Definition: Employees’ Provident Fund (EPF) commonly known as PF, is the scheme initiated by the government with the motive of providing post-retirement financial aid to the salaried employees. It applies to most of the companies belonging to the organised sector.

In this scheme, the employer needs to register with the Employees’ Provident Fund Organisation (EPFO) which is the functioning body of Employees’ Provident Funds and Miscellaneous Provisions Act. The employer deducts a standard percentage of the employee’s monthly salary to deposit to the employee’s EPF account, and the same amount is contributed individually by the employer too.

Content: Employees’ Provident Fund (EPF)

Contribution to Employees’ Provident Fund (EPF)

An employee has to compulsorily contribute 12% of his basic wages, commission, dearness allowance, and retaining allowance towards the EPF scheme. It is deducted before crediting the salary into the employee’s account.

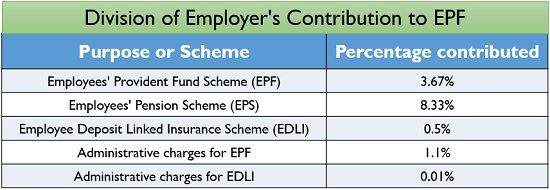

The employer’s contribution is 13.61% of the employee’s basic wages, commission, dearness allowance, and retaining allowance, which is distributed as follows:

- Employees’ Provident Fund (EPF) Scheme: The employer contributes 3.67% to the EPF scheme and gets a tax exemption for this amount. The primary purpose of the EPF scheme is to ensure employee’s pre-retirement savings.

- Employees’ Pension Scheme (EPS): A significant portion of the employer’s contribution, i.e. 8.33% is dedicated to the employees’ pension scheme. The employer receives a tax benefit on this amount.

- Employee Deposit Linked Insurance Scheme (EDLI): If the organisation has not opted for a group insurance scheme for employees, the employer needs to contribute 0.5% towards EDLI. Employee Deposit Linked Insurance Scheme provides a life insurance cover up to ₹600000 to the employees.

- Administrative charges for EPF: The employer has to bear the 1.1% as EPF administrative charges monthly.

- Administrative charges for EDLI: The employer is also liable to pay 0.01% as EDLI administrative charges if applicable.

Employees’ Provident Fund (EPF) Rules as per Employees’ Provident Funds and Miscellaneous Provisions Act, 1952:

Based on different aspects, the rules for the Employees’ Provident Fund (EPF) can be explained as follows:

Applicability:

- EPF and MP Act applies to all states in India, excluding Jammu and Kashmir.

- It is compulsory for a firm having more than 20 employees to register under EPFO.

- It is obligatory for any employee with a salary less than or equal to ₹15000.

Interest Rates:

- The Employees’ Provident Fund (EPF) interest rates for the year 2017-18 is 8.55% which has been the lowest for the last five years.

Taxation:

- The amount collected in the Employees’ Provident Fund (EPF) account and the interest earned on it are both exempted from tax only after the completion of 5 years of regular service.

- If PF is withdrawn before completion of 5 years of service, the principal amount is taxable @ 10% if PAN is submitted else @ 30%.

- The EPF amount is exempted from tax if the employee is laid off from the job before completion of 5 years due to illness.

- An employee who has given up a job due to illness is not supposed to pay tax on his EPF amount.

- The withdrawals of EPF share deposited in the National Pension Scheme (NPS) are not taxable.

- EPF withdrawals up to ₹50000 are free from Tax Deduction at Source (TDS).

Withdrawal:

- If the employee is terminated due to illness or he has been jobless for more than two months, he may withdraw his PF amount.

- Withdrawing the PF amount while moving from one job to another is considered illegal. A person can only transfer his PF account while changing position.

- EPFO has facilitated online withdrawal of PF, independent of the employer’s attestation, only if the Know Your Customer (KYC) is updated.

- If the employee changes his job and holds different PF accounts respectively with a regular contribution, it is considered as uninterrupted service.

- Partial PF withdrawals can be made for the marriage of employee, his siblings or children only after he has served for at least seven years in the organisation.

- PF amount can be entirely withdrawn for medical emergency or treatment of the employee, his dependent parents, spouse or children.

- PF can be withdrawn for repayment of home loan, but only after completion of 10 years of service.

- After five years’ regular service, PF amount can also be withdrawn for the construction of a new house or for buying a plot.

- Even for the renovation or repair of the existing house, PF amount can be withdrawn, only if the employee has served the organisation for at least five years.

- In case of need before retirement, the employee aged at least 54 years can withdraw the amount.

- PF can be withdrawn in case of premature retirement due to some disability.

- PF can also be withdrawn if the employee finds a job or settles abroad.

Pension:

- Central Government adds 1.16% to the employer’s contribution of 8.33% under EPS.

- The employee receives a pension throughout his life, and it is passed on to his spouse and two children after the employee’s demise.

- The employee is liable to get pension either after regular retirement at the age of 58 years or after voluntary retirement at the age of 50 years. The only condition for this is regular service of at least ten years.

Insurance:

- The employee gets a life insurance coverage up to ₹600000 under EDLI.

- The beneficiary (nominee) will get at least ₹250000 on employee’s death and a maximum of ₹600000.

Benefits of Employees’ Provident Fund (EPF)

Employees’ Provident Fund (EPF) has gained a lot of importance in the last few years. You must be bothering why so? Let us understand the benefits of EPF to the employees to answer this question:

- Universal Access: Due to digitalisation, EPF account can be assessed easily anytime and anywhere through Permanent Account Number (PAN).

- Tax-Free Savings Benefit: The EPF savings so accumulated in the EPF account is exempted from all taxes only if the amount is not withdrawn before five years of service. The interest earned on this account is also free from income tax.

- Insurance Benefit: The employer’s contribution of 0.5% towards EDLI, provides a life insurance coverage of ₹600000 to the employee and his family.

- Pension Benefit: Under the EPS, the employee is liable to receive a pension after retirement for his survival.

- Post-Retirement Benefit: Every month at least 24% of the employee’s basic wages + commission + dearness allowance + retaining allowance is deposited in the EPF account. It becomes a lump sum amount till the time of retirement and can be used to serve primary financial needs.

- Post-Death Benefit: In the incident of employee’s death, the beneficiary (nominee) will get the accumulated sum of the EPF account.

- Withdrawal Benefit: The Employees’ Provident Fund (EPF) amount can be withdrawn if the employee is jobless for a few months and facing financial problems.

- Additional Benefits: After a particular period of deposits in EPF account, the employee can withdraw it partially for in case of medical emergency of the employee or any family member (dependent parents, spouse or children), further education or marriage of children or siblings, repayment of house loan, purchase of property or house and repair of the present house.

Digitalisation of Employees’ Provident Fund (EPF)

The government has initiated the digitalisation of its departments to make it more simplified and easy to assess for the citizens. Employees’ Provident Fund (EPF) has also seen major digital evolutions, some of which are as follows:

- EPFO Website: The EPFO has created a website intending to redress grievances and invite suggestions. It facilitates the user to check the balance and even claim status.

- E-Sewa Web Portal: Later, EPFO launched a portal based on the UAN of the members with the objective providing an extensive range of services ranging from balance check, updating of KYC, view and download passbook, download UAN card, claim status, transfer the PF from one account to other, etc.

- EPFO Umang Mobile App: EPFO also launched a mobile app named EPFO Umang for the easy accessibility of the account by the member through a mobile phone. On this app, the user can see account status, download passbook, view as well as transfer claims, etc.

Conclusion

Employees’ Provident Fund (EPF) has been the most popular investment platform in India. It is also one of the most trusted options since the Central Government backs it.

The rate of interest on Employees’ Provident Fund (EPF) is better than that of savings account and fixed deposits. Moreover, it provides a financial backup to the salaried employees to live a quality life after retirement. EPFO’s initiative of digitalising the EPF process has made it more convenient for the members to access their savings cum investment.

Leave a Reply