate Pricing: The consumer is charged a fixed amount for availing the internet services for a defined period irrespective of the sage.

Usage-Sensitive Pricing: The utility tariff is divided into two sections, the provider first charges for the service connection and then for the usage in terms of price per unit (bit).

Transaction-Based Pricing: Here, the price is first charged for service connection and then each transaction is separately chargeable.

Precedence Model: The pricing here, is based on the security provided to the existing customers by setting up the priority of different applications. Data packets are formed based on network preference and are given different precedence numbers. In case of congestion, the packets are sent in the sequence of their assigned precedence numbers.

Smart Market Mechanism Model: This model is purely dependent on network congestion. It functions through a dynamic bidding system where the bit price fluctuates with the level of congestion or traffic in the network. The bidder with the highest bit or unit price wins the deal.

Every business organization has a different objective; not all the companies aim at profit-making. Some may look forward to capturing the market and others may focus on long term existence.

Thus, these organizational goals determine the pricing methods to some extent. However, the prevailing market trends or industry type also influence these decisions massively.

Leave a Reply