Definition: A cost sheet is a statement which represents the various costs incurred at different stages of business operations, in a tabular format. It determines the total cost or expenditure made by the organization, along with the cost incurred on each unit of a product or service in a particular period.

The cost sheet of a business organization provides an insight into its performance and efficiency. It helps in competitive analysis and improvement of the business operations through cost reduction.

Content: Cost Sheet

Components of Cost

An organization needs to bear multiple types of overheads while carrying out business operations. In a cost sheet, the following overheads or expenditure are presented systematically:

Prime Cost

The initial cost made for manufacturing a product, i.e., raw material, labour wages and other production-related expenses, is termed as prime cost.

Following is the equation for computing the prime cost:![]()

Where direct material is calculated with the help of the following formula:![]()

Works Cost or Factory Cost

The works cost is calculated by summing up the prime cost with the factory overheads and simultaneously adjusting the opening and closing stocks of work in progress. It can be denoted as:![]()

The various indirect overheads incurred at the factory premises can be computed with the help of the following formula:![]()

Let us now go through each of the indirect overheads in detail below:

Indirect Material

The indirect material includes all the additional items used for manufacturing products, but not directly contribute as a raw material for the finished goods. It can be anything like the oil, fuel, coal, stationery items and other factory utilities.

Also, the items which are though directly used for making a product, but are inexpensive and small, are considered as indirect material. These include thread, pins, cello tape, nails, nuts, etc.

Indirect Labour

The labour or human resource engaged in all the activities other than manufacturing of goods or services which are essential to carry out the business and assist the production operations is called indirect labour.

It includes salary paid to managers, cleaning staff, security staff, drivers, etc.

Indirect Expenses

All the other overheads which are neither directly contributing to the production operations, nor they can be termed as labour or material expense, are called indirect expenses.

These are the expenses made for running the business operations smoothly. These include advertisements, depreciation, rent, electricity, insurance, taxes, repairs and maintenance, etc.

Cost of Production

The cost of production includes all the direct and indirect cost, including the material, labour and other expenses, i.e., production cost, factory cost and office or administration cost.

The following formula denotes the computation of cost of production:![]()

After making an adjustment of the opening finished goods and the closing finished goods to the cost of production, we acquire the cost of production of goods sold.

Further, to calculate the cost of production of goods sold, the opening and closing stocks of finished products are adjusted with the cost of production. Its formula is:![]()

Total Cost

The final value of a product or service can be determined after adding all the selling and distribution expenses to the cost of production of goods sold. The formula to find out the total cost or cost of sales is:![]()

If the sales price of the products or service is known, the following method can be used to determine the profit:![]()

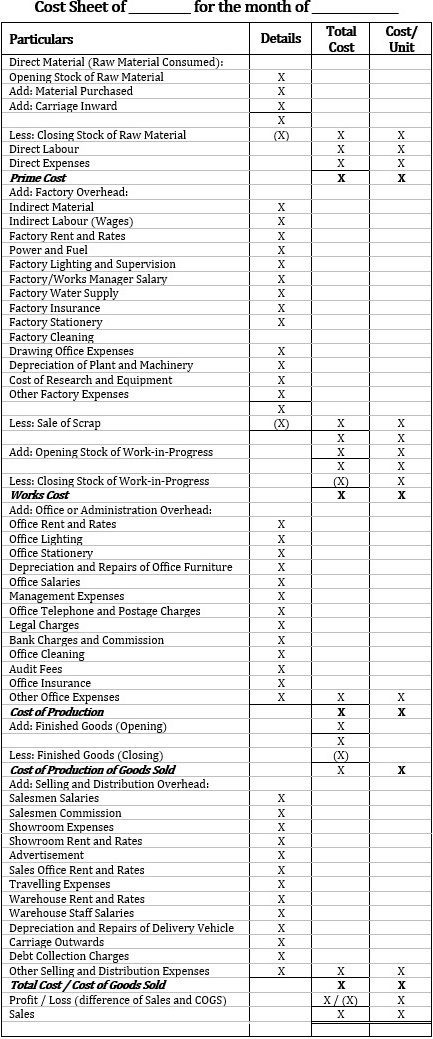

Cost Sheet Format

The companies which have their production or manufacturing units along with office premises and also carry out sales and distribution of goods, require a systematic cost accounting procedure to determine the cost, profit and sales price.

Given below is a proforma of a cost sheet to provide you with a complete understanding of cost accounting in business organizations:

In the above format, we have assumed that the cost sheet is being prepared for a month. However, the period of a cost sheet may vary according to the preference of the company, i.e., it can be made for a week, a month, a quarter or a year.

We can also determine the rate of profit, with the help of a cost sheet or a cost statement, if the sales price is known to us.

Example

The following information has been extracted from the books of ABC & Co. for the month ending January 31, 2019:

| Items | Amount |

|---|---|

| Raw Material (as on January 01, 2019) | 54000 |

| Work-in-Progress (as on January 01, 2019) | 27500 |

| Finished Goods (as on January 01, 2019) | 61500 |

| Raw Material (as on January 31, 2019) | 48500 |

| Work-in-Progress (as on January 31, 2019) | 24750 |

| Finished Goods (as on January 31, 2019) | 66750 |

| Material Purchased | 280000 |

| Carriage Inward for Raw Material | 2150 |

| Material destroyed by fire | 6650 |

| Productive Wages | 175000 |

| Wages of Storekeeper | 7500 |

| Depreciation on Machinery | 8200 |

| Factory Rent | 14000 |

| Electricity Bill of Factory | 6700 |

| Renovation of Factory Premises | 9300 |

| Machinery Repairs and Maintenance | 2500 |

| Office Cleaning | 900 |

| Depreciation on Office Computers | 3500 |

| Office Telephone Bill | 650 |

| Office Manager's Salary | 11000 |

| Office Stationery | 1700 |

| Fuel in Office Car | 2750 |

| Legal Charges | 850 |

| Salesperson Salary | 7750 |

| Warehouse Rent | 4500 |

| Freight Outwards | 550 |

| Depreciation of Delivery Van | 2350 |

| Showroom Rent and Taxes | 8500 |

| Advertisement | 5000 |

Prepare a cost sheet from the above data, showing:

- Prime cost

- Works cost

- Cost of production

- Total Cost

- Profit or loss, if the sales amounted to Rs. 661800.

Note that, 13236 units were manufactured in January 2019.

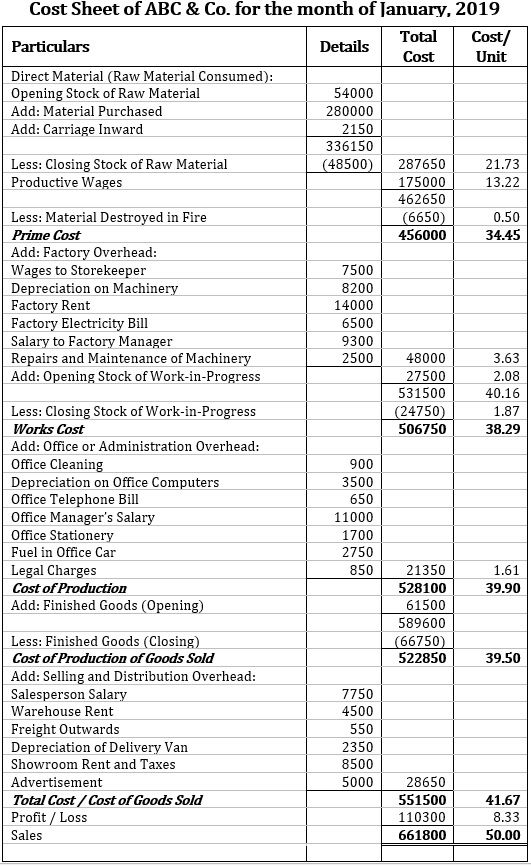

Solution:

The following is the cost sheet of ABC & Co. for January 2019:

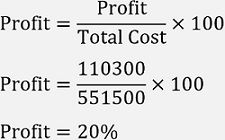

Here, the percentage of profit on goods sold is as follows:

Types of Cost Sheet

When we talk about the cost sheet, we can say that it is calculated by all kinds of organizations belonging to different industries. Thus, it can be bifurcated into two major categories:

Historical Cost Sheet

The statement of cost which records all those expenses or costs that have already been incurred by the organization, i.e., the actual cost born (direct or indirect) on the business operations in a particular period, is called a historical cost sheet.

The one which is illustrated above is a practical application of this specific type of cost sheet.

Estimated Cost Sheet

It is a cost statement which is prepared in advance before the actual production of goods or services take place. It is made to predict or determine the cost which will be incurred by the organization, the potential or profitability of the product or service and to fix a suitable selling price.

This type of cost sheet is usually prepared at the time of filling tenders or taking contracts to quote an appropriate price of the goods or service.

Advantages of Cost Sheet

Cost sheet is an essential statement for the organization engaged in the production of goods or services. Following are some of the benefits of preparing a cost sheet:

- A cost sheet provides per unit cost of a product or service which the organization incurs at every stage of business operation, which helps the management to analyze and control such overheads.

- It also helps in deciding the selling price of a product or service based on the cost incurred and profit expected out of it.

- The cost managers or production managers can study the past figures of the company’s cost sheet to ensure the efficiency of business operations and for eliminating the non-productive expenses.

- It also acts as a base for comparing the actual cost incurred, with that of the estimated or budgeted cost, to find out any deviations and take the necessary corrective actions.

- The preparation of a cost statement is an essential document for the application of kaizen costing in the business.

- A cost statement provides for the adjustments of the opening and closing stocks of:

- raw material;

- work in progress;

- and finished goods.

Conclusion

A cost sheet is a useful tool for the managers to keep control over the business expenses and cost of the products or services.

In large organizations, cost statements play a vital role in keeping track of multiple components of costs incurred at different stages and departments including production, factory, office, selling and distribution.

Pankaj kumar says

Thanx alot..

GIREESAN VAMADEVAN says

Very easy to understand. Thank you very much.

Srikanth says

Thank you

Aditya Aggarwal says

Very well explained.

Anupam Das says

It is really help full for me

Thank you sir

Md..Abdul Mojid says

Thank you very much & very easy to understand .

Rajee says

Very useful and easy to undestand. Thank you

Ravichandra Yallur says

Very helpful information tq you so much

Karan Mehta says

It is easy to understand it.

jayram says

very nice explanation and workout

Puja says

You explainrd costsheet very well…… Thank you❤

Elakkiya Srinivasan says

Good content