Definition: Purchasing Power Parity (PPP) is a beneficial tool for determining the exchange rate. The Purchasing Power Parity among the two nation’s currencies is the nominal exchange rate at which accustomed basket of services and goods would charge the constant amount in every nation.

For instance, Suppose the basket of services and goods that charges. 100 £ in the UK, cost ₹ 1000 in India. Then, the Purchasing Power Parity is ₹ 10 per UK £ at the exchange rate of 1000 ₹ = 100 £. Thus, the market basket charges a constant amount in both nations.

The theory of purchasing power parity(PPP) is positioned on a law known as “The Law of One Price”. This law affirms that a product must sell for the constant amount in all locations, or else there would be space for profit left unused. To explain the Purchasing Power Parity theory, it is profitable to give a view on the Law of One Price as a base of Purchasing Power Parity theory and indicate its absolute and relative aspects.

Content: Purchasing Power Parity (PPP)

The Law of One Price

The Law of One Price is the basis of the Purchasing Power Parity theory. It considers that products in two distinct nations are sold for the constant prices beyond taking into account a presence of potation charges, duties, taxes and other obstacles to trade. The Law of One Price specifies the cost of a similar product, which are exchanged on competitive markets, would have a similar cost in each exchange-related country when the cost is determined in the identical currency. This assurance shall be described in the following example by means of the “iPhone” price Pi, which is sold in two competitive markets beyond any considerable trade obstacles or transaction charges.

Example

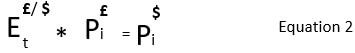

In the UK as the domestic market and in the US as a foreign market. If we say that the price of an iPhone in the UK is Pi £ and in the US is Pi $, then it is attainable to get the price of an iPhone on the United States (US) market, determined by the exchange rate Et$, like this:

The Law of One Price indicated in equation one (1) that the price of an iPhone must be identical as in the United States. If we use the second equation below, in which Et $/£ is expressing the amount of US dollars per UK pound exchange rate, e.g., 4:2 and we estimate that the price for an iPhone in the United Kingdom is 400 £ then in the united states is 800$.

If we go farther and presume that Pi £ boosted by 300£, an ingenious trader will purchase iPhone probably in the US market and trade them to the UK market. A class of operations when one generates profit from price variations in distinct nations is known as “Arbitrage”. If those arbitrages arise in the largest scales, the higher demand will increase the cost of US iPhones and will make this United States product overpriced for the Unites Kingdom requesters. Similarly, the iPhones on the United Kingdom market would get economical as a result of the increased supply of iPhones from the United States.

This evolution will continue as far as the prices concentrate at the symmetry, which is suggested by the Purchasing Power Parity amidst the United States (US) dollar and United Kingdom (UK) pound. To get from the Law of One Price to Purchasing Power Parity rather than the price of similar product such as iPhone in our example of Law of One Price, we need to use the price of the basket of services and goods which serves the price level of an economy altogether in a fixed time period.

Where,

∝ = the density of a specific product or group of products.

i = Whole economy.

Pi = Price of the product.

t = Certain period of time.

Types of Purchasing Power Parity (PPP)

Now, let us understand what is Absolute Purchasing Power Parity and Relative Purchasing Power Parity?

1. Absolute Purchasing Power Parity (APPP)

As seen, above it is understood that Absolute Purchasing Power Parity is based on the Law of One Price. i.e., If two or more nations manufacture a similar product, the price of the product must be similar, no matter which nation manufacture it. Let’s take a simple example:

Let’s say; Price of Domino’s Pizza in India = ₹ 400

Price of the same Pizza in the USA = 10 $

Now, if the Law of One Price holds, the purchasing power of two currencies should be identical for similar products, then finding a ratio of prices of identical products, i.e., what we have in the equation below:

![]()

Where, E = Exchange Rate

0 (Zero) = Current Exchange Rate

P(IND)/P(USA) = Ratio of similar products in two countries.

Therefore, putting value in the equation:

![]()

Or Vis-a versa;

![]()

What you realize is 40 ₹ 0.025 $ are simply reciprocal of each other.

Remember, that (APPP)is based on the Law of One Price but not the (APPP)itself. Rather the Absolute Purchasing Power Parity says that the current exchange rate which we knew as the spot rate is simply a ratio of prices of identical products amidst countries. APPP is a static concept as it does not reveal changes in exchange rates. i.e., it doesn’t tell us how the exchange rate is likely to behave in future; is the currency going to be depreciated or appreciated that question is not answered by the Absolute version of Purchasing Power Parity if we want to know that than we have to learn the Relative version of Purchasing Power Parity.

Relative Purchasing Power Parity

The Relative version of Purchasing Power Parity relates changes in the national price levels and exchange rates. To put it as briefly as possible, if the inflation rises in the country, it should exert downward pressure on the value of its currency. Therefore, there is going to be an inverse relationship between the rate of inflation and currency value. Now, this should not lead you to the simplistic belief that whenever inflation arises, the currency value depreciates and vis-a versa. Your approach must be holistic in the sense that the price level changes are just one amongst many other factors that determine exchange rates and out of these many factors the role of inflation is to depress the currency value. Still, if other mitigating factors are more reliable, you may find that the currency is holding steady or even appreciating in spite of inflationary pressures.

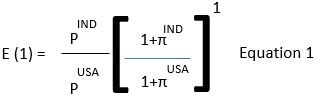

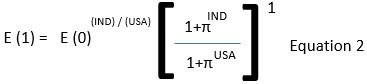

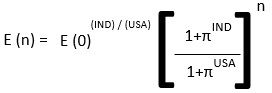

We are going to focus on the Relative Purchasing Power Parity, which, as we said before, says that there is an inverse relationship between national price levels and currency value. Let us denote the current exchange rate as E (0) and let the exchange rate one period ahead as E (1). Then,

Where,

E1 = Expected exchange rate at one period ahead.

P (IND) / P(USA) = Ratio between the prices of products in two countries.

[1+ π IND /1+ π USA] = Measuring the rate of change in inflation in both countries.

π = Rate of Inflation.

The ratio of price level among the countries is equal to the current exchange rate. That is what we write in the second equation below:

Where,

E (0) = the ratio of prices

Now, if you want to find out the expecting exchange rate of (n) period ahead, then the equation become

Conclusion

Purchasing Power Parity is an adjustment for prices that reflects the number of goods the consumers can buy in their own country using their own currency and consistent with their own living standards and per capita income.

Leave a Reply