Definition: Capital structure refers to an arrangement of the different components of business funds, i.e. shareholder’s funds and borrowed funds in proper proportion. A business organization utilizes the funds for meeting the everyday expenses and also for budgeting high-end future projects.

Computation of capital structure involves a lot of analytical thinking and strategical approach.

The calculation consists of different ratios and formulae like the cost of capital, the weighted average cost of capital, debt to equity ratio, cost of equity, etc.

Content: Capital Structure

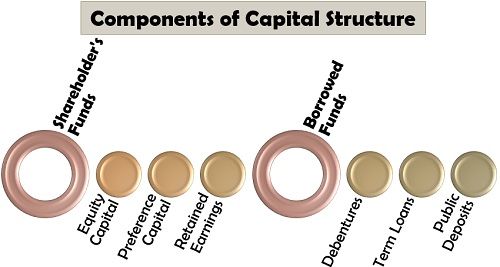

Components of Capital Structure

The capital structure of the company is nothing but taking decision-related to the acquisition of funds from various sources and composition of debts and equity.

Followings are the multiple sources of funds which the company takes into consideration while determining its capital structure:

Shareholder’s Funds

The owner’s funds refer to generating capital by issuing new shares or utilizing the retained earnings to meet up the company’s financial requirement. However, it is an expensive means of acquiring funds. The three sources of capital acquisition through shareholder’s funds are as follows:

- Equity Capital: The new shares are issued to the equity shareholders who enjoy the ownership of the company are liable to get dividends in proportion to the profits earned by the company. They are also exposed to the risk of loss associated with the company.

- Preference Capital: The preference shareholders enjoy a fixed rate of dividends along with preferential rights of receiving the return on capital in case of the company’s liquidation, over the equity shareholders. However, they have limited rights of voting and control over the company.

- Retained Earnings: The company sometimes utilize the funds available with it as retained earnings accumulated by keeping aside some part of the profit for business growth and expansion.

Borrowed Funds

The capital which is acquired in the form of loans from the external sources is known as borrowed funds. These are external liabilities of the firm, which leads to the payment of interests at a fixed rate. However, there is a tax deduction on such borrowings; it creates a burden on the company. Following are the various types of borrowed funds:

- Debentures: It is a debt instrument which the companies and the government issue to the public. Though the rate of interest is quite high on debentures, they are not by any collateral or security.

- Term Loans: The fund acquired by the company from the bank at a floating or fixed rate of interest is known as a term loan. This is an appropriate source of fund for the companies which have a good and strong financial position.

- Public Deposits: The management invite public through advertisements to create deposits in the company. It facilitates meeting up the medium or long term financial needs of the company, such as working capital requirements and enjoy a fixed rate of interest on it.

Factors Determining Capital Structure

The business is affected by its internal and external environment. There are multiple related factors which affect capital structure decisions:

Nature of Business: The form of market structure, the company, is operating into, determines its capital structure. For instance, a business functioning monopolistic competition market where profit is low, it must prefer shareholder’s capital.

Cost of Capital: The company must prefer the funds which have a low cost of capital so that the shareholder’s earnings can be increased.

Debt-Equity Ratio: Having a sound or low debt-equity ratio is the aim of the management. This is because debt is a liability but acts as a cheap source of funds; however, equity is the giving away of business ownership and more expensive source of fund.

EBIT-EPS Analysis: The management can prepare a suitable capital structure by analysing the earnings before interest and taxes and the earning per share. If the EBIT is higher than the EPS, the company must go for sources of debts.

Size of Company: The companies which are large can go for long term borrowings and share capital since they are considered to be more reliable than the small organizations.

Risk of Cash Insolvency: The company also analyzes its risk-taking ability and its liquidity position while selecting a particular source of fund. High debts may result in the burden of paying high fixed interests leading to a shortage of cash in hand.

Flexibility: The management must plan a capital structure which retains its elasticity, raising funds as and when required and reducing the cost of capital at its discretion.

Financing Purpose: The another factor which should be considered is the objective or purpose for which the funds are required. Usually, for acquiring assets like machinery and plant, the company must issue debentures.

Future Provisions: Planning of capital structure is for the long term. Therefore, the company must design its capital structure such that it is in a state of acquiring funds at any time in future also.

Flotation Cost: The cost involved in issuing of new securities, i.e. registration fees, printing expenses, underwriting fees and legal fees, is termed as the flotation cost. A high flotation cost discourages companies from generating funds through shareholder’s capital.

Degree of Control: The level of control the company wants to hold over the business determines its capital structure to some extent. If it wants to retain a high degree of control, it will prefer debts over equity.

Finance Period: The capital structure is designed according to the duration for which the company requires the funds. A business having a short-term requirement will not prefer debentures; instead, it will go for other sources of borrowings like bank loans.

Regular Earnings: In the case of irregular earnings, the company avoids debts, since paying off fixed interest becomes difficult in such a situation.

Legal Requirements: The statutory provisions related to the particular source of funds plays a vital role in framing the capital structure of the company.

Risk in Variation of Earnings: The management keeps in mind the possibility of generating a low income to meet up the debts of the company while planning the capital structure.

Money Market Conditions: The company considers the conditions of the stock market while issuing new shares to acquire capital since it will be fruitful only in a bullish market.

Tax Rates: Tax rates also influence the capital structure decision. As we know, the tax deduction is allowed on interest on debts; therefore, if the high tax rates prevail, the company should go debt funds and vice-versa.

Government Policies: The lending policies of banks and other financial institutions, the government’s fiscal and monetary policies and SEBI regulations determine the borrowings of the company.

Sales Stability: If the company has a consistent sales revenue which is quite high, it will be able to pay off the fixed interest on debentures and other loans. Companies with unstable sales should opt for equity capital.

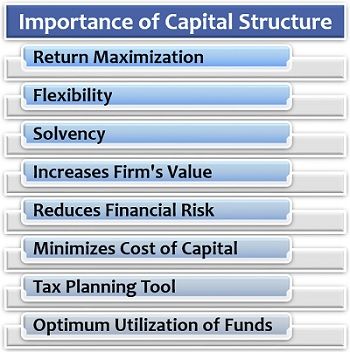

Importance of Capital Structure

Capital structuring is an essential function of the management to maintain a sound financial position of the business and fulfil the financial requirements.

To know more about its significance for the company, read below:

- Return Maximisation: A well-designed capital structure provides a scope of increasing the earnings per share, which ultimately maximizes the return for equity shareholders and recover the cost of borrowings.

- Flexibility: It also facilitates the expansion or contraction of the debt capital to suit the business strategies and conditions.

- Solvency: A sound capital structure helps to maintain liquidity in the firm because an unplanned debt capital leads to the burden of interest payments, ultimately reducing the cash in hand.

- Increases Firm’s Value: Investors prefer to put in their money in the company, which has a sound capital structure. Thus, leading to a rise in the market value of the firm’s shares and securities.

- Reduces Financial Risk: Balancing the proportion of debt and equity in the business through capital structure assist the business firms in managing and minimizing risk.

- Minimizes Cost of Capital: It provides for planning the long term debt capital of the company strategically and thus reducing the cost of capital.

- Tax Planning Tool: For the company opting for debt funds, the capital structure provides them with a benefit tax deduction and saving, decreasing the cost of borrowing.

- Optimum Utilization of Funds: A well planned, strategically designed and systematically arranged capital structure assists the companies in generating maximum output from the available funds.

Planning the Capital Structure

The company has to initially analyze its financial requirement on the short, medium and long-term basis. Taking the various factors into consideration, the management must plan an appropriate composition of debt and equity.

The management must have a logical answer to these questions: How stable the earnings of the company is? How much financial leverage the company can bear? Will the company be able to meet its debts with its profits? And many more.

Recapitalization of the Company

To optimize business operations, the company must improvize its capital structure from time to time. In other words, it has to redesign the proportion of debts and equity with the changing needs and business requirements.

The first and foremost means of recapitalization is the issuing of debts and repurchasing equity. It is a suitable option for the companies which prefer to reserve the ownership right and control with themselves. They plan to increase their debts by reducing equity.

The second option is similar to the first one; the company plans to issue debts and utilize these funds to pay off a one-time dividend to the equity shareholders. This ultimately reduces the value of the equity shares for future investors.

The third way is for unstable companies which have high debt liabilities. They prefer to repay their debts with the help of the funds acquired through issuing of new shares.

Leave a Reply